The Innovation Ambassadors program counting 84 innovative projects submitted from 24 countries worldwide in 2024, shows that innovation can be found everywhere at BNP Paribas Cardif. Discover how BNP Paribas Cardif automates its call analysis processes through AI and the Call Analyzer solution.

Could you please introduce yourself briefly?

My name is Jérôme Sarrail. Following several years as Chief Risk Officer for EMEA at BNP Paribas Cardif, I joined in late 2024 the Corporate Analytics department to drive the adoption of AI solutions across our entities.

In my current role, I wear multiple hats, including Product Manager of Call Analyzer, an innovative, internally-developed solution that utilizes AI to automatically extract valuable insights from customer interactions.

As Product Manager, my responsibilities include defining the product roadmap, coordinating the development of new features, and deploying new use cases that address the needs of our customers.

Tell us about your project: your main focus, what it is, how it came about and what it will bring to BNP Paribas Cardif

The first use cases of Call Analyzer were launched in Q4 2023 in Peru and Colombia, with the audit of telemarketing calls. To guarantee the integrity of the sales process, our solution incorporated automated controls that monitor adherence to the sales script and streamline cross-selling process, thereby enhancing overall efficiency.

Building on this achievement, we expanded our efforts in 2024 to explore two dimensions:

Firstly, we harnessed the power of Generative AI and Large Language Models (“LLM”) to enhance our solution. This integration has enabled us to reduce annotation workload (resulting in faster time-to-market) and more sophisticated analysis of customer interactions.

Secondly, we broadened our scope to develop a new family of use cases focused on understanding customers’ needs and pain points, complementing our existing audit-related use cases.

These advancements have paved the way for the deployment of several use cases in 2025, which are expected to bring benefits to various stakeholders, including customers, partners, and employees.

What did you find most striking/surprising during this project (perhaps you have a joke to tell us)?

Every AI project starts with data.

What struck me most was the unexpected hurdles we faced in accessing and using our own call data. It’s easy to assume that obtaining the necessary information would be straightforward, but in reality, it often proved to be a significant challenge: contract with our call centers to access to call recordings, issues with inconsistent audio formats (some calls were recorded in mono, while others were in stereo). Furthermore, we had to carefully consider the storage and security of the calls to guarantee a safe and compliant data journey, particularly when dealing with sensitive information.

In practice, the time required for managing these issues frequently exceeds the estimates outlined in plans and roadmaps.

What advice would you give to employees who also want to innovate?

In the rapidly evolving fields of AI and Gen AI, it’s essential to have a mindset that scales. This means limiting the time spent on proof-of-concepts (POCs) and focusing on collaborative teamwork to industrialize new ideas from scratch.

At BNP Paribas Cardif, we’ve successfully built Transversal Analytics Solutions to harness the power of AI and drive value creation across our global teams. These solutions are developed through a strong partnership between our Corporate Analytics, IT, and Data teams, demonstrating the importance of cross-functional collaboration in bringing innovative ideas to life.

The Innovation Ambassadors program counting 84 innovative projects submitted from 24 countries worldwide in 2024, shows that innovation can be found everywhere at BNP Paribas Cardif. Discover how BNP Paribas Cardif and Icare automates claim management for cars.

Could you please introduce yourself briefly?

My name is Elena Tsitouris and I work at ICARE, a BNP Paribas Cardif subsidiary specialising in mechanical breakdown warranty and used-vehicle maintenance contracts. I’ve been a Digital and Data Project Manager for seven years now.

In practical terms, my team and I are responsible for outlining, implementing and rolling out the digital services of tomorrow for our partners, customers and internal employees. A 360° project management job with lots of freedom, there’s never a dull moment!

I have a little girl and a second one on the way and I’m always listening to a lifestyle or cultural podcast!

Tell us about your project: your main focus, what it is, how it came about and what it will bring to BNP Paribas Cardif

Our technical platform in Le Mans has always been a strong differentiating asset for Icare, and one that is highly valued by our partners and customers because of the short response time and the expertise of our operators, most of whom are former mechanics.

But our accelerating development, particularly on an international scale, has led us to rethink our model. Automation has emerged as an obvious response to our growing business. And so the Claim Automation project was born!

Encouraged by feedback from other Group entities (BNP Paribas Cardif in Spain, Karapass, etc.) and supported by a team entirely dedicated to this project, which is important, we were able start the work. This involved:

- The development of an analytical model for the automatic approval of claims based on the industry expertise of our operators

- Many UX workshops to improve the online claim filing experience

- Major IT developments to streamline workflow

Today, we’re proud to have an average of 1,000 claims approved automatically every month, and our goal is to reach 2,000 claims per month by September 2025.

What did you find most striking/surprising during this project (perhaps you have a joke to tell us)?

I was impressed by the level of technical expertise and know-how of our technical platform. A car is made up of approximately 900 parts. From an industrial point of view, it’s a technological marvel. I also discovered the sustainable side of automotive after-sales services: re-used parts, parts recycling, etc.

And the fact that, strangely enough, there are very few digital platforms in France that cater to repair shops. As someone who originally came from the insurance sector, I was able to discover the automotive side of my job.

What advice would you give to employees who also want to innovate?

Securing support from management very much helps bring your innovation to life. Having strong support helps to create an environment that is conducive to innovation – in terms of resources, of course, but also a secure workspace that leaves room for iteration and failure.

Lastly, I’m not telling you anything new, but having dedicated IT teams working full-time on the project is a major asset.

Related articles

The Innovation Ambassadors program counting 84 innovative projects submitted from 24 countries worldwide in 2024, shows that innovation can be found everywhere at BNP Paribas Cardif. Discover how BNP Paribas Cardif, in partnership with Orange, enables the processing of claims for phone damage and oxidation in just a few seconds.

Introduce yourself briefly: country, division, main tasks, personal interests outside the company (e.g., leisure and hobbies)

My name is Tom Thiberge and I’ve been working for BNP Paribas Cardif for 10 years now, having started here on a work-study programme. A few months ago, I joined Karapass, a subsidiary specialising in affinity insurance products, where I manage a data team. My role is to develop and promote our data services and analytics offer from an operational perspective, while steering Karapass towards a resolutely AI-driven approach, meaning an approach where AI plays a central role in decision-making, automation and process optimisation.

Outside work, I love making pizza and I’m a football fan, a fervent supporter of AS Monaco.

Tell us about your project: its main focus, what is its about, how it came about, and what it will bring to BNP Paribas Cardif.

Because phones are so central to our lives, we had to offer our customers an immediate solution in the event of a claim. Thanks to AI, we have reduced claims acceptance times from an average of two hours to just a few seconds. Responding in less than five seconds is not only a technological feat, but also a powerful lever for increasing customer satisfaction.

This innovation is based on a score calculated by AI using data from the claim report and the applicant’s history. It allows claims related to broken or oxidised phones to be accepted in a matter of seconds, for fast processing even in the evening or at the weekend. For more complex claims that cannot be handled by AI, policyholders are automatically redirected toward the traditional process with specialised claims managers. Customers can also choose to be assisted by a claims manager and forgo the automatic approval process.

Implementing this solution in collaboration with our partner Orange illustrates our shared desire to offer an optimal customer experience by providing immediate and effective responses at every stage of the process.

Our determination to be a market maker in the affinity insurance sector is reflected in this solution, which creates value at every level: for our customers, our partners, our employees and for the group.

What did you find most striking/surprising during this project (perhaps you have an anecdote to tell us)?

The ability to meet our commitments in a very short space of time, despite a dense roadmap. This was made possible by our teams of experts and their exceptional commitment. The success of the project is also due to the commitment of our employees, who have gone beyond the scope of their jobs to ensure that it was successful.

What advice would you give to employees who also want to innovate?

It is essential for employees to be proactive and able to connect their area of expertise to the industrial processes that have to be integrated. We must always ask ourselves the question of what is the added value of innovation and then provide a concrete answer.

For a project to be successful, I think three essential success factors need to be in place:

• Innovation must be part of an industrialisable process and provide clearly measurable value, especially for the core business.

• Teams must be aligned from the design to the delivery stage, and effective, regular exchanges must take place with the sponsor and/or decision-maker.

• Stakeholders must be committed to delivering a solution.

Related articles

The Innovation Ambassadors program counting 84 innovative projects submitted from 24 countries worldwide in 2024, shows that innovation can be found everywhere at BNP Paribas Cardif.

Learn more about the importance of continuous education in the distribution industry and how BNP Paribas Cardif in Japan, by leveraging Tovie.Al Tutor Bot, helps our partner salespeople develop a better understanding of CPI products.

Introduce yourself briefly: country, division, main tasks, personal interests outside the company (e.g., leisure and hobbies)

Hello, my name is Hiroshi Chin. I am from Japan and work in the Transformation Division at BNP Paribas Cardif in Japan. My role is Analytics Manager and Chief Data Officer. My primary responsibility is to foster a data-driven culture within the company and drive digital transformation.

CIn recent years, my focus has been on analytics. We have conducted a series of analyses on both internal and external data, which has helped strengthen our partnerships through data-driven insights.

In terms of innovation, last year, we introduced a chatbot for customer education, which we call the CPI Tutor. This project has been an exciting initiative within our company, enhancing customer engagement and learning experiences.

Outside of work, I enjoy product making. In my free time, I experiment with making cheese and occasionally bread at home.

Tell us about your project: its main focus, what is is about, how it came about, and what it will bring to BNP Paribas Cardif.

Our project aims to enhance the education of our partner salespeople, helping them develop a better understanding of CPI products. By strengthening their foundational knowledge, they can offer and distribute more suitable plans to end users.

To achieve this goal, we have been conducting CPI Tutor lessons for our partner sales teams. However, due to limited human resources,-our team consists of only four people-it has been challenging to scale these sessions nationwide. Additionally, we work with approximately 70 partners, many of whom have more than tens of branches, resulting in a large number of salespeople to train.

Given these challenges, we came up with the idea of leveraging chatbots to provide remote educational courses. This approach allows us to deliver training more efficiently and ensure broader accessibility for our partners. Additionally, by offering digitalized services like CPI Tutor, we aim to showcase our company digital transformation capabilities. This tool not only enhances training but also serves as a valuable asset in negotiations with our partners, demonstrating our technological strengths and innovation.

Also, this is the first project in BNP Paribas Cardif to utilize Tovie.ai- a company-supported Chat bot platform. This chatbot will provide users with a unique and interactive experience. First, it will educate users using a Data book – a text document explaining different aspects of CPI in Japanese.

Second, it will offer quizzes to reinforce learning.

Third, it will engage users in role-playing exercises, providing a practical speaking experience to enhance their sales communication skills.

Additionally, all relevant documents will be displayed on the screen within the dialogue window for seamless reference. The chatbot leverages basic NLP (Natural Language Processing) to assess whether the role-play responses contain the necessary sales content, ensuring a comprehensive training experience.

What did you find most striking/surprising during this project (perhaps you have an anecdote to tell us)?

Although the first version of our chatbot prototype has limited functionality. In the POC, we found more than around 80% of users considered this solution useful. In next stage, we plan to broaden our product offerings by introducing additional coverage options including product knowledge or insurance claim knowledge. We will also implement a FAQ section to streamline partner inquiries and provide easier access to essential information. These improvements aim to reduce the inquiry from the partner.

Many of our partners and their salespeople have found it valuable for strengthening their CPI knowledge and supporting their daily work. Given this positive feedback, we believe there is great potential to continue improving the CPI Tutor and further align it with our goals.

From an AI perspective, leveraging AI for education is both an exciting and challenging approach. It presents new opportunities that were not possible in the past in the industry. Therefore, we should continue researching and investing in this field to enhance our capabilities and maximize its impact.

What advice would you give to employees who also want to innovate?

Right now, we are in a highly dynamic era filled with opportunities, especially in the field of AI, where progress is advancing at an unprecedented pace. To keep up with these rapid changes, we must stay creative and embrace challenges within the company.

To go further

The Innovation Ambassadors programme, which includes 11 winners among 84 innovative projects submitted by 24 entities around the world in 2024, shows that innovation is everywhere at BNP Paribas Cardif! Find out how BNP Paribas Cardif’s impact programme in France has made insurance more accessible to people living with Inflammatory Bowel Diseases (IBD).

Introduce yourself briefly: country, division, main tasks, personal interests outside the company (e.g., leisure and hobbies)

My name is Céline Scazzola. After gaining experience in various subsidiaries and commercial divisions within the BNP Paribas Group, I am currently part of the Impact Department under the leadership of Nathalie Doré, Director of Impact & Innovation. For the past four years, I have been supporting different core business lines in France in rolling out initiatives designed to have a positive impact. These initiatives mainly focus on savings, CPI (Creditor Protection Insurance), and protection schemes, covering topics such as product innovation/improvement, customer journeys and services, as well as certain procedural aspects.

As a coordinator, I assist, support and help embed Impact into core business activities.

My role is incredibly cross-functional, and I collaborate with nearly everyone on a daily basis! The Marketing teams are my closest allies, along with the Asset Management Department, Actuarial Affairs, and Customer Division. These groups sit on the business CSR committees, and I genuinely enjoy our regular interactions.

On a personal note, I love live performances (theatre and concerts), Pilates, skiing and restoring vintage chairs.

Tell us about your project: its main focus, what is is about, how it came about, and what it will bring to BNP Paribas Cardif

In our efforts to improve access to insurance for our customers in France—whether it’s Creditor Protection Insurance or protection schemes—we’ve been addressing impaired health risk coverage for over 15 years. This work has involved focusing on a range of conditions, including asthma, paraplegia, tetraplegia, Parkinson’s disease and, more recently, Chronic Inflammatory Bowel Diseases (CIBD).

For each condition, we take a deep dive: What are its defining characteristics? What are the latest treatment options? The main goal is to offer customers affected by these conditions fairer pricing that reflects their actual circumstances, with fewer extra premiums and exclusions.

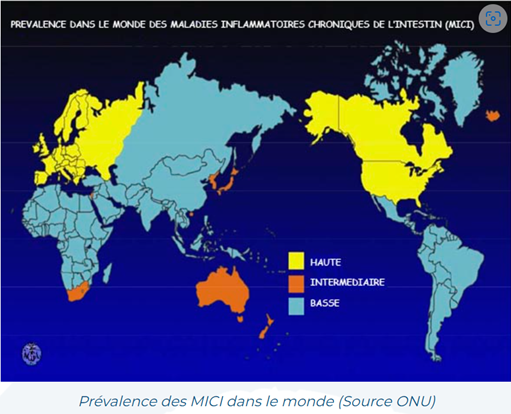

In France, Inflammatory Bowel Diseases (IBD) affect more than 300,000 people. Globally, these conditions are on the rise, as shown in the prevalence data below:

Source :Fiche “Maladies inflammatoires chroniques de l’intestin” I L’Assurance Maladie (ameli.fr), 2022

This project on IBD was born from a meeting between Sigrid Motillon (Actuarial affairs, France), Pierre-Emmanuel Coville (Customer Division, France), and Professor Matthieu Allez, Head of the Gastroenterology Department at Hôpital Saint-Louis. The meeting took place in April 2019 during the annual event for the association of medical advisors in personal insurance, where Professor Allez was giving a lecture.

An initial conversation with the Professor confirmed that this condition would affect an increasing number of people in the future. At the same time, significant medical advances, particularly in treatment options, were emerging. This prompted us to initiate work to update our knowledge and approach to this condition.

Innovation #1: Benefit from the real-time expertise of a specialist in pathology

The partnership with Professor Matthieu Allez has enabled the development of an innovative risk assessment, taking into account real-time clinical data, including the effectiveness of the very latest treatments or therapies arising from recent medical advancements.

This information is highly valuable and complements the statistical studies conducted over several years.

Innovation #2: Development of a specific questionnaire addressing lifestyle habits

Beyond the latest medical breakthroughs, Professor Allez’s expertise has also made it possible to consider how individuals live with the illness, for instance, in terms of physical or professional activities. How does the person manage their illness? Have they found a balance between personal life and work life? And so on.

We are able to offer coverage and premium quotation that are better suited to the actual situation of individuals affected by these conditions, particularly since some people can lead a normal life despite having a severe form of the illness.

This approach allows us to enhance our insurance offerings by providing more comprehensive coverage, meaning without exclusions, and by cancelling or reducing extra premiums. All these improvements make insurance more accessible and inclusive for our customers.

As a result, our policyholders are better protected and can, for example, pursue their professional projects or acquire real estate.

Results observed

The initial results observed are very positive and confirm our expectations.

As an example: across the BNP Paribas branch network, we offered comprehensive creditor insurance with no exclusions for over 90% of customers, a level nearly twice as high as before. In two-thirds of cases, the offer was made under standard conditions without a surcharge, again double the previous rate.

The first study allowed a before/after comparison of 140 cases involving individuals with IBD. The application of the new pricing structure significantly increases the acceptance of insurance at the standard rate (without exclusions or surcharges), rising from 12% to 47% of cases. Furthermore, the remaining surcharges are lower, thus enabling acceptance without exclusions. The initial figures obtained since the launch confirm this trend.

What did you find most striking/surprising during this project (perhaps you have an anecdote to tell us)?

These are tasks that require collaboration with medical experts for each of the relevant conditions, which is unusual in our profession. In fact, it’s very interesting to listen to the podcast with Professor Allez, where he mentions that he was initially apprehensive about working with an insurer, fearing it would hinder some of his patients’ ability to access property. He quickly realised, however, that it would actually help increase access.

The desire to improve things for our customers is the driving force behind our pursuit of innovation. These projects can be lengthy, so it’s important to stay on course while keeping in mind the goal of improving our products.

And as part of our ongoing efforts, since December 1st 2024, 9 out of 10 people treated for HIV can now access Creditor Protection Insurance with no surcharge or exclusions at BNP Paribas Cardif.

What advice would you give to employees who also want to innovate?

Innovation can take many forms and cannot be achieved alone, especially in a large group like ours. We must listen to everyone’s ideas and seize the opportunities that align with BNP Paribas Cardif. It’s a team effort that is we carry out together and that lets us move mountains!

In the field of impaired health risk coverage, ideas can come from various sources: the medical advisor at BNP Paribas Cardif, actuarial affairs, employees through reading or knowledge of conditions…It is up to us to find the specialists for the conditions we plan to target. In my view, we’ll have reached a level of maturity that means that the specialists themselves approach us, asking us to focus on their specific condition.

The Innovation Ambassadors program, counting 84 innovative projects submitted from 24 countries worldwide in 2024, shows that innovation can be found everywhere at BNP Paribas Cardif!

Learn more about how BNP Paribas Cardif in Brazil has cracked into a new CPI market, offering affordable credit protection for elderly customers who want to carry out their projects, and ultimately making insurance more accessible.

Introduce yourself briefly: country, division, main tasks, personal interests outside the company (e.g., leisure and hobbies)

I’m Luciano Benicio, Commercial Director for Banks at BNP Paribas Cardif in Brazil. My responsibility is to win new partnerships in this sector and develop existing ones, like BRB (Regional Bank of Brasilia) and digital banks such Neon and PagBank.

Outside of BNP Paribas Cardif I practice running and like all Brazilians, I´m passionate about football, and follow Flamengo, the biggest and most famous team in Brazil.. I also like to read and study topics related to economics, demographics and behavioral finance. Finally, I really like to watch movies and go to the beach with my family.

Tell us about your project: its main focus, what is is about, how it came about, and what it will bring to BNP Paribas Cardif.

Well, the initiative is basically the increase of the age limit for CPI from 70 years old to 80 years old in BRB (Regional Bank of Brasilia). Iin Brazil it´s really new and innovative.

Since the beginning of the operation in 2023, we have been discussing opportunities beyond what was already planned in the Business Plan. One of the opportunities identified was when they showed us a relevant part of their credits were given to the clients 70+, which were not protected by the previous insurer.

We very quickly evaluated the opportunity, including using fresh information from our new demographic census (2022), where the aging nature of our population is made perfectly clear.

Besides, we negotiated with BRB that we would just approve the product with less commission, considering the inevitable raise of client value. So, for this product, we reduced commission at the same rate we were expecting the client value increase.

We had a lot of benefits: GWP increase; on top of what was planned on the BP. Moreover, the product is a perfect example of our culture, based on making insurance more accessible and with higher Client Value. Finally, we´ve just started to spread this initiative to other partners.

What did you find most striking/surprising during this project (perhaps you have an anecdote to tell us)?

I would like to underline the importance of diving into the partner’s business—this case was a great example. BNP Paribas Cardif is in São Paulo, but BRB’s headquarters is in our capital Brasília (1000 km away). In 2023, I actually spent more days inside the BRB office than in São Paulo!

I’m always visiting branches and talking to managers, holding meetings with teams from different areas and looking for opportunities to improve and grow the business. In one of these meetings with the lending team, they made a comment about the volume of loans for people 70+ and that they were made without CPI.

They brought up this point with little hope that Cardif would take up the challenge of protecting these operations. However, I brought the opportunity to Cardif and in less than 90 days the product was implemented.

The bank was impressed with Cardif’s agility, and this is a clear case that shows how proximity and investigation always generates new opportunities.

What advice would you give to employees who also want to innovate?

Innovation requires courage, resilience, a good communication strategy and strong arguments to convince others. That’s why we must be even deeper in the analysis of facts and data to build an innovative solution.

That´s why I really like to ask questions to data. With well-structured questions, data takes great pleasure in bringing us good answers. After all, it is questions that move the world and transform it continuously.

Finally, this answer reminds me of two of my favorite books that exemplify the way I think about Innovation that could inspire our community: Originals – How Non-Conformists Move the Rooms (Adam Grant) and Fact Fullness – Ten Reason We´re Wrong About the World (Hans Rosling)

Read more

For more than 10 years, BNP Paribas Cardif has been using Artificial Intelligence to improve the quality of its services, meet the clients’ needs for immediacy and make insurance more accessible.

Michael de Toldi, Chief Analytics Officer, and Sandrine Aymes, Analytics Manager at BNP Paribas Cardif, share their expertise on AI in insurance.

Click on the image below to view our new video Cover Stories:

Pour aller plus loin

Each year, BNP Paribas Cardif’s Innovation team carries out a massive sourcing campaign across all BNP Paribas Cardif regions to identify projects that are ready for public communication that could be candidates for Innovation Ambassadors.The ultimate goal of this program is to reward exceptional teams, promote a culture of innovation, and boost our company’s efficiency through the sharing of the best practices.

This year’s submissions included 97 proposals from 24 entities across BNP Paribas Cardif. Many of the initiatives focused on two main themes:

- Artificial Intelligence

Showing the value that AI creates for partners, customers, and collaborators by optimizing processes & distribution, personalizing and improving customer satisfaction, ensuring better brand protection, and more…

- Impact

Providing offers dedicated to underserved populations (due to age or medical condition), increasing value and ease-of-use of products and services in order to make insurance more accessible.

The grand jury, composed of Stanislas Chevalet (Deputy CEO, Transformation & Development), Carine Lauru (Chief Communication officer), Nathalie Dore (Chief Impact and Innovation officer) and Vivien Berbigier (Chief Value Proposition Officer), chose 11 outstanding initiatives as the Innovation Ambassadors 2024.

The initiatives selected are from all our countries, clearly showing that innovation can be found everywhere at BNP Paribas Cardif. Stay tuned for profiles of each of our 11 Innovation Ambassador initiatives on our website and on BNP Paribas Cardif social networks in the coming months.

Read more

BNP Paribas Cardif has once again demonstrated its commitment to innovation by participating in the 8th edition of VivaTech, one of the largest European event dedicated to technology and innovation. The 2024 edition of VivaTech, which took place from May 22 to 25 at Paris Expo Porte de Versailles, had as its main theme artificial intelligence (AI), a technology at the heart of the current transformations in various sectors, including insurance.

Watch the video highlights of this 2024 edition of VivaTech!

Big presence with key interventions

Among the highlights of the event was the intervention of Michael de Toldi, Chief Analytics Officer at BNP Paribas Cardif, who participated at BNP Paribas’ live stream dedicated to “Artificial Intelligence”. His pitch highlighted BNP Paribas Cardif‘s latest advances in AI and how these innovations are helping to improve the services offered to partners and customers.

The Cardif Lab’: at the heart of innovation

The “Floor Tour” organised by the Cardif Lab’ allowed our partners, members of the Executive Committee and even the general public to discover innovative start-ups at the cutting edge of technology in their various sectors. Promising startups discovered during this round include Aqemia, which specializes in AI drug discovery, Citadel AI, which develops AI-based security solutions, Petnow, an app dedicated to pet recognition, and Mob-Energy, which offers innovative solutions for electric vehicle charging.

By participating in VivaTech 2024, BNP Paribas Cardif is reaffirming its role as an innovative insurer and its desire to remain at the forefront of advances, particularly in the field of artificial intelligence. This active presence is a testament to the company’s commitment to transforming the insurance industry to better meet the expectations of its partners and their customers in an ever-changing world.

Read more

BNP Paribas Cardif is simplifying claims management with automation by shortening its processing time and thus providing better and quicker service to our customers and partners.

Judith Will, Corporate Analytics Manager at BNP Paribas Cardif, briefly introducing us to automation.

Check the full interview:

What is automation, and how is it implemented at BNP Paribas Cardif?

At BNP Paribas Cardif, automation is not an end in itself, but a means in a much bigger picture: the redesigning of processes. When looking at a specific process within the customer or partner journey for example, we first need to take a step back and define the objectives we aim to achieve. It could be speed, efficiency, accuracy, seamlessness… Once the target is set, we can assemble the necessary pieces: this is where automation comes into play. Our teams determine the level of automation desired, aligned with the identified needs, and we leverage the appropriate assets across AI, parametric, digital, data, etc.

How can automation improve customer experience?

Redesigning processes and leveraging automation has significant potential for our customers: for example, in Germany our local teams have leveraged automation processes to create a transparent claim process. This thanks to automated and immediate notifications informing policyholders about their claim status, without any human interference. This has contributed to enhance their digital experience as well as their satisfaction. It is key to add that, for BNP Paribas Cardif, automation isn’t and end in itself and is therefore always combined with human expertise.

Can automation bring more value to our distribution partners?

Indeed! Shortening claims processing time makes a real difference for partners. Automation, when well implemented, can have a lot of impact on their customer’s experience and satisfaction, therefore contributing to their brand recognition. To mention only one example, in Chile, we have been implementing automation solutions based on artificial intelligence for a while, for 2 partners in particular: Scotiabank and Caja Los Andes. This enabled their customers to benefit from an impressive reduction of claims processing time: from 10 days and 7 days before, to just 10 minutes! These good results also help our partners improve their customers’ loyalty.

One last word?

I’d say that automation isn’t just good for our clients and partners, but also for us as employees! It can increase speed and efficiency and free up time. Time we can spend to develop business, to focus on high added value tasks, and to develop our skills even further!