As the Latin American insurance market undergoes rapid digitalisation, BNP Paribas Cardif is leading the way with its new Insurance Distribution Platform (IDP). Designed for agility, speed, and scalability, IDP is already transforming the way insurance is distributed across the region. From banking and consumer finance to retail and automotive industries, the platform empowers BNP Paribas Cardif’s partners to deploy customised insurance solutions with unprecedented speed and ease.

Pierre-Henri Zoller, Deputy CEO of BNP Paribas Cardif in Latin America, gives his view on the way IDP works, its impact, and the ambitious vision of insurance-as-a-service behind it.

What exactly is IDP, and why is it such a significant innovation?

Pierre-Henri Zoller:

Our distribution platform IDP represents a radical shift towards Insurance-as-a-Service. It’s a fully modular, API-first platform that integrates effortlessly with our distribution partners’ digital ecosystems. What makes it truly innovative is the speed and flexibility it offers. Launch timelines have moved from several months to just a few weeks and that’s a game-changer in a fast-moving market like Latin America.

Beyond technology, IDP also changes the way we think about partnerships. It gives our partners the right tools to tailor insurance offers to their needs, to manage claims, to monitor performance, and optimise the entire journey of their customers in real time—all within a single, unified platform.

What makes this platform stand out compared to traditional distribution insurance schemes?

Pierre-Henri Zoller:

Actually, two things: scalability and end-to-end integration. With IDP, we cover the entire insurance lifecycle—pre-sales, sales, after-sales, and claims management. And we do it in a way that’s completely transparent, thanks to real-time dashboards and data insights. It’s not just about simplifying processes, it’s about giving our partners complete control over the products and visibility.

We also designed it to be easily understandable and usable, true to our mission to make insurance more accessible. Whether our partner is a bank, a fintech, an automotive group, or a retailer, the platform adapts to their requirements. And because IDP is modular, we can roll out just the pieces our partners need, when they need them.

What products does IDP support, and how does it help BNP Paribas Cardif’s partners stand out?

Pierre-Henri Zoller:

The platform supports a wide range of products: creditor protection insurance (CPI), life, health, property & casualty, and home insurance. But what is truly differentiating is that it gives our partners the ability to launch and adapt products quickly. That is where lies its real value.

We provide ready-to-use templates and pre-configured APIs, so even complex insurance products can be deployed fast, without heavy development work. This helps our partners remain agile, test new offerings, and fine-tune them based on real-time feedback.

How has IDP performed in real-life deployments?

Pierre-Henri Zoller:

Our pilot in Colombia was extremely promising. We managed to integrate seamlessly with local IT systems, which proved the platform’s agility and adaptability. It gave us a blueprint for regional expansion—and we are now actively rolling it out in Mexico, Chile, Brazil, and Peru.

We have already observed efficiency gains, faster time-to-market, and better alignment with customer expectations. It also had a positive impact on compliance and data governance, thanks to its built-in monitoring tools.

What does the future look like for IDP in Latin America?

Pierre-Henri Zoller:

By 2026, we plan to make IDP the backbone of our insurance distribution across the region. It’s not just a tool,it’s a strategic enabler. It helps our partners accelerate their digital transformation, improves customer satisfaction, and strengthens our position as a leading digital player. In a landscape where agility defines success, IDP enables us all to stay ahead of the curve.

In today’s fast-evolving banking sector, easy access and simplicity are essential success drivers. This is why Nickel – a French fintech and part of the BNP Paribas group that is democratising access to basic banking services – decided to expand its offering with a new 100% digital comprehensive home insurance solution. To develop the new product, Nickel teamed with BNP Paribas Cardif and Lemonade, an insurtech recognised for cutting-edge technology.

It took the partners just six months to create an innovative insurance solution that is both broadly accessible and simple to use, aligned with the expectations of Nickel customers. Nickel Chief Executive Officer Marie Degrand-Guillaud and Marine Perraud, Head of Alternative Distribution for BNP Paribas Cardif in France, talk about the success factors that underpin this partnership.

Why did you decide to launch this insurance solution with BNP Paribas Cardif and Lemonade ?

Marie Degrand-Guillaud (Nickel) :

Our customers had been asking us for an insurance solution for some time, but we didn’t want to just add another product. We needed a partner to help us design a solution aligned with our identity. This three-way collaboration with BNP Paribas Cardif and Lemonade has proved a tremendous success for Nickel and our customers. It allows us to expand our product offering while remaining faithful to our DNA, which centers on simplicity and accessibility.

Marine Perraud (BNP Paribas Cardif) :

At BNP Paribas Cardif, we strongly believe that insurance should be a useful and inclusive service. This project is a perfect illustration of our ability to combine our strengths with those of digital players to create a customer experience that’s both simple and totally satisfying. Thanks to this fully-digital solution, we have not only met the expectations of Nickel customers, but also introduced an entirely new approach to home insurance.

How did the collaboration between the three partners work ?

Marie Degrand-Guillaud :

Our collaboration is underpinned by complementary expertise. Nickel has an in-depth understanding of its customers’ expectations and knows how to devise simple digital processes. Lemonade brought its technology and data expertise, and BNP Paribas Cardif contributed its extensive know-how in risk management and insurance partnerships. This combination enabled us to accelerate decision-making to design a very fluid and intuitive user experience.

Marine Perraud :

We applied a very iterative process, aligning our visions at each stage in the project. A collaborative and agile process let us design a solution that’s integrated end to end with the Nickel ecosystem. This was definitely an outstanding achievement in terms of both product design and execution.

How does this solution meet the specific needs of Nickel customers ?

Marie Degrand-Guillaud :

The innovation lies not so much in the product itself, but in the customer experience. Our customers want services that are simple, transparent and instantly available. The policies start at 4 euros per month.* The subscription process is 100% digital and takes just a few minutes via the Nickel app. This is perfectly matched to their lifestyle. It’s also a way to boost loyalty across a targeted customer segment by addressing concrete needs while meeting our objective of inclusiveness.

Marine Perraud :

Absolutely. This home insurance is designed for both renters and owners, who have complete control over managing the contract, with a totally digital journey. This proves that a well-conceived insurance product can make people’s lives easier and not be perceived as a constraint. We exceeded our sales targets in just three months, confirming that our product is well-matched to market demand.

What are your key takeaways for this collaboration ?

Marie Degrand-Guillaud :

Above all, we were able to draw on shared essential values. Successfully delivering a project like this in such a short timeframe requires effective teamwork. We combined agility, an ambitious vision and a sense of service. This shows that when you work together you can create something that truly has an impact, even in a tightly regulated sector like banking and insurance.

Marine Perraud :

This initiative proves that insurance can indeed be simple, accessible and useful. At the same time, it reflects our ability to adapt to new digital uses and to team with agile players such as Nickel. It’s a great success story from both a human and strategic perspective.

* Annual premium starting at 59 euros, including VAT. First monthly payment of 10.83 euros includes the “terrorism tax” of 6.50 euros, followed by 11 monthly payments of 4.33 euros. Premium for a renter with a 25 sq. meter apartment with personal property value under 10,000 euros and valuable or precious objects estimated at under 5,000 euros. There is a deductible of 500 euros and a liability cap of 6 million euros.

- Pre-tax net profit of 1.6 billion euros for full-year 2024, up 13% compared to 2023

- Gross written premiums of 36.4 billion euros at end-2024, up 21% compared to 2023

- 287 billion euros in assets under management, up 13% compared to 2023

- Over one hundred partnerships renewed or signed in 2024

“2024 was a very good year for BNP Paribas Cardif, with record revenues and a sharp rise in pre-tax net profit. Our business is dynamic and is based on strong savings inflows and robust partnerships. Our diversified partnership model has once again demonstrated its effectiveness and allows us to consolidate our leading positions in savings and protection. Making insurance more accessible guides us on a daily basis and over the long term. Through this commitment, we are firmly focused on supporting our policyholders’ projects, providing insurance coverage for as many people as possible. Finally, in a continuous improvement approach, we accelerate thanks to artificial intelligence and the implementation of new technologies, in a secure way and a strengthened customer experience.” commented Pauline Leclerc-Glorieux, Chief Executive Officer of BNP Paribas Cardif.

2024 results up sharply

BNP Paribas Cardif continued its growth trajectory with pre-tax net profit of 1.6 billion euros in 2024, up 13% compared to 2023. Gross written premiums for the BNP Paribas Group’s Insurance Business Line reached 36.4 billion euros, an increase of 21% compared to 2023. At the end of 2024, assets under management totalled 287 billion euros, up 13% compared to the end of 2023.

BNP Paribas Cardif operates in 30 countries and generates nearly half of its gross written premiums (48% in 2024) outside of France. Leveraging its diversified partnership model, the insurer, a global leader in bancassurance partnerships, generates more than half of its gross written premiums (52% in 2024) with partners outside the BNP Paribas Group.

Gross inflows in savings worldwide amounted to 28.3 billion euros at the end of 2024 (+24%), with 34% in unit-linked products. In France, savings inflows increased by 15% compared to 2023, reaching 16.9 billion euros. Internationally, gross inflows stood at 11.5 billion euros, up 40% compared to 2023.

Protection gross written premiums reached 8 billion euros in 2024, up 11% compared to 2023. In France, gross written premiums were up 5% to 1.9 billion euros, energised by property and casualty insurance, which recorded 12% growth, and by affinity insurance with nearly 1.9 million customers at the end of 2024. In international markets, protection gross written premiums reached 6.1 billion euros, an increase of 14% compared to 2023. Growth in Latin America was driven by the rollout of long-term partnerships, particularly in Brazil, where gross written premiums totalled 1.9 billion euros, up 13% compared to 2023. In Europe (excluding France) and other countries, business was up 16% over 2023, with gross written premiums of 3.2 billion euros. Asia recorded gross written premiums of 1.1 billion euros (+10% compared to 2023).

Over one hundred partnerships renewed or signed in 2024 to strengthen products and services for policyholders

The strength of BNP Paribas Cardif’s partnership model was once again manifest in 2024 with the development of key partnerships in Italy with the BCC Iccrea cooperative banking group and in France with the private bank Neuflize OBC. These two major partnerships will enable the insurer to consolidate its leadership in savings and tap into new distribution networks. In France, BNP Paribas Cardif, convinced that life insurance is an essential vehicle that allows French savers to grow their savings and at the same time help finance the economy, relies on a diversified euro fund with a net rate excluding bonuses of at least 2.75% for 96% of its life insurance and capitalisation contracts in 2024. A prudent long-term management strategy and solid reserves allow BNP Paribas Cardif to support its policyholders’ projects and savings objectives over extended periods, with attractive returns on their savings.

The renewal or signing of over one hundred partnerships in 2024 will support long-term business development and strengthen product offerings for policyholders. This dynamism is reflected in new agreements in creditor insurance, a segment where BNP Paribas Cardif is the global leader*. In France, for example, BNP Paribas Cardif has concluded a new partnership with Simulassur, the Magnolia Group’s B2B marketplace specialising in loan insurance, to expand access to its “Cardif Libertés Emprunteur” contract to new brokers and clients. It has also launched new creditor insurance offerings, including in the Nordic countries with the digital bank Northmill. At the beginning of 2025 in France, BNP Paribas Cardif continued to develop its affinity insurance business, notably with the renewal of its partnership with Orange.

Positive impact drives growth and trust for clients and partners

As shown by the results of the global study entitled “Protect & Project Oneself” , conducted by BNP Paribas Cardif, demand for protection insurance remained significant in 2024. To address concerns and support individual client projects, BNP Paribas Cardif is continually guided by its mission to make insurance more accessible. By making insurance more inclusive, more understandable, easier to subscribe and to use, BNP Paribas Cardif helps individuals better protect themselves to better plan for the future. This is the case in individual protection solutions with the introduction of a new and educational approach based on a personalised diagnosis, allowing BNP Paribas French Commercial Banking to offer clients the most appropriate level of protection for themselves and their loved ones. This approach as a responsible insurer is also reflected in improving subscription conditions for creditor insurance for people undergoing treatment for HIV in France, going beyond the criteria set by the AERAS agreement, by now approving without additional premium surcharge or exclusions patients with an undetectable viral load at the time of subscription and for loans up to €1 million. This action is part of a broader approach taken for over the past 15 years to offer coverage to the most vulnerable segments of the population under optimal terms and conditions. Additionally, in 2024, BNP Paribas Cardif expanded coverage of the Total Temporary Disability guarantee in its “Cardif Libertés Emprunteur” contract, marketed in France by brokers, financial advisors, and on Cardif.fr. This “Family Assistance” guarantee – which has two components, “parental presence” and “family caregiver” – now better meets the expectations of families facing difficult life events.

BNP Paribas Cardif considers positive impact to be a foundational element in its investment strategy, convinced that this commitment is a factor that nurtures trust among its clients and partners. The insurer implements a responsible investment policy and applies an ESG filter to investments in its general fund. In 2024, 96% of the assets in BNP Paribas Cardif’s euro funds in France underwent ESG analysis, and more than 33% of unit-linked assets are invested in responsible vehicles , representing 19.4 billion euros. BNP Paribas Cardif, which actively implements the BNP Paribas Group’s energy transition policy, has been committed since 2021 to supporting the transition to a low-carbon economy reducing greenhouse gas emissions in its investment portfolios and contributing to compliance with the Paris Agreement. At the end of 2024, the carbon footprint (Scopes 1 and 2 ) of its directly held equity and corporate bond portfolio in the assets of its euro funds had continued to decrease by at least 50% compared to the end of 2020. This approach is also supported by investments aimed at supporting impact initiatives. BNP Paribas Cardif recorded 3 billion euros in positive impact investments addressing environmental and societal issues during 2024, which corresponds to an average of 2 billion euros per year since 2019.

This commitment to positive impact for the benefit of stakeholders is also reflected in actions taken by BNP Paribas Cardif in favour of a more inclusive society. In 2024, BNP Paribas Cardif and Sistech, an association that supports employment for refugee women in technology and digital professions, signed a partnership to support the association’s beneficiaries. The initiative is part of the “Women & Girls in Tech” program, supported by the BNP Paribas Group. This program aims to promote the recruitment of women in digital and IT fields. In addition, because the number of obesity cases is increasing significantly worldwide, BNP Paribas Cardif has been mobilised since 2021 around the prevention of overweight and obesity. The approach centres on funding research with an international group of doctors and nutrition expert researchers, and supporting several associations worldwide dedicated to preventing overweight and obesity in young people. The program has already benefited 650,000 children and 2 million people, including their family members, in 13 countries.

Technology and artificial intelligence to better serve human needs and increase customer satisfaction

BNP Paribas Cardif firmly believes that technology, particularly artificial intelligence, is key to improving customer satisfaction and supporting partners with quality products and optimised processes. Some 80 AI use cases are currently in production at BNP Paribas Cardif, including 20 dedicated to claims management. The “CardX” solution developed in 2021 to accelerate claims management and automate document processing already handles over 50,000 pages per month in Brazil, Colombia, Spain, and Poland in 2024. New solutions were also deployed in 2024, including with Orange in France, where BNP Paribas Cardif introduced an automatic claims acceptance process based on a score calculated using artificial intelligence. This allows eligible claims declared by policyholders for their mobile devices to be accepted in just seconds.

An insurer’s business involves numerous interactions with its clients. For BNP Paribas Cardif, analyzing and understanding this mass of information is essential to meet the needs for immediacy and efficiency. Its objective is to design simple and accessible customer experiences to meet its three major challenges: raising the level of protection for a greater number of policyholders through greater personalisation and loyalty, improving the customer experience through automation, and optimising processes to meet the expectations of customers and partners.

After entering into exclusive negotiations on August 1st, AXA and BNP Paribas Cardif today announce the signing of the Share Purchase Agreement for AXA Investment Managers (AXA IM).

This signing follows the completion of the information-consultation procedure on strategic issues with the relevant employee representative bodies of both AXA and BNP Paribas groups.

“This signing marks an important step in the acquisition process of AXA IM and our long-term partnership with AXA. In anticipation of the closing process, all teams are now working to welcome AXA IM’s employees and customers into the BNP Paribas Cardif Group” said Renaud Dumora, Chairman of BNP Paribas Cardif, Deputy COO of BNP Paribas.

As previously communicated, the agreed price for the acquisition and the long-term partnership is €5.1 billion, with the closing expected mid-2025 and an anticipated impact on BNP Paribas Group’s CET1 ratio of 25 bps subject to agreements with the relevant authorities.

Financial advisors accelerate diversification of offering and grow client franchise with increasingly personalized support

- 67% of financial advisors report an increase in the number of clients, and 82% expect to develop their business in the coming years thanks to a larger client portfolio and product range.

- 67% of financial advisors note preference for lower risk investments among clients during the past 12 months.

- 68% of financial advisors believe their clients will place greater priority on yield, diversification of assets (51%) and risk exposure (46%) in the next 12 months.

- 82% of financial advisors think artificial intelligence (AI) will become indispensable to wealth management in the future.

BNP Paribas Cardif is pleased to present the results of its 2024 survey of financial advisors. Conducted with Kantar, one of the world’s leading market research agencies, this 18th edition of the BNP Paribas Cardif survey confirms a stronger market that is welcoming new investment opportunities to meet the needs of a diversified client base.

Financial advisors buoyed by confidence and the diversity of their clientele

Nearly half the financial advisors have a younger clientele (47%) and report a trend towards client profiles with more modest asset levels (34%). This confirms the success of their commercial approach and their ability to continually renew their product offering in order to attract new categories of clients. The 2024 survey shows a continuous increase in their client portfolios over the past five years, a trend that 67% of them confirm for the past 12 months.

On the strength of the expansion of the client base and their product offering, 82% of the respondents expect to pursue their development, primarily through organic growth of their firm. This momentum also reflects the confidence the financial advisors express in their business: 83% of the respondents foresee significant growth over the next five years.

From a more macroeconomic perspective, the survey also reveals a growing trend towards market consolidation. Some 41% of the financial advisors are considering acquisitions, while 46% envisage the sale of their business, reflecting a dynamic market undergoing major transformations.

At the same time, the financial advisors underline several key challenges to be addressed, in particular – for 70% of them – integrating regulatory changes, requiring constant monitoring to guarantee compliance and protect the interests of their clients. Another challenge noted by 47% of respondents is identifying investment solutions adapted to the economic environment, while 34% say recruiting new clients is a top-of-mind challenge. Charging fees for their services has, for the first time this year, emerged as a significant new challenge, cited by 29% of respondents.

Financial advisors are establishing themselves as 360-degree players to meet the challenges facing the sector.

In a turbulent market, financial advisors say the past year has seen clients placing greater priority on savings solutions that above all carry lower risk (67%), emphasizing security for their investments. However, respondents believe that potential yield will remain the argument with the greatest impact for clients (68%) in the coming year. They also cite a desire among clients to diversify assets, both in life insurance portfolios (51%) and non-life investment vehicles (28%).

To meet these expectations, financial advisors are proposing a broad and dynamic range of financial investment solutions, coupled with increasingly personalized advice to adapt to fluctuating markets and the specific needs of savers. With regards to life insurance and capitalisation products, the euro fund confirms its number four ranking among the solutions financial advisors propose to clients. In the months ahead 31% plan to propose more of these solutions alongside ETF funds (48%), structured products (39%) and private equity investments (32%).

Beyond life insurance and capitalisation contracts, financial advisors who are positioning themselves as comprehensive wealth management providers say in the coming 24 months, they want to offer individual and collective pension planning products (39% and 26%, respectively), along with individual protection (27%) and creditor insurance products (23%).

Artificial intelligence, a new ally for financial advisors

Artificial intelligence (AI) has emerged as an absolutely essential tool for wealth management in the future according to 82% of financial advisors. Nearly a quarter of them (24%) already employ AI tools to automate or facilitate certain tasks, and 50% expect to use it for these reasons in the future. Among the reasons cited, 83% of respondents say AI could help find regulatory information, and 81% believe it could help identify investment solutions. The growing importance of AI is reflected in the fact that 21% of respondents cite it as a key challenge for the profession.

Consistent with their proactive adaptability to change, some 66% of financial advisors are interested in training on how to leverage AI in their profession, in addition to financial engineering training (51%) and training for regulatory developments (45%).

Alongside these transformations in the business and new opportunities, financial advisors continue to express optimism and resilience, and 94% believe their profession is doing well. With their deep expertise, financial advisors have a positive outlook for the future, and a record 91% of respondents state they are confident about their business.

Read more

BNP Paribas enters into exclusive negotiations with AXA for the acquisition of AXA Investment Managers and a long term partnership in Asset Management

The BNP Paribas Group announces today that it has entered into exclusive negotiations with AXA to acquire 100% of AXA Investment Managers (AXA IM), representing close to €850bn1 assets under management, together with an agreement for a long-term partnership to manage a large part of AXA’s assets.

BNP Paribas Cardif, the insurance business of BNP Paribas, after having directly proceeded to the proposed transaction as principal, would have the opportunity to rely on this platform for the management of up to €160bn of its savings and insurance assets.1

With the combined contribution of BNP Paribas’ asset management platforms, the newly formed business, which total assets under management would amount to €1,500bn1, would become a leading European player in the sector.

Specifically, it would become the European leading player in the management of long-term savings assets for insurers as well as pension funds, with €850bn of assets1, leveraging powerful platforms of public and private assets. The acquisition would also allow the combined businesses to benefit from AXA IM Alternatives’ leading market position and track record in private assets which will drive further growth with both institutional and retail investors.

The agreed price for the acquisition and the set-up of the partnership is of €5.1bn at closing, expected mid-2025.

With a CET1 impact of circa 25 bp for BNP Paribas, the expected return on invested capital of the transaction would be above 18% as soon as the 3rd year, following the end of the integration process.

The signing of the proposed transaction, expected by the end of the year, is subject to the information process and consultation of the employees’ representative bodies. The closing of the transaction is expected by mid-2025 once regulatory approvals have been obtained.

“This project would position BNP Paribas as a leading European player in long-term asset management. Benefiting from a critical size in public and alternative assets, BNP Paribas would serve its customer base of insurers, pension funds, banking networks and distributors more efficiently. The strategic partnership entered into with AXA, the cornerstone of this project, confirms the ability of both our groups to join forces. This major project, which would drive our growth over the long-term, would represent a powerful engine of growth for our Group.” said Jean-Laurent Bonnafé, Director and CEO, BNP Paribas.

“AXA Investment Managers has been a homegrown success story for the AXA Group. Over the past 25 years, we have built an exceptional franchise anchored in investment expertise, a relentless client focus and a proven track record on sustainability. Thanks to the quality of its teams, AXA IM is today a leading player, notably in Alternatives in Europe.” said Thomas Buberl, CEO of AXA. “By joining forces with BNP Paribas, AXA IM would become a global asset manager with a wider product offering and a mutual objective to further their leading position in responsible investing. I would like to thank all AXA IM employees for their unwavering commitment, and their continued focus on delivering value for our clients.”

“The creation, within the Investment & Protection Services (IPS) division of the BNP Paribas Group, of a European leader in the management of long-term insurance and savings assets, would enable the IPS division to exceed EUR 2 trillion of assets entrusted by its clients. This operation would allow BNP Paribas Cardif to benefit from premium access to the services of an asset management expert on the asset classes required for insurance management. The combined expertise of the BNP Paribas Asset Management and AXA IM teams in public and private assets, as well as their leadership in sustainability, would be valuable assets to better meet future needs of clients.” said Renaud Dumora, Deputy Chief Operating Officer, Investment & Protection Services, BNP Paribas.

1 Based on assets as at 31.12.2023

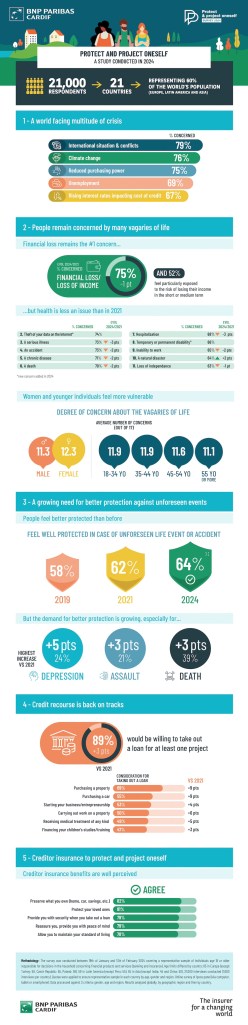

New BNP Paribas Cardif survey: “Protect & Project Oneself”1

A general sentiment of being well protected, coupled with greater expectations regarding insurance coverage

- A world facing multiple crises: international conflicts, climate events, purchasing power;

- People are slightly less concerned about unforeseen life events than in 2021, but have not returned to levels of confidence seen in 2019;

- Financial loss remains the primary source of concerns around the world, followed by cybersecurity;

- Creditor insurance is viewed as a useful solution to support a renewed focus on personal projects requiring financing.

A growing need for protection in the face of multiples crises

Results of the 2024 survey show that people are slightly less concerned about unforeseen life events than in 2021. However, the degree of concerns remains above levels measured in 2019. Although the world is gradually recovering from the pandemic, other crises remain, and inflation worries have replaced fears related to Covid since 20222. At the same time, at the global level, 79% of respondents in the survey say they are particularly concerned about international conflicts, 76% about climate change, and 75% by the drop in purchasing power. The French are more concerned with the latter two issues, notably the decline in purchasing power for 86% of the respondents. While people in all regions share concerns regarding climate change, unemployment is the top concern in Latin America and Asia (86% and 71% of respondents, respectively).

With regards to unforeseen life events, loss of income remains a major source of concern for three-quarters of the global population. Cybersecurity, a new topic included in this year’s survey, was directly ranked second, cited as a chief concern by 74% of respondents. The percentage of people citing concerns also rose for other topics such as physical assaults and violence (+3pts vs. 2021 and +4pts vs. 2019) and cars theft or damage (+2pts vs. 2021 and +4pts vs. 2019). As more time passes since the health crisis, worries about health have diminished, but still remain higher than in 2019. Concerns regarding depression rose 2 points worldwide, cited by 62% of those interviewed.

Lastly, while the percentage of people who feel they are sufficiently protected against unforeseen events continues to rise – reaching nearly two-thirds of the population in the 2024 survey (+2pts vs. 2021 ; +6pts vs. 2019) – only 14 % of respondents say they feel “very well protected”. This sentiment of vulnerability is highest in Latin America. The percentage of people who feel “very well protected” is higher in France than in any other country (72% in France vs. 64% worldwide). At the same time, expectations in terms of protection continue to climb in all three regions, particularly for issues related to mental health (+5pts vs. 2021), death (+3pts vs. 2021) and physical assault (+3pts vs. 2021).

Creditor insurance supports return to plans for personal projects

In 2024, personal projects and the need to finance them have once again become a priority, and the number of people who plan to resort to credit has increased across all geographies. In this context, creditor insurance is viewed as a useful solution in all three regions to help people move forward with their life plans. Respondents believe that these insurance products encourage them to pursue their projects while looking to the future with serenity. Creditor insurance in particular is seen as a solution that lets people retain ownership of property (82% agree), protect their family (81%), ensure security when they take out a loan (79%) and maintain their standard of living (78%).

The percentage of the population ready to resort to credit for a real estate acquisition has returned to pre-Covid levels (69%, +9pts vs. 2021), as has the number of people with plans to buy a car (55%, +9pts vs. 2021). Appetite for consumer credit is also on the rise, in particular to finance home improvement projects (cited by 50% of respondents), or to pursue plans to move to another region or another country (33%).

The 2024 survey showed an upturn in projects requiring financing both in France and the rest of the world. While a real estate acquisition remains the primary motivation for taking out a loan, the percentage remains below the 2019 level: 60% of the French cited real estate acquisitions in 2024 (stable vs. 2021 but -16pts vs. 2019). A car purchase is also cited as a reason to resort to credit (55%). Lastly, there is also an increase in the number of people who say they would resort to credit for home improvement projects (48%), to finance studies (37%) and for medical treatment (34%).

An infographic showing results from the survey is available on bnpparibascardif.com.

1 Methodology: The survey was conducted online between 19 January and 13 February 2024 on a group of 21,000 people in 21 countries on 3 continents (Europe, South America and Asia), covering a representative sample of individuals age 18 or older who are responsible for decisions in the household concerning financial products and services (banking and insurance). Age limits differed by country: 65 in Europe (except Turkey: 50, Czech Republic: 55, Poland: 59), 59 in Latin America (except Peru: 55), 55 in Asia (except India, 45, and China, 50). 21,000 interviews were conducted (1,000 interviews per country). Quotas were applied to ensure representative sample in each country by age, gender and region. Online survey of Ipsos panel using device agnostic questionnaire (computer, tablet or smartphone). Data processed against 3 criteria: gender, age and region. Results analyzed globally, by geographic region and then by country.

2Ipsos survey: “What worries the world?” – January 2024

- Pre-tax net profit for full-year 2023 of 1.4 billion euros, an increase of 4% versus 2022

- 30.3 billion euros in gross written premiums in 2023, up 2% versus 2022

- 255 billion euros in assets under management at end-2023, up 4% year-on-year

- Nearly 100 partnerships signed or renewed thanks to the company’s ability to adapt its products and to provide growth drivers to its partners

2023 results buoyed by business momentum

BNP Paribas Cardif reports solid results for 2023, reflecting a balanced model and robust sales momentum. Pre-tax net profit for the insurance business of the BNP Paribas Group came to 1.4 billion euros in 2023, up 4%1. Gross written premiums amounted to 30.3 billion euros, an increase of 2%2 versus 2022. At end-2023, assets under management totalled 255 billion euros, up 4% year-on-year.

With a presence in over 30 countries, BNP Paribas Cardif generates nearly half its gross written premiums (46%) outside of France. The insurer also generates nearly half its gross written premiums (49%) with partners outside the BNP Paribas Group, underlining the strength of its diversified business model.

In an unprecedented environment, global savings inflows totalled 22.9 billion euros at 31 December 2023 (up 1%2), of which 32% was invested in unit-linked products. Savings inflows in France grew by 12% year-on-year to reach 14.7 billion euros. International savings inflows came to 8.3 billion euros, down 13%2.

Protection gross written premiums totalled 7.3 billion euros, an increase of 4%2. In France, the protection segment grew 6% to 1.8 billion euros, primarily led by property and casualty insurance, affinity insurance and personal protection. In international markets, protection gross written premiums came to 5.5 billion euros, a 4%2 increase supported by all geographies. The protection segment continued to grow in Latin America, particularly in Brazil, with the region recording 1.7 billion euros in gross written premiums, up 8%2. In Europe (excluding France) and other countries, the segment recorded a 2%2 increase versus 2022 with 2.7 billion euros in gross written premiums, thanks partly to the development of partnerships in Eastern Europe. Asia reported gross written premiums of 1.0 billion euros (up 1%2).

Partnership development fuels growth

With protection products clearly in demand, as illustrated by the survey conducted by BNP Paribas Cardif in 2021 indicating that almost 40% of the global population feels insufficiently protected, the company is pursuing its mission of making insurance more accessible. This is being achieved through simplified products and procedures for customers, a unique partnership model, and the diversification of online distribution channels, in line with the objectives set out in the 2025 strategic plan.

In the savings segment, BNP Paribas Cardif reports a record level of inflows in France in 2023, up 12% from 2022, thanks notably to a solid euro fund and a high-quality product offer, which proved its worth in an unprecedented environment. Pursuing its policy of convergence of policyholder participation in returns regardless of product or distribution channel, the company provided a net return excluding bonuses of 3% for 93% of its contracts, increasing the return rate on its life insurance and capitalisation contracts by 100 basis points for 2023. BNP Paribas Cardif ensures that all policyholders benefit from the reversal of the policyholders surplus reserve. The prudent reserve-building policy implemented in recent years has nonetheless allowed it to maintain the policyholders surplus reserve at a high level, representing 5.44% of outstandings or 4.619 billion euros. High-quality financial management also enables the insurer to maintain a dynamic management strategy over the long term. The globally dynamic performance achieved last year once again confirms the merits of diversification and the successful balance across the various distribution networks.

Thanks to the company’s ability to adapt its products and to provide growth drivers to its partners in more than 30 countries, BNP Paribas Cardif signed or renewed nearly 100 partnerships in 2023. In France, for example, an agreement was signed with Assurancevie.com to expand its offering via digital channels. In Italy, BNP Paribas Cardif forged a strategic partnership in life insurance with BCC Iccrea, the country’s second-largest banking group by number of branches, with a portfolio of 5 million customers. This new partnership consolidates the company’s position in the global insurance market and strengthens its international bancassurance strategy, notably in Italy, a strategic market for BNP Paribas Cardif. In Brazil, the insurer’s exclusive partnership with leading local retailer Magalu, spanning the sale of insurance products across all its platforms, was renewed in 2023 for 10 years. BNP Paribas Cardif also bolstered its positions in Europe during the year through new alliances, such as the partnership signed with Velobank in Poland to offer creditor insurance to its customers.

The protection segment recorded further solid gains in Latin America and France, particularly in affinity insurance and in property and casualty insurance through the Cardif IARD subsidiary, which saw an increase in gross written premiums of 10.6% between 2022 and 2023. In France, in a tight property market, creditor insurance business was driven by its two pillars: a collective product and an individual product. These two complementary approaches enable BNP Paribas Cardif to meet the needs of all borrowers.

In late 2023 BNP Paribas Cardif obtained a license to provide life and non-life reinsurance as of 1st January 2024. With this new business, the company continues to diversify its portfolio to provide insurance and protection to as many customers as possible. The creation of this internal reinsurance vehicle will enable the company to optimise internal risk-taking by centralising the risks managed by its local subsidiaries, but also to forge new partnerships and expand existing partnerships through additional services.

Harness the power of technology to enhance insurance products and the customer experience

In 2023, BNP Paribas Cardif pursued the objectives set out in its strategic plan by simplifying products and customer procedures and developing partnerships with insurtech companies to make insurance easier to purchase and use.

In France, as part of its mobile phone insurance partnership with Orange, BNP Paribas Cardif – which already approves nearly nine claims of out of ten – rolled out an automated claims approval system based on artificial intelligence. The new solution reduces the time required to approve claims from an average of two hours to just a few seconds. Also during the year, to facilitate and improve online formalities for creditor insurance policyholders in the BNP Paribas branch banking network, a partnership was signed with French government department DINUM and national health insurer CNAM to enable policyholders to benefit from a simplified and even more secure online experience via FranceConnect, a centralised online identification system proposed by the French government. The succession journey for beneficiaries of a life insurance policy was also revamped during the year, to make it simpler from the outset and create a more supportive customer experience. The new procedure resulted in a customer NPS at end-2023 of +40.

The year also saw a ramp-up in digital partnerships, including one with insurtech Lemonade to offer fully-digital home insurance for renters in France. The product provides a simple and fluid customer experience thanks to a 100% online policy subscription and claims submission process – all within seconds, on any device. Available online via cardif.fr or lemonade.com/fr or via the Lemonade app, the policy is currently offered to Nickel customers who rent their homes.

Confirmed positive impact trajectory

BNP Paribas Cardif puts positive impact at the centre of its strategy and its value proposition. In 2023 this commitment resulted in a strengthening of the company’s initiatives for the benefit of employees, customers, the environment and society in general.

As a major player in creditor insurance, BNP Paribas Cardif has been actively committed over the past 15 years to making insurance more inclusive, by proposing products aligned with the needs of people suffering from certain pathologies and taking into account the latest medical advances to offer the most equitable terms. The company strengthened its commitment in 2023 by making it easier for people suffering from inflammatory bowel disease (IBD) to take out creditor and personal protection insurance in France, where IBD affects more than 270,000 people. Also, for the first time in Japan, BNP Paribas Cardif extended the scope of its “spouse coverage” to include same-sex partners. Expanding this coverage, which provides for lump-sum payments if a creditor’s partner is diagnosed with cancer, enables them to be protected in the same way as married couples.

As an organisation, BNP Paribas Cardif nurtures a corporate culture designed to encourage positive impact in every area. It also has a duty to take action to help build a more sustainable and inclusive world. In 2023, the insurer signed a philanthropy partnership in France with Institut Imagine, the leading European centre for genetic disease research, care and education. Under the agreement, BNP Paribas Cardif France will provide support for three years to the institute’s “Springboard” program, which aims to convert research findings into innovations or diagnostic or therapeutic solutions. BNP Paribas Cardif also conducts awareness initiatives among its employees, partners and policyholders, aimed at improving their knowledge of genetic diseases to avoid misdiagnoses. Employees endorse the company’s actions, as illustrated by the results of an internal survey3 in which nearly 90% confirmed their support for the mission of making insurance more accessible.

BNP Paribas Cardif also demonstrates its commitment to positive impact through its role as an institutional investor and through its long-term approach to asset management, based on a combination of financial performance and positive impact on society and the environment. In France, at the end of 2023, 95% of the assets managed by BNP Paribas Cardif in the euro fund were assessed against ESG criteria, and 41.6% of the outstandings in unit-linked contracts were invested in responsible funds4 (21.7 billion euros). In line with the commitments set out in its strategic plan, BNP Paribas Cardif recorded 1.7 billion euros in positive impact investments in 2023, bringing the average per year since 2019 to 1.8 billion euros. In 2023, these included investments in the “BNP Paribas European Impact Bonds Fund 2”, which aims to support the rollout of impact bonds across the European Union, and the “Climate Impact Infrastructure Debt Fund”, designed to support energy transition projects across continental Europe.

1At historical scope and exchange rates; given that 2023 results take into account the application of IFRS 17 Insurance Contracts and IFRS 9 Financial Instruments from 1 January 2023, results for 2022 have been adjusted for the impact of these standards as if applied from 1 January 2022

2At constant exchange rates

Value totals may differ due to rounding

3Internal survey carried out from June 19th till July 7th, 2023 on all employees

4A unit-linked fund is said to be “responsible” if it has been labelled by an independent body (such as ISR, GreenFin, NG, Finansol, LuxFlag ESG, Towards Sustainability) or declared Article 9 within the meaning of the European Union’s Sustainable Finance Disclosure Regulation (SFDR)

Read more

Chrystelle Renaud is appointed Deputy Chief Executive Officer and General Secretary.

Christian Gibot is appointed Chief Financial Actuary, Capital and Modelling Officer

Chrystelle Renaud joins BNP Paribas Cardif as Deputy Chief Executive Officer and General Secretary. By bringing together the Risk, Compliance, Internal Audit, Legal Affairs and Institutional Affairs functions, the creation of the General Secretariat underlines the key contribution these functions make to the development of BNP Paribas Cardif’s value proposition and to acceleration of the company’s growth.

Christian Gibot is appointed Chief Financial Actuary, Capital and Modelling Officer of BNP Paribas Cardif. Having held a series of technical and commercial positions within the company between 2015 and 2022, Christian Gibot has in-depth knowledge of BNP Paribas Cardif’s business activities and operating environment.

Chrystelle Renaud and Christian Gibot both become members of the Executive Committee of BNP Paribas Cardif and report to Pauline Leclerc-Glorieux, Chief Executive Officer of BNP Paribas Cardif.

Biographies

Chrystelle Renaud

Holding degrees in pure and applied mathematics and finance, Chrystelle Renaud began her career as a teacher and researcher. She joined the BNP Paribas Group in 2001 as a quantitative analyst within the Risk department before taking the responsibility for Credit & Rating Policies and Models in the context of the implementation of Basel 2 regulatory framework. She joined Bank of the West in California in 2008 as senior advisor before being appointed Chief Risk Officer and a member of the Executive Committee of Arval, where she also supervised ALM and Insurance. In 2013, she joined Commercial & Personal Banking in France (CPBF) as the head of pricing and was then appointed head of a business centre for corporates. She set up the technological innovation department for CPBF in 2017. From 2019 until 2024 Chrystelle took the responsibility of Investor Relations and Financial Information of the BNP Paribas Group.

Christian Gibot

After beginning his career with Axa France as actuarial research manager and then head of the actuarial team, Christian Gibot held a serie of positions as advisor in the office of the chief executive officer of the Caisse des Dépôts from 2008 to 2011. He was then technical director for France at CNP Assurances from 2011 to 2015. He joined the BNP Paribas Group in 2015 as Actuarial Director for savings products and ALM at BNP Paribas Cardif, the Group’s insurance subsidiary. From 2019 to 2022 Christian Gibot was Chief Executive Officer of Cardif Lux Vie, a life insurance subsidiary of BNP Paribas Cardif in Luxembourg. He was subsequently appointed CEO of International Markets at BNP Paribas Wealth Management (Luxembourg, Switzerland, Spain, the Netherlands, Middle East, Monaco and Germany) and a member of the BNP Paribas Wealth Management Executive Committee. He is also head of BNP Paribas Wealth Management Luxembourg within BGL and a member of the Executive Committee.

Christian Gibot is a graduate of Ecole Polytechnique and holds an MBA CHEA from Paris Dauphine University. A certified actuary, he is an alumnus of Saïd Business School, Oxford and a former auditor of the IHEE (Institut des Hautes Etudes de l’Entreprise).

At 1 March, 2024, the Executive Committee of BNP Paribas Cardif comprises the following members:

- Pauline Leclerc-Glorieux, Chief Executive Officer

- Fabrice Bagne, Deputy Chief Executive Officer, France Italy & Luxemburg

- Vivien Berbigier, Chief Value Proposition Officer

- Pauline de Chatillon, Chief Compliance Officer

- Stanislas Chevalet, Deputy Chief Executive Officer, Transformation & Development

- Charlotte Chevalier, Chief Executive Officer EMEA (Europe, Middle East, Africa)

- Alessandro Deodato, Chief Executive Officer Italy

- Nathalie Doré, Chief Impact and Innovation Officer

- Christian Gibot, Chief Financial Actuary, Capital and Modelling Officer

- Olivier Héreil, Deputy Chief Executive Officer, Asset Management

- Carine Lauru, Chief Communications Officer

- Anne du Manoir, Chief Human Resources Officer

- Eric Marchandise, Deputy Chief Executive Officer, Finance

- Michael Nguyen, Deputy Chief Executive Officer, Efficiency, Technology, Operations

- See See Ooi, Chief Executive Officer, Asia

- Murielle Puron Chambord, Chief Risk Officer

- Chrystelle Renaud, Deputy Chief Executive Officer and General Secretary

- Francisco Valenzuela, Chief Executive Officer, Latin America

Biographies and photos of members of the Executive Committee of BNP Paribas Cardif are available from the press office.

Read more

In 2023, BNP Paribas Cardif celebrated its 50th anniversary. Half a century of adventure, partnerships, and international expansion celebrated by our employees around the world.

Watch the video of the events and opportunities that marked the year for BNP Paribas Cardif.

Exciting partnerships

- In Brazil, BNP Paribas Cardif and Magazine Luiza have renewed their exclusive partnership until 2033. Magazine Luiza will continue to offer our insurance products to its 13 million customers across all its platforms.

- In Poland, BNP Paribas Cardif has partnered with VeloBank to increase the value of products for customers. Together, new products have been developed to improve the scope of life and health services offered to customers.

- In Turkey, BNP Paribas Cardif has renewed its partnership with MediaMarkt for a further 3 years. Through this partnership, the insurer serves 6,000 customers per month with an average claims processing time of less than 7 days and a claims acceptance rate of 92%.

Innovative new products:

- In France, in order to meet the expectations of customers, especially the youngest, BNP Paribas Cardif is partnering with Lemonade to offer a multi-risk home insurance product for tenants. This B-to-C offer offers a simple and fluid customer experience thanks to a fast and 100% digital subscription and claims process.

- In Korea, BNP Paribas Cardif has developed a Creditor Insurance product using the Insurance Risk Score (IRS) system, which is calculated based on the customer’s personal credit data. This encourages good individual financial management through an annual IRS calculation, offering a greater discount on one’s ADE rate and if the score improves year-over-year. In addition, BNP Paribas Cardif supports its clients in the regular management of their loans.

- In France, in order to improve and facilitate online procedures, FranceConnect, the French National Health Insurance Fund and BNP Paribas Cardif are joining forces, allowing its policyholders of a borrower insurance contract in the BNP Paribas network, to benefit from a simplified and more secure care process. in the event of indemination following a work stoppage.

- BNP Paribas Cardif supports scientific research, led by experts, to improve the detection and effectiveness of obesity prevention. Thanks to partnerships with many associations around the world, 20 million people in 12 countries were raised awareness 2023*.

- In France, BNP Paribas Cardif has signed a sponsorship partnership with the Imagine Institute, Europe’s leading centre for research, care and education on genetic diseases, with the aim of encouraging medical research and accelerating discoveries towards innovative therapeutic avenues.

- BNP Paribas Cardif has also improved the terms and conditions for underwriting creditor insurance and individual life insurance policies for people with inflammatory bowel disease (IBD).

In 2023, BNP Paribas Cardif forged strong partnerships and developed innovative products to make insurance ever more accessible.

* source : Unicef