Emmanuel Gendreau has been appointed Director of BNP Paribas Epargne & Retraite Entreprises, effective from 5 January 2026. He succeeds Nicolas Villet, who has been appointed Director of the EMEA (Europe, Middle East, Africa) region at BNP Paribas Cardif. Emmanuel Gendreau joins the executive committee of BNP Paribas Cardif France and will report to Charlotte Chevalier, Deputy Chief Executive Officer of BNP Paribas Cardif Head of France and Luxembourg.

BNP Paribas Epargne & Retraite Entreprises is the entity specialising in corporate savings solutions (employee savings and collective retirement savings), co-managed by

BNP Paribas Asset Management for financial management, and BNP Paribas Cardif for insurance activities. At the end of 2024, the company managed

€30.2 billion in assets for 26,000 businesses and for 1.6 million savers.

Emmanuel Gendreau joined the

BNP Paribas Group in 1998. After holding various positions, notably in mergers and acquisitions within BNP Paribas Group Financial Management department, he became Managing Director at Financial Institutions Coverage at BNP Paribas CIB in 2005. He covered major French insurers as a Senior Banker and was appointed Global Head of Insurance in 2015. In 2021, he joined the Investment & Protection Services (IPS) division, responsible for Institutional Partnerships and the restructuring project of the division’s private assets activities. Following this restructuring, he was appointed Head of IPS Investments in 2023.

Emmanuel holds a master’s degree in management from ESCP Europe and a

Master 1 in Applied Mathematics from Université Paris IX Dauphine.

Read more

- Charlotte Chevalier has been appointed Deputy Chief Executive Officer, Head of France and Luxembourg,

- Maxime Boyer Chammard has been appointed Chief Operating Officer (COO), Head of Efficiency, Technology & Operations,

- Michael Nguyen has been appointed Chief Executive Officer of Asia,

- Nicolas Villet has been appointed Chief Executive Officer of EMEA (Europe, Middle East, Africa).

Charlotte Chevalier began her career at the Inspection Générale des Finances (IGF). From 2009 to 2016, she held several positions within the French Ministry of Finance (Tax Legislation Department and at the DGFIP) but also at the French Prime Minister Private office as an advisor in charge of tax policies. From 2016 to 2019, she was Director of Strategy and Transformation at Covea where she implemented digital transformation and competitiveness programs. In 2019, she joined the Transformation and Development Department of BNP Paribas Cardif as Head of Strategy and M&A, and Secretary to the Executive Committee of BNP Paribas Cardif. She then was appointed Chief Proposition Officer in 2021 and Chief Executive Officer of EMEA (Europe, Middle-East, Africa) in 2023.

Charlotte Chevalier is a graduate of Sciences-Po Paris, ENSAE and the National School of Administration.

Maxime Boyer Chammard began his career with the

BNP Paribas Group in 2000, where he held several management positions in France. In 2010, he was appointed Chief Operating Officer (COO) of

BNP Paribas Financial Services in the United States, then Chief Operating Officer (COO) of BNP Paribas Securities Services in the United Kingdom in 2013. His responsibilities include overseeing outsourcing services as well as implementing technology and business transformations. He was previously Global Head of Investment and Funds Services Operations at

BNP Paribas Securities Services, in charge of fund administration, transfer agency, middle office outsourcing, investment analytics and data services. Maxime Boyer Chammard was also a member of

BNP Paribas Securities Services Management Board and played a key role in client transformation initiatives, operational strategy and digital innovation.

Maxime Boyer Chammard holds a Master degree in management with a major in finance from ESSCA Business School.

Michael Nguyen started his career in Corporate Strategy and M&A in 2002 for the Airbus Group. From 2005 to 2016, he held various management positions for large global groups, including Bouygues and AXA. He joined the SCOR Group in 2016 where he was Group Head of Operations Strategy and Transformation. Directly reporting to the Group Chief Operating Officer (COO), he led SCOR’s operations strategy from planning to execution and oversaw the reinsurer’s strategic projects portfolio. Michael Nguyen joined BNP Paribas Cardif in 2020 as Chief Information Officer. He was then appointed Deputy Chief Executive Officer and Chief Operating Officer (COO) in charge of the Efficiency, Technology and Operations department of

BNP Paribas Cardif.

Michael Nguyen holds a Master of Science from Pierre and Marie Curie Paris University, a Master in management from HEC and Mines ParisTech, and a MBA from INSEAD.

Nicolas Villet began his career at Deloitte in the Financial Transactions and Valuations department. In 2009, he joined the Development department of the Casino Group, where he participated in the creation and development of GreenYellow. In 2011, he joined the

BNP Paribas Group to work in Finance management, then BNP Paribas Cardif in 2013 as Head of Strategy and Secretary of the Executive Committee. In 2016, he continued his career in Hong Kong as Chief Financial Officer and then as Deputy Chief Executive Officer

of BNP Paribas Cardif in Asia. In 2020, he was appointed Head of BNP Paribas Epargne & Retraite Entreprises and Deputy Chief Executive Officer of

BNP Paribas Cardif France in 2024.

Nicolas Villet is a civil engineer from the Ecole des Mines and a graduate of HEC Paris.

Photos are available from the BNP Paribas Cardif press office.

Read more

The insurer BNP Paribas Cardif has purchased an office building located at 8 place de la Bourse and 5-9 rue Feydeau in Paris from a French institutional investor.

The property encompasses two buildings built between 1920 and 1951 to house a telecommunications centre. It has eight floors and approximately 6,500 square metres of floor space. Given the unique architectural features of the building on Place de la Bourse, it is listed as a heritage asset.

The building was completely renovated in 2021 and contains office spaces of between 500 and 800 square metres. In addition, an underground level has parking space for 19 cars, 24 motorcycles, plus a bicycle parking area. It also has approximately 500 square metres of accessible exterior space and is fully leased to several different businesses.

This acquisition enables BNP Paribas Cardif to pursue its investment strategy and diversify assets for its policyholders. The transaction was carried out via the Cardimmo unit-linked real estate investment vehicle managed by BNP Paribas Cardif, and via its pension savings euro fund.

BNP Paribas Cardif was advised by Wargny Katz, Jadero, Opéra Avocats, David Colin (attorney) and Ikory Project Services.

Read more

More than four out of five financial advisors (85%) express confidence in their business for the coming 12-month horizon.

- 67% of financial advisors report a year-on-year increase in the number of clients.

- 78% of financial advisors believe their clients are concerned about their investments given the geopolitical and economic situation.

- 58% of financial advisors believe their clients will track the performance of their asset allocations more closely, 57% the diversification and 54% the level of risk over the coming 12 months.

- A third of financial advisors (34%) say they plan to offer more individual pension products.

- A quarter of financial advisors (27%) now regularly employ artificial intelligence (AI) in their work.

BNP Paribas Cardif has released the results of its 19th annual survey of financial advisors. Conducted with Kantar, one of the world’s leading market research agencies, the 2025 survey confirms that financial advisors play a central role in defining investment strategies, with a focus on product diversification and by proposing a range of thematic investment options.

Dynamic, attractive, confident: the profession stays the course in a changing world

The current environment introduces new challenges. A full 78% of financial advisors believe their clients are concerned regarding their investments given evolving geopolitical and economic factors – up 25% since 2024 and a record figure, even compared with levels of concern measured when the Covid pandemic ended. The international geopolitical climate is the primary negative factor impacting business activities, say the financial advisors (72%), 18% more than last year. This is followed by regulatory factors (retail investment strategy requirements were cited by 48% of respondents, and the “Green Industry Law” by 45%), alongside the economic context (47%). At the same time, financial advisors listed AI and the profit-sharing law as elements that create opportunities (54%) and could drive business growth.

Nevertheless, this finding contrasts with the positive mindset among financial advisors and the development of the profession. More than four out of five (85%) financial advisors expressed confidence in the coming 12 months, reflecting the dynamic outlook for the profession, thanks in particular to the growth of their clientele franchise: 67% of financial advisors reported an increase in clients compared with the previous year. Despite economic and geopolitical turbulence, the profession is doing well. Both the confidence of the financial advisors themselves and the confidence their clients have in their expertise continue to rise.

The three fundamentals for financial advisors remain performance, risk management and diversification

Financial advisors believe that economic uncertainties have led clients to seek safer investments (63%) and diversification, both within and outside the framework of life insurance investment vehicles (52%). They believe these expectations will be confirmed in coming months, and over half of them think their clients will want greater diversification, both in their portfolios (57%) and in terms of risk exposure (54%). In line with results from the previous three surveys, however, performance remains a top-of-mind factor, since 58% of financial advisors say their clients will be looking more closely at yield.

This demand for diversification is reflected in the wealth management products and solutions offered by financial advisors within the scope of life insurance vehicles and capitalisation contracts. While 61% of financial advisors plan to take advantage of opportunities related to investments in French and European defence and sovereignty, 56% intend to propose thematic funds (innovation, tech, health, energy, etc.). In addition, financial advisors plan to propose more ETFs (43%), private equity investments (37%), structured products (35%) or discretionary portfolio management products (28% of respondents this year, compared with just 13% in 2024).

In addition to life insurance vehicles, financial advisors have a clear and focused strategy and are addressing current social and economic issues regarding pension planning. Some 59% of financial advisors plan to promote pension savings solutions (34% individual and 25% collective). Half the financial advisors also plan to target protection insurance in their business portfolio within the next two years (29% individual protection and 21% collective protection).

Financial advisors seek to diversify client franchise and target younger population segments

As proven experts in wealth management, financial advisors are well-positioned to adapt to the variety of needs and expectations of their clients. Their top challenge today is to renew and diversify the makeup of their clientele franchise, adding younger profiles in particular (under 45). This segment is seen as a strategic avenue for growth by 90% of the respondents. Nearly half the financial advisors (49%) report that their client base is already becoming younger.

This new younger clientele segment is dynamic and actively engaged, with new habits and behaviours. Some 83% of financial advisors note their independence and high level of digital adoption, 42% say these clients have a higher appetite for risk, and a third (33%) note that they are more financially savvy. Demonstrating their ability to adapt to market shifts and align with these profiles, 42% of financial advisors focus on structured products for this clientele, 34% on ETFs and 26% on private equity.

A third of the financial advisors (31%) now count new socio-professional profiles in their clientele.

Strategic use of AI accompanied by monitoring of regulatory compliance figures among top priorities for financial advisors

Fast-paced changes require financial advisors to continually adapt and learn. For 71% of survey respondents, the primary challenge is ensuring regulatory compliance, ahead of adopting AI (44%) or changing investment solutions to adapt to the economic climate (38%). What’s more, half the financial advisors (52%) say they would be interested first and foremost in training centred on regulatory developments.

Lastly, 54% of financial advisors believe artificial intelligence will have a positive impact on their business, an increase of 14% over last year. A full 56% of financial advisors already use AI – regularly or occasionally – to automate or facilitate certain tasks, up from only 23% in 2024. On the other hand, the use of AI will remain primarily concentrated on automation of repetitive administrative tasks (79%), as well as for monitoring regulatory and compliance issues (67%).

Nearly a third of financial advisors (28%) believe their clients feel that personal contact will remain the cornerstone of the relationship with their advisor, and 64% say that AI will not have any direct impact on their client relationships. The expertise of financial advisors and personal support remain key to the added-value delivered by financial advisors and constitute the very heart of the profession.

BNP Paribas Cardif has finalised the acquisition of AXA Investment Managers (AXA IM) and signed a long-term partnership with the AXA Group to manage a large part of its assets.

This operation, announced on 1st August 2024, will enable the BNP Paribas Group to create a leading European asset management platform with over EUR 1.5 trillion in assets under management entrusted by its clients. It allows the Group to become the European leader in long-term savings management for insurers and pension funds with around EUR 850 billion, with the ambition to become the European leader in fund collection for private asset investments and positioning itself among the main providers of ETFs in Europe. This operation is also part of the Group’s core mission to support the economy by mobilising savings to finance future-oriented projects in the best interests of its clients.

By combining the expertise of AXA IM, BNP Paribas Asset Management, and BNP Paribas REIM, this new platform will have a wide range of traditional and alternative assets, an expanded global distribution network, enhanced innovation capabilities, and a more comprehensive offering in responsible investment. It will benefit from AXA IM Alts’ market position and expertise in private assets, which are key drivers of future growth for institutional and individual clients, as well as AXA IM’s know-how in long- term asset management for insurance and retirement. In this context, BNP Paribas Cardif will leverage the capabilities of this platform for the management of a large part of its assets, notably its general funds.

The formation of this new platform marks a major milestone in the development and growth journey of the IPS division. It will fully benefit from BNP Paribas’ integrated model, in close collaboration with the CPBS and CIB businesses, particularly within the framework of the “originate to distribute” approach.

“This acquisition is an important moment for the entire BNP Paribas Group. We are delighted to welcome the AXA IM teams, who will find within the BNP Paribas Group a strong culture of customer service as well as ambitious growth and innovation prospects. These are teams with recognised and complementary expertise that will build together a European industrial project to better serve our clients. I have every confidence in the ability of the management teams of our asset management activities to grow the business and create value for our clients and employees,” said Jean-Laurent Bonnafé, Director and Chief Executive Officer of BNP Paribas.

Joint working groups with AXA IM teams are already in place to reflect on and develop a common roadmap, particularly with regard to offerings and services. This roadmap will be submitted to the appropriate employee representative bodies.

The project to merge the legal entities of AXA IM, BNP Paribas AM and BNP Paribas REIM, which would create the new platform held by BNP Paribas Cardif, is currently the subject of consultation with employee representative bodies.

Sandro Pierri, CEO of BNP Paribas AM, will lead the BNP Paribas Group’s asset management activities and Marco Morelli, the current Executive Chairman of AXA IM, will chair the BNP Paribas Group’s asset management activities.

From a financial perspective:

- The Group’s revenue growth by 2026, including the impact of the transaction, will be greater than +5% (CAGR 24-26), with an average annual jaws effect of +1.5 pts.

- Return on Invested Capital (ROIC) will be more than 14% in year three (2028) and more than 20% in year four (2029).

- From a prudential perspective, the impact of the operation on the Group’s CET1 ratio is estimated at approximately -35bp as of the 3rd quarter 2025 results, discussions with supervisory authorities are still on going.

An update on the progress of the operation will be provided upon the release of the third-quarter 2025 results ahead of a Deep Dive, that will take place during the first quarter 2026, focused on the Group’s trajectory including this operation.

- Pre-tax net profit of 1.6 billion euros for full-year 2024, up 13% compared to 2023

- Gross written premiums of 36.4 billion euros at end-2024, up 21% compared to 2023

- 287 billion euros in assets under management, up 13% compared to 2023

- Over one hundred partnerships renewed or signed in 2024

“2024 was a very good year for BNP Paribas Cardif, with record revenues and a sharp rise in pre-tax net profit. Our business is dynamic and is based on strong savings inflows and robust partnerships. Our diversified partnership model has once again demonstrated its effectiveness and allows us to consolidate our leading positions in savings and protection. Making insurance more accessible guides us on a daily basis and over the long term. Through this commitment, we are firmly focused on supporting our policyholders’ projects, providing insurance coverage for as many people as possible. Finally, in a continuous improvement approach, we accelerate thanks to artificial intelligence and the implementation of new technologies, in a secure way and a strengthened customer experience.” commented Pauline Leclerc-Glorieux, Chief Executive Officer of BNP Paribas Cardif.

2024 results up sharply

BNP Paribas Cardif continued its growth trajectory with pre-tax net profit of 1.6 billion euros in 2024, up 13% compared to 2023. Gross written premiums for the BNP Paribas Group’s Insurance Business Line reached 36.4 billion euros, an increase of 21% compared to 2023. At the end of 2024, assets under management totalled 287 billion euros, up 13% compared to the end of 2023.

BNP Paribas Cardif operates in 30 countries and generates nearly half of its gross written premiums (48% in 2024) outside of France. Leveraging its diversified partnership model, the insurer, a global leader in bancassurance partnerships, generates more than half of its gross written premiums (52% in 2024) with partners outside the BNP Paribas Group.

Gross inflows in savings worldwide amounted to 28.3 billion euros at the end of 2024 (+24%), with 34% in unit-linked products. In France, savings inflows increased by 15% compared to 2023, reaching 16.9 billion euros. Internationally, gross inflows stood at 11.5 billion euros, up 40% compared to 2023.

Protection gross written premiums reached 8 billion euros in 2024, up 11% compared to 2023. In France, gross written premiums were up 5% to 1.9 billion euros, energised by property and casualty insurance, which recorded 12% growth, and by affinity insurance with nearly 1.9 million customers at the end of 2024. In international markets, protection gross written premiums reached 6.1 billion euros, an increase of 14% compared to 2023. Growth in Latin America was driven by the rollout of long-term partnerships, particularly in Brazil, where gross written premiums totalled 1.9 billion euros, up 13% compared to 2023. In Europe (excluding France) and other countries, business was up 16% over 2023, with gross written premiums of 3.2 billion euros. Asia recorded gross written premiums of 1.1 billion euros (+10% compared to 2023).

Over one hundred partnerships renewed or signed in 2024 to strengthen products and services for policyholders

The strength of BNP Paribas Cardif’s partnership model was once again manifest in 2024 with the development of key partnerships in Italy with the BCC Iccrea cooperative banking group and in France with the private bank Neuflize OBC. These two major partnerships will enable the insurer to consolidate its leadership in savings and tap into new distribution networks. In France, BNP Paribas Cardif, convinced that life insurance is an essential vehicle that allows French savers to grow their savings and at the same time help finance the economy, relies on a diversified euro fund with a net rate excluding bonuses of at least 2.75% for 96% of its life insurance and capitalisation contracts in 2024. A prudent long-term management strategy and solid reserves allow BNP Paribas Cardif to support its policyholders’ projects and savings objectives over extended periods, with attractive returns on their savings.

The renewal or signing of over one hundred partnerships in 2024 will support long-term business development and strengthen product offerings for policyholders. This dynamism is reflected in new agreements in creditor insurance, a segment where BNP Paribas Cardif is the global leader*. In France, for example, BNP Paribas Cardif has concluded a new partnership with Simulassur, the Magnolia Group’s B2B marketplace specialising in loan insurance, to expand access to its “Cardif Libertés Emprunteur” contract to new brokers and clients. It has also launched new creditor insurance offerings, including in the Nordic countries with the digital bank Northmill. At the beginning of 2025 in France, BNP Paribas Cardif continued to develop its affinity insurance business, notably with the renewal of its partnership with Orange.

Positive impact drives growth and trust for clients and partners

As shown by the results of the global study entitled “Protect & Project Oneself” , conducted by BNP Paribas Cardif, demand for protection insurance remained significant in 2024. To address concerns and support individual client projects, BNP Paribas Cardif is continually guided by its mission to make insurance more accessible. By making insurance more inclusive, more understandable, easier to subscribe and to use, BNP Paribas Cardif helps individuals better protect themselves to better plan for the future. This is the case in individual protection solutions with the introduction of a new and educational approach based on a personalised diagnosis, allowing BNP Paribas French Commercial Banking to offer clients the most appropriate level of protection for themselves and their loved ones. This approach as a responsible insurer is also reflected in improving subscription conditions for creditor insurance for people undergoing treatment for HIV in France, going beyond the criteria set by the AERAS agreement, by now approving without additional premium surcharge or exclusions patients with an undetectable viral load at the time of subscription and for loans up to €1 million. This action is part of a broader approach taken for over the past 15 years to offer coverage to the most vulnerable segments of the population under optimal terms and conditions. Additionally, in 2024, BNP Paribas Cardif expanded coverage of the Total Temporary Disability guarantee in its “Cardif Libertés Emprunteur” contract, marketed in France by brokers, financial advisors, and on Cardif.fr. This “Family Assistance” guarantee – which has two components, “parental presence” and “family caregiver” – now better meets the expectations of families facing difficult life events.

BNP Paribas Cardif considers positive impact to be a foundational element in its investment strategy, convinced that this commitment is a factor that nurtures trust among its clients and partners. The insurer implements a responsible investment policy and applies an ESG filter to investments in its general fund. In 2024, 96% of the assets in BNP Paribas Cardif’s euro funds in France underwent ESG analysis, and more than 33% of unit-linked assets are invested in responsible vehicles , representing 19.4 billion euros. BNP Paribas Cardif, which actively implements the BNP Paribas Group’s energy transition policy, has been committed since 2021 to supporting the transition to a low-carbon economy reducing greenhouse gas emissions in its investment portfolios and contributing to compliance with the Paris Agreement. At the end of 2024, the carbon footprint (Scopes 1 and 2 ) of its directly held equity and corporate bond portfolio in the assets of its euro funds had continued to decrease by at least 50% compared to the end of 2020. This approach is also supported by investments aimed at supporting impact initiatives. BNP Paribas Cardif recorded 3 billion euros in positive impact investments addressing environmental and societal issues during 2024, which corresponds to an average of 2 billion euros per year since 2019.

This commitment to positive impact for the benefit of stakeholders is also reflected in actions taken by BNP Paribas Cardif in favour of a more inclusive society. In 2024, BNP Paribas Cardif and Sistech, an association that supports employment for refugee women in technology and digital professions, signed a partnership to support the association’s beneficiaries. The initiative is part of the “Women & Girls in Tech” program, supported by the BNP Paribas Group. This program aims to promote the recruitment of women in digital and IT fields. In addition, because the number of obesity cases is increasing significantly worldwide, BNP Paribas Cardif has been mobilised since 2021 around the prevention of overweight and obesity. The approach centres on funding research with an international group of doctors and nutrition expert researchers, and supporting several associations worldwide dedicated to preventing overweight and obesity in young people. The program has already benefited 650,000 children and 2 million people, including their family members, in 13 countries.

Technology and artificial intelligence to better serve human needs and increase customer satisfaction

BNP Paribas Cardif firmly believes that technology, particularly artificial intelligence, is key to improving customer satisfaction and supporting partners with quality products and optimised processes. Some 80 AI use cases are currently in production at BNP Paribas Cardif, including 20 dedicated to claims management. The “CardX” solution developed in 2021 to accelerate claims management and automate document processing already handles over 50,000 pages per month in Brazil, Colombia, Spain, and Poland in 2024. New solutions were also deployed in 2024, including with Orange in France, where BNP Paribas Cardif introduced an automatic claims acceptance process based on a score calculated using artificial intelligence. This allows eligible claims declared by policyholders for their mobile devices to be accepted in just seconds.

An insurer’s business involves numerous interactions with its clients. For BNP Paribas Cardif, analyzing and understanding this mass of information is essential to meet the needs for immediacy and efficiency. Its objective is to design simple and accessible customer experiences to meet its three major challenges: raising the level of protection for a greater number of policyholders through greater personalisation and loyalty, improving the customer experience through automation, and optimising processes to meet the expectations of customers and partners.

After entering into exclusive negotiations on August 1st, AXA and BNP Paribas Cardif today announce the signing of the Share Purchase Agreement for AXA Investment Managers (AXA IM).

This signing follows the completion of the information-consultation procedure on strategic issues with the relevant employee representative bodies of both AXA and BNP Paribas groups.

“This signing marks an important step in the acquisition process of AXA IM and our long-term partnership with AXA. In anticipation of the closing process, all teams are now working to welcome AXA IM’s employees and customers into the BNP Paribas Cardif Group” said Renaud Dumora, Chairman of BNP Paribas Cardif, Deputy COO of BNP Paribas.

As previously communicated, the agreed price for the acquisition and the long-term partnership is €5.1 billion, with the closing expected mid-2025 and an anticipated impact on BNP Paribas Group’s CET1 ratio of 25 bps subject to agreements with the relevant authorities.

Financial advisors accelerate diversification of offering and grow client franchise with increasingly personalized support

- 67% of financial advisors report an increase in the number of clients, and 82% expect to develop their business in the coming years thanks to a larger client portfolio and product range.

- 67% of financial advisors note preference for lower risk investments among clients during the past 12 months.

- 68% of financial advisors believe their clients will place greater priority on yield, diversification of assets (51%) and risk exposure (46%) in the next 12 months.

- 82% of financial advisors think artificial intelligence (AI) will become indispensable to wealth management in the future.

BNP Paribas Cardif is pleased to present the results of its 2024 survey of financial advisors. Conducted with Kantar, one of the world’s leading market research agencies, this 18th edition of the BNP Paribas Cardif survey confirms a stronger market that is welcoming new investment opportunities to meet the needs of a diversified client base.

Financial advisors buoyed by confidence and the diversity of their clientele

Nearly half the financial advisors have a younger clientele (47%) and report a trend towards client profiles with more modest asset levels (34%). This confirms the success of their commercial approach and their ability to continually renew their product offering in order to attract new categories of clients. The 2024 survey shows a continuous increase in their client portfolios over the past five years, a trend that 67% of them confirm for the past 12 months.

On the strength of the expansion of the client base and their product offering, 82% of the respondents expect to pursue their development, primarily through organic growth of their firm. This momentum also reflects the confidence the financial advisors express in their business: 83% of the respondents foresee significant growth over the next five years.

From a more macroeconomic perspective, the survey also reveals a growing trend towards market consolidation. Some 41% of the financial advisors are considering acquisitions, while 46% envisage the sale of their business, reflecting a dynamic market undergoing major transformations.

At the same time, the financial advisors underline several key challenges to be addressed, in particular – for 70% of them – integrating regulatory changes, requiring constant monitoring to guarantee compliance and protect the interests of their clients. Another challenge noted by 47% of respondents is identifying investment solutions adapted to the economic environment, while 34% say recruiting new clients is a top-of-mind challenge. Charging fees for their services has, for the first time this year, emerged as a significant new challenge, cited by 29% of respondents.

Financial advisors are establishing themselves as 360-degree players to meet the challenges facing the sector.

In a turbulent market, financial advisors say the past year has seen clients placing greater priority on savings solutions that above all carry lower risk (67%), emphasizing security for their investments. However, respondents believe that potential yield will remain the argument with the greatest impact for clients (68%) in the coming year. They also cite a desire among clients to diversify assets, both in life insurance portfolios (51%) and non-life investment vehicles (28%).

To meet these expectations, financial advisors are proposing a broad and dynamic range of financial investment solutions, coupled with increasingly personalized advice to adapt to fluctuating markets and the specific needs of savers. With regards to life insurance and capitalisation products, the euro fund confirms its number four ranking among the solutions financial advisors propose to clients. In the months ahead 31% plan to propose more of these solutions alongside ETF funds (48%), structured products (39%) and private equity investments (32%).

Beyond life insurance and capitalisation contracts, financial advisors who are positioning themselves as comprehensive wealth management providers say in the coming 24 months, they want to offer individual and collective pension planning products (39% and 26%, respectively), along with individual protection (27%) and creditor insurance products (23%).

Artificial intelligence, a new ally for financial advisors

Artificial intelligence (AI) has emerged as an absolutely essential tool for wealth management in the future according to 82% of financial advisors. Nearly a quarter of them (24%) already employ AI tools to automate or facilitate certain tasks, and 50% expect to use it for these reasons in the future. Among the reasons cited, 83% of respondents say AI could help find regulatory information, and 81% believe it could help identify investment solutions. The growing importance of AI is reflected in the fact that 21% of respondents cite it as a key challenge for the profession.

Consistent with their proactive adaptability to change, some 66% of financial advisors are interested in training on how to leverage AI in their profession, in addition to financial engineering training (51%) and training for regulatory developments (45%).

Alongside these transformations in the business and new opportunities, financial advisors continue to express optimism and resilience, and 94% believe their profession is doing well. With their deep expertise, financial advisors have a positive outlook for the future, and a record 91% of respondents state they are confident about their business.

Read more

The BNP Paribas Group announces today that it has entered into exclusive negotiations with AXA to acquire 100% of AXA Investment Managers (AXA IM), representing close to €850bn1 assets under management, together with an agreement for a long-term partnership to manage a large part of AXA’s assets.

BNP Paribas Cardif, the insurance business of BNP Paribas, after having directly proceeded to the proposed transaction as principal, would have the opportunity to rely on this platform for the management of up to €160bn of its savings and insurance assets.1

With the combined contribution of BNP Paribas’ asset management platforms, the newly formed business, which total assets under management would amount to €1,500bn1, would become a leading European player in the sector.

Specifically, it would become the European leading player in the management of long-term savings assets for insurers as well as pension funds, with €850bn of assets1, leveraging powerful platforms of public and private assets. The acquisition would also allow the combined businesses to benefit from AXA IM Alternatives’ leading market position and track record in private assets which will drive further growth with both institutional and retail investors.

The agreed price for the acquisition and the set-up of the partnership is of €5.1bn at closing, expected mid-2025.

With a CET1 impact of circa 25 bp for BNP Paribas, the expected return on invested capital of the transaction would be above 18% as soon as the 3rd year, following the end of the integration process.

The signing of the proposed transaction, expected by the end of the year, is subject to the information process and consultation of the employees’ representative bodies. The closing of the transaction is expected by mid-2025 once regulatory approvals have been obtained.

“This project would position BNP Paribas as a leading European player in long-term asset management. Benefiting from a critical size in public and alternative assets, BNP Paribas would serve its customer base of insurers, pension funds, banking networks and distributors more efficiently. The strategic partnership entered into with AXA, the cornerstone of this project, confirms the ability of both our groups to join forces. This major project, which would drive our growth over the long-term, would represent a powerful engine of growth for our Group.” said Jean-Laurent Bonnafé, Director and CEO, BNP Paribas.

“AXA Investment Managers has been a homegrown success story for the AXA Group. Over the past 25 years, we have built an exceptional franchise anchored in investment expertise, a relentless client focus and a proven track record on sustainability. Thanks to the quality of its teams, AXA IM is today a leading player, notably in Alternatives in Europe.” said Thomas Buberl, CEO of AXA. “By joining forces with BNP Paribas, AXA IM would become a global asset manager with a wider product offering and a mutual objective to further their leading position in responsible investing. I would like to thank all AXA IM employees for their unwavering commitment, and their continued focus on delivering value for our clients.”

“The creation, within the Investment & Protection Services (IPS) division of the BNP Paribas Group, of a European leader in the management of long-term insurance and savings assets, would enable the IPS division to exceed EUR 2 trillion of assets entrusted by its clients. This operation would allow BNP Paribas Cardif to benefit from premium access to the services of an asset management expert on the asset classes required for insurance management. The combined expertise of the BNP Paribas Asset Management and AXA IM teams in public and private assets, as well as their leadership in sustainability, would be valuable assets to better meet future needs of clients.” said Renaud Dumora, Deputy Chief Operating Officer, Investment & Protection Services, BNP Paribas.

1 Based on assets as at 31.12.2023

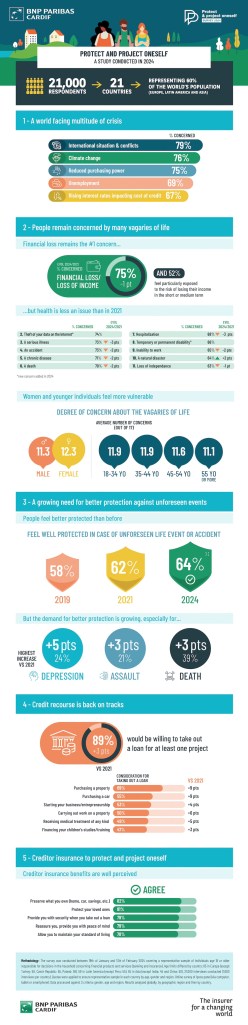

New BNP Paribas Cardif survey: “Protect & Project Oneself”1

A general sentiment of being well protected, coupled with greater expectations regarding insurance coverage

- A world facing multiple crises: international conflicts, climate events, purchasing power;

- People are slightly less concerned about unforeseen life events than in 2021, but have not returned to levels of confidence seen in 2019;

- Financial loss remains the primary source of concerns around the world, followed by cybersecurity;

- Creditor insurance is viewed as a useful solution to support a renewed focus on personal projects requiring financing.

A growing need for protection in the face of multiples crises

Results of the 2024 survey show that people are slightly less concerned about unforeseen life events than in 2021. However, the degree of concerns remains above levels measured in 2019. Although the world is gradually recovering from the pandemic, other crises remain, and inflation worries have replaced fears related to Covid since 20222. At the same time, at the global level, 79% of respondents in the survey say they are particularly concerned about international conflicts, 76% about climate change, and 75% by the drop in purchasing power. The French are more concerned with the latter two issues, notably the decline in purchasing power for 86% of the respondents. While people in all regions share concerns regarding climate change, unemployment is the top concern in Latin America and Asia (86% and 71% of respondents, respectively).

With regards to unforeseen life events, loss of income remains a major source of concern for three-quarters of the global population. Cybersecurity, a new topic included in this year’s survey, was directly ranked second, cited as a chief concern by 74% of respondents. The percentage of people citing concerns also rose for other topics such as physical assaults and violence (+3pts vs. 2021 and +4pts vs. 2019) and cars theft or damage (+2pts vs. 2021 and +4pts vs. 2019). As more time passes since the health crisis, worries about health have diminished, but still remain higher than in 2019. Concerns regarding depression rose 2 points worldwide, cited by 62% of those interviewed.

Lastly, while the percentage of people who feel they are sufficiently protected against unforeseen events continues to rise – reaching nearly two-thirds of the population in the 2024 survey (+2pts vs. 2021 ; +6pts vs. 2019) – only 14 % of respondents say they feel “very well protected”. This sentiment of vulnerability is highest in Latin America. The percentage of people who feel “very well protected” is higher in France than in any other country (72% in France vs. 64% worldwide). At the same time, expectations in terms of protection continue to climb in all three regions, particularly for issues related to mental health (+5pts vs. 2021), death (+3pts vs. 2021) and physical assault (+3pts vs. 2021).

Creditor insurance supports return to plans for personal projects

In 2024, personal projects and the need to finance them have once again become a priority, and the number of people who plan to resort to credit has increased across all geographies. In this context, creditor insurance is viewed as a useful solution in all three regions to help people move forward with their life plans. Respondents believe that these insurance products encourage them to pursue their projects while looking to the future with serenity. Creditor insurance in particular is seen as a solution that lets people retain ownership of property (82% agree), protect their family (81%), ensure security when they take out a loan (79%) and maintain their standard of living (78%).

The percentage of the population ready to resort to credit for a real estate acquisition has returned to pre-Covid levels (69%, +9pts vs. 2021), as has the number of people with plans to buy a car (55%, +9pts vs. 2021). Appetite for consumer credit is also on the rise, in particular to finance home improvement projects (cited by 50% of respondents), or to pursue plans to move to another region or another country (33%).

The 2024 survey showed an upturn in projects requiring financing both in France and the rest of the world. While a real estate acquisition remains the primary motivation for taking out a loan, the percentage remains below the 2019 level: 60% of the French cited real estate acquisitions in 2024 (stable vs. 2021 but -16pts vs. 2019). A car purchase is also cited as a reason to resort to credit (55%). Lastly, there is also an increase in the number of people who say they would resort to credit for home improvement projects (48%), to finance studies (37%) and for medical treatment (34%).

An infographic showing results from the survey is available on bnpparibascardif.com.

1 Methodology: The survey was conducted online between 19 January and 13 February 2024 on a group of 21,000 people in 21 countries on 3 continents (Europe, South America and Asia), covering a representative sample of individuals age 18 or older who are responsible for decisions in the household concerning financial products and services (banking and insurance). Age limits differed by country: 65 in Europe (except Turkey: 50, Czech Republic: 55, Poland: 59), 59 in Latin America (except Peru: 55), 55 in Asia (except India, 45, and China, 50). 21,000 interviews were conducted (1,000 interviews per country). Quotas were applied to ensure representative sample in each country by age, gender and region. Online survey of Ipsos panel using device agnostic questionnaire (computer, tablet or smartphone). Data processed against 3 criteria: gender, age and region. Results analyzed globally, by geographic region and then by country.

2Ipsos survey: “What worries the world?” – January 2024