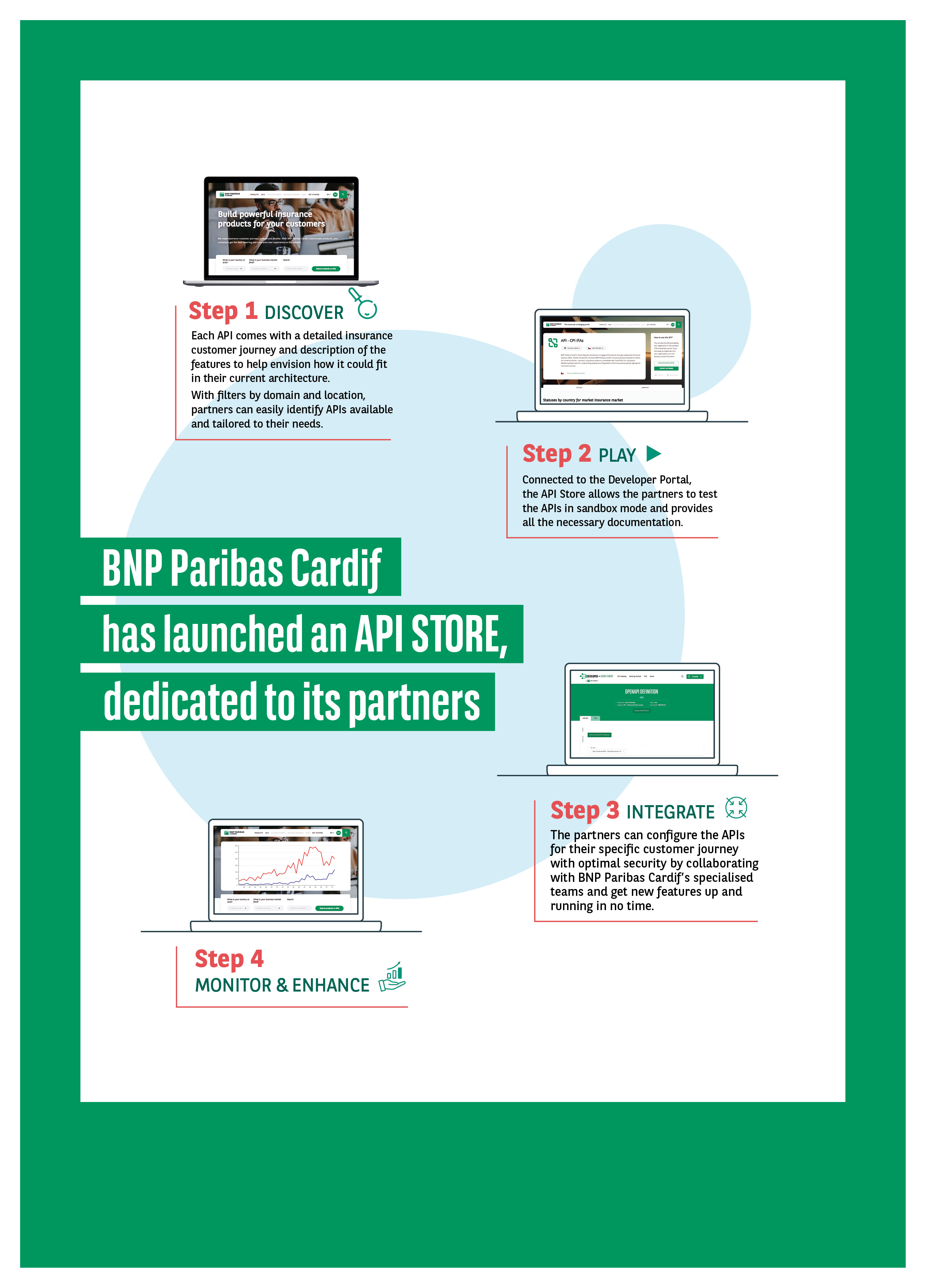

With the introduction of its API Store, BNP Paribas Cardif takes a step further toward its vision of Insurance-as-a-Service. This new digital platform showcases in-house digital assets and is easy to browse, understand and integrate for current and potential partners. It is already available in 30+ countries, with 200+ APIs covering the entire customer and distributor journeys.

Our partner experience is broken down into 4 steps:

Read more

The extra-financial performance of investments is strictly regulated and reflects growing demand among clients (1), making it an increasingly important factor in the investment strategy of both savers and investment managers. Sustainable investing is thriving, spurred both by clients who seek meaningful investments, as well as by distribution partners, who want to diversify their investment offerings. But what does managing savings more sustainabily exactly means?

Bertrand Bussière, BNP Paribas Cardif Sustainable Investment Coordinator and Alice Mignon, Head of Impact transformation at BNP Paribas Cardif, share their insights during this interview for the business report.

How would you qualify BNP Paribas Cardif’s responsible investing policy?

Bertrand Bussière: Our approach as a responsible investor is based on a proven methodology that has been applied for around 15 years at BNP Paribas Cardif. This progressive approach is now extremely robust, integrating regulatory changes as they are introduced. We carefully select investments based on how they measure up against responsibility criteria, and different exclusions are applied in stages to narrow the investment range available to our asset managers.

How do you integrate ESG (environmental, social and governance) criteria into the asset management process, and what impact does this have on financial performance?

Bertrand Bussière: Integrating these criteria is one of the most important steps in the process we apply to reduce the number of corresponding investments. We analyse this data and then exclude companies or countries that have not attained a sufficient score in our view. This leads to the elimination of about a third of the assets during one or the other of our different screening stages. The direct link between ESG criteria and financial performance is difficult to establish for a short-term horizon, but placing priority on investments with the best ESG scores most certainly reduces long-term risks. And this improves their performance, since they will show better resilience in the face of both climate and social changes. The cornerstone of our business as a long-term investor is to generate yield for our policyholders while mitigating risks.

How do you define the notion of positive impact investments? And how does this inform BNP Paribas Cardif’s investment strategy?

Bertrand Bussière: At the end of the selection process for investments, we qualify some of them as having positive impact. They must therefore meet several criteria, in particular the intention to generate a positive impact. This intention must be quantifiable and measurable using indicators.

Alice Mignon: For example, we have invested in green bonds, which provide financing for projects with high environmental value. We also collaborated recently with several impact funds launched by BNP Paribas Group. One was a debt fund, the Climate Impact Infrastructure Debt Fund, which provides funding for infrastructures that accelerate the transition to a low carbon economy. Another is a social impact bond, the European Impact Bonds Fund II, which supports social innovation at the regional level, such as reuse of waste or job creation for vulnerable members of society. At BNP Paribas Cardif, we are particularly proud of our commitment to allocate an average of €1 billion annually to positive impact investments between 2019 and 2025. In 2023 alone, we invested €1.7 billion in these investments.

How can clients identify responsible investment assets?

Alice Mignon: Since 2022, clients in the European Union have been asked about their preferences in terms of sustainability. Their financial advisors are then expected to take these ESG preferences into account when they recommend investments.

Bertrand Bussière: At the same time, Europe’s SFDR (2) regulation requires transparency regarding sustainability for asset managers that market financial products. This regulation establishes categories for investment products, and all information published must be made available to our policyholders.

What are the advantages for savers when they choose responsible investment products?

Alice Mignon: These solutions enable savers to choose investments aligned with their personal values and benefit from both asset growth and positive impact. Thanks to our life insurance or retirement savings solutions, they can for example support issues they believe in, such as protecting biodiversity, developing renewable energy sources, or fighting inequalities and corruption. This is clearly in line with the growing trend towards responsible consumption. Consumers see their spending choices as a way to impact the world. And savers increasingly believe that savings should be meaningful thanks to responsible choices and opportunities to help finance a more sustainable economy.

Bertrand Bussière: We see the same priorities among our distribution partners, who want to propose investment solutions matching the specific expectations of their clients, leading to an offer that is better aligned in terms of sustainability. This criteria has become a major differentiating factor in the market. For several years now, two thirds of the financial advisors surveyed say they believe that the responsibility factor is important for a fund. They also recognise the educational role they need to play. (3) Our euro funds available within BNP Paribas Cardif life insurance contracts and pension savings plans, for example, are both classified as Article 8 investment vehicles under the European SFDR regulation. (4)

Alice Mignon: In France, our policyholders can also consult independent labels, such as ISR, GreenFin or Finansol to identify responsible investment products – there are about 1,300 different investment vehicles offered – and identify those that best meet their goals using filters available on our websites.

What are the advantages of choosing BNP Paribas Cardif as the asset manager for sustainable investments?

Bertrand Bussière: I think one of the primary advantages is that savers benefit from the responsible management of our euro fund. For many years now, we have progressively oriented its portfolio towards decarbonised assets. In 2023, in France, 95% of the investments in our euro fund were analysed against ESG criteria. Our unit-linked product offer is also very diversified. Also in 2023, nearly 42% of the €52 billion we manage in unit-linked investments had received a sustainable label from outside independent organisations. Building on this commitment, in 2021 we joined the Net-Zero Asset Owner Alliance (NZAOA) alongside 90 international institutional investors in order to pool our forces, methodologies and ideas. The goal is to align our portfolios with the carbon neutral trajectory by 2050. This entails trajectories to reduce the carbon footprint of assets, placing priority on targeting a reduction of holdings in sectors with the highest carbon emissions, coupled with joints initiatives to dialogue with businesses to foster these issues.

Alice Mignon: We continually seek to create value for our partners and for their clients. Offering responsible investment options is an important factor in respecting our mandate to protect the savings of our policyholders over the long term. Moreover, we want to be recognised as a trusted partner. We believe it is essential to support our distribution partners to help them effectively promote responsible investment solutions for their clients thanks to better disclosure of information and transparency, enabling them to make informed choices regarding sustainability.

(1) 75% of French savers believe that the environmental impact of investments is an important issue. Source: OpinionWay in the French Financial Market Regulator, AMF, July 2023.

(2) Sustainable Finance Disclosure Regulation (SFDR).

(3) Annual survey of investment advisors by Kantar and BNP Paribas Cardif.

(4) As defined in SFDR regulation: Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainabilityrelated disclosures in the financial services sector.

Read more

- Every year for the last five years, BNP Paribas Cardif has held P-Tech Days alongside IBM and Orange.

- These are two immersion days when high school students are mentored by BNP Paribas Cardif employees and are able to explore our premises and find out about our partner companies.

- The P-Tech Days are part of a series of initiatives carried out by our company as part of the P-Tech program.

What is the P-Tech program?

- IBM created and implemented the P-Tech project (Pathways in Technology Early College-High School) in 2011 at a school in New York. The initiative aimed to promote equal opportunities and received the support of the American government.

- The program was then rolled out around the rest of the world.

P-Tech Days: BNP Paribas Cardif opens up its doors to high school students for two days of immersion

Students in the last year of high school from the La Tournelle school in La Garenne-Colombes, mentored by BNP Paribas Cardif employees, will take part in two days of immersion with partner companies.

Workshops, games and presentations will allow these high school students to:

- get familiar with new professions and sectors of activity (insurance, coding, and more)

- learn about tomorrow’s challenges;

- build up networks by meeting professionals in the field;

- explore the Odyssée site in Nanterre, where over 4,000 BNP Paribas Cardif employees have been working for the last ten years (Station France, Cardif Lab, trading room, and more).

BNP Paribas Cardif promotes equal opportunities through the P-Tech program

Introducing high school students to the business world through mentoring

27 mentors from BNP Paribas Cardif guide these high school students and help them build their professional careers by providing them with a clearer vision of the business world and by introducing them to the digital professions of today and the future, notably in the insurance sector.

Other BNP Paribas Cardif initiatives within the framework of the P-Tech scheme

Expert presentations at our partner high school

BNP Paribas Cardif employees visit the La Tournelle high school to share their expertise with high school students through a series of workshops on various subjects, including:

- help with writing CVs and covering letters;

- raising awareness of e-identity and cyber-security issues;

- using social networks.

Mentored students invited to major events

Mentored high school students are regularly invited to attend major sporting and cultural events sponsored by BNP Paribas, including:

- The Roland Garros tournament;

- Film previews.

BNP Paribas: co-creator of the P-Tech system in France

At the Tech for Good 2019 summit, BNP Paribas companies, IBM and Orange launched the P-TECH project in France, in partnership with the Ministry of National Education and Youth.

This project aims to promote equal opportunities by allowing young people from all backgrounds to develop the skills they need for tomorrow’s professions.

The P-Tech program is based on public-private partnerships between educational establishments and private companies.

Since 2020, the Efficiency Technology & Operations (ETO) unit of BNP Paribas Cardif has been officially committed to this scheme, which is open to all employees, under the supervision of Michael Nguyen, Deputy CEO of Efficiency, Technology and Operations at BNP Paribas Cardif.

Read more

Capable of automating certain tasks and speeding up and improving decision-making with the help of machines, artificial intelligence (AI) is disrupting our work modes.

So, what is AI, and what is its purpose in the context of insurance? How is it revolutionizing the insurance sector and its various aspects?

Goh Hirose and Solenne de Montessus, explain how AI can make insurance more accessible, inclusive, and straightforward for consumers.

How would you define AI and its role in the field of insurance, including its relevance to customers?

Solenne de Montessus: AI cannot exhibit feelings and emotions and therefore cannot be defined as intelligence in the strict sense. It also requires statistics and data provided by humans to replicate simple and repetitive manual tasks, help humans understand certain trends, and facilitate their decision-making in the insurance sector. For example, for an algorithm to be able to find or recognize a cat in an image, we must first train it by exposing it to a large number of photos containing cats. While AI generates new risks and is sometimes seen as a threat, its use remains highly controlled. At BNP Paribas Cardif, for example, we have implemented specific governance tools to protect our customers and partners on this issue.

How is Artificial Intelligence changing the insurance sector, including the transformation of a company like BNP Paribas Cardif, and its impact on insurance policies and customer services?

Solenne de Montessus: At BNP Paribas Cardif, our goal is to use AI to make insurance more accessible. We develop AI solutions internally to improve our business processes, better understand our partners and customers, streamline their journeys, and provide them with the best possible experience. In the context of insurance claims, for example, we use AI to speed up the handling process and automate the verification of supporting documents, benefiting our commercial and personal customers. We also work closely with our partners to enhance their revenue through AI, helping them better target high-potential prospects, maximize conversion rates, or identify customers on the verge of canceling their policies. In the commercial sector, AI helps our company improve its operations and customer services. Company employees can also harness the power of AI to boost their productivity. For instance, our legal teams can use an AI-powered tool to easily access information and documents when needed.

AI increases employee productivity by automating some repetitive tasks. But is there a risk that AI will completely replace humans, particularly in the insurance sector?

Goh Hirose: I don’t think we should fear technology in any form, and it seems very unlikely that AI will progress to the point of replacing humans in the insurance industry in the next few decades. The challenge is rather to find the right balance between human qualities and needs and what machines can do to help us work in a more efficient way, as illustrated by the examples provided by Solenne. AI offers advantages both externally for customers, such as reducing wait times in call centers and improving customer service, and internally for employees who can delegate certain repetitive tasks to machines and focus on more interesting and value-added work.

How can AI, including artificial intelligence and insurance, make insurance more accessible, considering various aspects such as health, personal needs, and the best help for customers?

Goh Hirose: AI allows us to go beyond the traditional insurance value chain. It’s no longer just about providing the best coverage. We can think about how to help individuals and businesses prevent incidents or accidents and how to recover and rebuild more quickly. There are also many areas where AI can help us better tailor our products and services to individuals’ needs and risks, providing the best help and compensation in case of unfortunate events.

Solenne de Montessus: All these considerations are already underway at BNP Paribas Cardif, where we focus on insurance, business operations, and benefits. In Latin America, our policyholders covered by a protection contract, for example, can receive personalized advice through AI, coaching sessions, help with CV writing, or online courses after a job loss.

How do you envision the future of insurance with artificial intelligence, considering its impact on financial aspects and the insurance industry as a whole?

Goh Hirose: In addition to bringing more efficiency, AI helps us provide better services to our customers, both in terms of financial aspects and the overall insurance industry. It allows us to improve data analysis, risk assessment, and anticipation, which are at the core of the insurance business. I believe that in the near future, insurance companies will fall into two categories:

- Those that use data analysis solely to prevent damages and save more money, benefiting both their company and their customers;

- And others like BNP Paribas Cardif, which use this information to make insurance more accessible, cover more people, and better support policyholders, offering them the best help and compensation when they need it the most.

Read more

Founded in 1973, BNP Paribas Cardif is celebrating its 50th anniversary this year. To mark the occasion, we wanted to commemorate with our employees through several actions in the 30 countries in which we operate.

Charitable initiative

We offered our employees the opportunity to help local charities of their choice. As volunteers during their working time, our teams were able to participate in different workshops about solidarity, environment or health and well-being.

By implementing this project, BNP Paribas Cardif is taking part in BNP Paribas’ “#1MillionHours2Help” program, which aims to allow employees, to use some of their working time to support charities, in order to promote equitable and sustainable growth.

Exhibition about our mission

At the service of our partners and our customers for 50 years, it is therefore natural for us to recall our expertise as an insurer and to heighten the pride of our employees.

Through a dedicated exhibition, we shared all tangible initiatives and local achievements which contribute to making insurance more accessible. By making insurance more inclusive, simpler and easier to understand, as well as easier to subscribe to and to use, we help individuals better protect themselves and look to the future with confidence. This is what gives meaning to our job.

Above all, BNP Paribas Cardif is 50 years of shared adventure with all our 8000 employees cultivating the Cardif Spirit. Indeed, our employees celebrated this anniversary with enthusiasm and energy throughout the world!

Discover the history and evolution of the company told by our employees.

Read more

As an emblematic profession in the insurance sector, actuaries are experts in mathematical and statistical models. They are responsible for assessing, anticipating, and managing risks. Their area of activity is vast, ranging from insurance (life insurance, savings, retirement), to finance, as well as consulting. But their jobs are currently being transformed by new tools and technologies such as artificial intelligence, data science, etc., and the evolution of standards, particularly over the last ten years (Solvency II and IFRS 17). Actuaries now having to update their skills in order to seize the opportunities arising from these developments.

The evolving actuarial profession

Actuaries are specialists in risk management. They use mathematical techniques such as probability and statistics to identify, model, and manage the financial consequences arising from uncertain events (risks).

At BNP Paribas Cardif, actuaries are at the heart of our business and even sit on the Executive Committee itself, where several members are actuaries, including Pauline Leclerc-Glorieux, Chief Executive Officer. Actuaries work on various strategic subjects:

- Pricing

- Monitoring financial risks

- Business and product innovation

- Actuarial modelling

- Data science

- Accounting and regulatory standards/processes (for example IFRS17 and Solvency II)

- Risk Management (for example ORSA2)

At the heart of the company’s strategy and development, actuaries are in regular contact with the top management, as well as with cross-functional business lines. They need to have a sense of synthesis and to communicate and popularise complex subjects, so that all stakeholders can work together. As well as collaborating with the various internal teams, actuaries are also required to work in a diversified external ecosystem, including with reinsurers, brokers, distribution partners, professional organisations, members of the ACPR, as well as with other entities of the BNP Paribas Group. They therefore interact with different people and work on a wide range of projects.

Adapting to a constantly changing financial environment

In an evolving and unprecedented financial context (a rapid rise in interest rates after a period of negative rates, market stresses, equities, inflation, etc.), actuaries have to constantly adapt their tools and their monitoring and get involved quickly and pro-actively in defining strategic and financial orientations (new product offerings, adapting asset management policies, changes in regulations, risk management, etc.). They must therefore master different insurance mechanisms and have an overview of the elements that can affect various financial metrics (accounting or regulatory), as well as relations with policyholders. In this aspect actuaries act as the watchtower for insurers. They also make proposals for putting in place firewalls (financial or for policyholders). In this current particularly turbulent context, actuaries must show a high capacity for adaptation, questioning, responsiveness, and pedagogy.

Taking into account ESG (Environmental, Social and Governance) criteria

Raising awareness of CSR topics is also an opportunity for actuaries, both in the field of asset management, as well as in products and guarantees, to be more inclusive and work with more departments. Supporting the ecological and social transition of the insurance sector is now part of the role of actuaries.

Actuarial work subject to increasingly demanding standards

A series of standards implemented over recent years are also affecting the work of actuaries.

Since the European Solvency II directive came into effect in 2016, insurance and reinsurance companies in the European Union member countries must now better adapt their own capital to tackle the risks inherent in their business operations. They are required to provide proof of a minimum amount of capital (or solvency margin), in order to guarantee their commitments to their customers, and better deal with the inherent hazards in the insurance market. Ensuring compliance with these rules is now also part of the actuaries’ job.

The IFRS 17 standard is designed to ensure that entities provide the relevant information for assessing the impact of insurance contracts on their financial position, financial performance, and cash flows. Its adoption means that actuaries must work alongside accountants to develop assessment tools that comply with the standard.

Increasingly sophisticated tools for actuaries

The digital transformation of insurance and the development of new technologies, such as Artificial Intelligence (AI), Machine Learning, Deep Learning and Data Science have been disrupting the actuarial profession for the past ten years.

These tools make it possible to collect a larger quantity of data to feed and improve actuarial models and risk management in insurance, manage emerging risks more effectively (cyber risks), as well as facilitate the work of actuaries by freeing them from certain time-consuming and low value-added tasks. Ultimately, they are contributing to the development of insurance companies as a whole.

Actuary: new skills required by insurance companies

The emergence of new technologies and standards is changing actuarial training requirements. Students who hope to become an actuary must therefore now be trained to use the tools required for their future profession, such as data sciences, AI, etc.

Insurance companies are also providing in-house training programs for those already working as actuaries to help them develop these skills. BNP Paribas Cardif is also supporting actuaries by providing them with financing for specific continuing education courses, including Enterprise Risk Management, Certificate of Actuarial Expertise and Analytics, among others, to help them increase their knowledge and expertise.

The digital transformation of the insurance sector and the change in standards are disrupting the actuarial profession. While these factors are pushing universities and schools to adapt their courses, they are also encouraging insurance companies to increase their actuaries’ access to continuing education in order to remain competitive.

Read more

What is a medical consultant? How does her work contribute to making insurance more accessible? Gaëlle Bergot, senior medical consultant at BNP Paribas Cardif, answers our questions.

Gaëlle, you are Senior Medical Consultant at BNP Paribas Cardif. To get to know you better, let’s take a quick look at your background.

I trained as a general practitioner, with a specialty in adult and paediatric medical emergencies. I worked at a private home-emergency medical group for 17 years. In 2003, I took a diploma course as an insurance and legal compensation doctor for personal injuries¹, in order to practice medical and insurance consultancy.

How did you get into the insurance business?

My first role as a medical consultant in the insurance sector involved the analysis of medical files for medical leave and disability, in the context of insurance coverage claims. Then, after various assignments as medical consultant at various insurance companies, I was appointed chief medical officer of a personal insurance company, specialising in group insurance. I continued my career, moving to a major reinsurer, and I now work at BNP Paribas Cardif, which I joined in June 2020.

So why exactly does a company like BNP Paribas Cardif call upon a medical consultant?

Because from the moment when a company holds medical documents, in order to guarantee the application of medical secrecy, it is obliged to have a contractual relationship with a medical consultant. All of the medical data of their clients are under their responsibility. I should also point out that we have an independence clause in our contract. This allows us to study dossiers in a purely medical manner, and totally independently, vis-à-vis the insurer, and without any commercial standpoint. Also, in a company like ours, the level of technicality of the medical information needing to be analysed often requires professional expertise.

Going back to medical confidentiality, could you tell us a bit more about that?

Bear in mind that in France we have to respect the legislative rules on the application of professional medical confidentiality, and a medical consultant, just like any other doctor, is subject to the Code of Medical Ethics of the Conseil de l’Ordre des Médecins. Of course, we don’t deal directly with patients, but we deal with customers who entrust us with their personal medical information. We have to obey the same duties of protection as we would for any other patient. The application of medical confidentiality by the insurer allows customers to feel protected when they entrust us with information about their health. In a nutshell, we are the communication relays for all exchanges of medical data relating to customers.

In practice, who is trained in medical confidentiality at BNP Paribas Cardif?

Employees whose duties include underwriting and compensation writing have partial delegation of medical analyses. They are specifically trained and authorised for that. They work within the medical confidentiality bubble at the Nanterre site, alongside the medical consultants. We also train other employees who might come into contact with confidential documents containing personal health data, whether these documents are paper-based or digital. This type of data enters a medical EDM² system, is marked as “confidential”, and is accessible only to authorised persons. Also, as part of my role, I take part in the process of securing medical documents communicated to us by clients.

And so, going back to your role: what are the main roles of a medical consultant?

In addition to the role of guarantor of securely held and confidentially processed medical information, the roles of the medical consultant are varied and cross-departmental.

We are in charge of medical risk analysis. We have a lot of discussions with actuaries and lawyers about the evolution of rules, constraints, and the limits of this risk analysis. We seek to adapt to scientific progress and societal changes, in order to improve the way the insurer deals with pathologies. In addition, we take part in committees and professional federations aiming to expand the rules for the processing insurance medical files.

Your roles are very customer-oriented.

We even have an almost direct link with customers, as one of our roles is writing letters explaining decisions with medical content to customers (or their heirs). So I would answer yes, as a medical consultant, we have a duty to protect and support customers. But also that of helping the insurer to establish fairness between the medical information transmitted, and the application of contracts (verifying that requests for compensation correspond to what was initially provided for in the contract). In practice, we recruit and assign independent medical experts to examine and assess the incapacities/degrees of incapacity of customers. This network is a pillar of analysis and medical decision-making.

A topical question: has the Lemoine law³ altered your approach, or even your role as a medical advisor?

We adapt our practices and tools to successive legislative developments, but our technical analysis remains the same. The Lemoine law³ provides for easier access to insurance for certain people who have aggravated health risks. We continue to study medical dossiers following coverage claims, that being the main role of the medical consultant and expert. Another of our roles is to respond to customers who request explanations about the application of this principle to their particular case.

In conclusion, what makes you passionate about your job as a medical consultant?

The intellectual approach to investigation, that pushes us to do research on infrequent or unknown pathologies that we come across. This objective medico-technical-legal analysis of cases allows us to work in two worlds: the world of medicine and the world of business. And the human aspect: experience on the ground allows me to project myself further than just a dossier, and put myself in the place of a customer suffering from a pathology which is impacting their daily life, on a personal and professional level, and helping them in their coverage plan. And not forgetting the sharing of experience and expertise within the teams interested in this rich and varied medical subject.

¹ University Diploma RJDC – Legal Compensation for Bodily Injury – insurance specialty at the University of Paris V René Descartes

² EDM: Electronic Document Management

³ Lemoine Law: voted on February 28th, 2022, this law aims to simplify consumers’ access to Borrower Insurance for their real estate loans. It brings some major changes: removal of medical formalities according to certain criteria, facilitating termination/substitution, strengthening of the right to be forgotten.

Vito Cavaliere worked in France for almost 14 years, before returning to his native Italy at the end of 2020 to join the BNP Paribas Cardif Asset Management team as head of equity and bonds. He is now leading the progressive implementation of the company’s Socially Responsible Investment (SRI) strategy into the Italian general funds which totalled around 25.2 billion euros in assets in 2021.

Could you describe your job?

As an insurer, we believe that our role as an institutional investor comes with responsibilities. My job is to manage savings entrusted to us by our policyholders over the long-term with the objective of combining financial performance with a positive impact on society and the environment. Socially Responsible Investing (SRI) is quite naturally a key priority for BNP Paribas Cardif in Italy, because it is aligned with our objective of protecting the assets invested by our customers while promoting the transition towards a more sustainable world. I am convinced that these investment choices strengthen the resilience of our portfolios in the short, medium and long term.

What are your day-to-day objectives?

In close partnership with our asset management colleagues in France and Luxembourg, we work across a three-pillar approach. First of all, we apply different filters to the investments we make via our general funds: an ESG (Environmental, Social and Governance) filter, a carbon transition filter and sector filters (such as thermal coal) applied to our investment universe. All directly held assets in our general funds are evaluated through extra-financial criteria. We place priority on companies that apply best practices and are committed to protect the environment and people.

Secondly, we deepen our commitments to tackle climate change, in line with the commitment of BNP Paribas Cardif which also joined international initiatives like the UN-convened Net-Zero Asset Owner Alliance. Finally, we continuously develop positive impact investments with a measurable social and environmental impact, while generating a financial return for our customers.

What are you most proud of?

As part of our SRI strategy in Italy, during the recent years, we have improved the ESG coverage of our investments. Today, close to 93% of the assets in our general fund is evaluated according to ESG criteria. We have also improved our indicators for analysing and monitoring our investments in terms of climate change. I am also proud of the acceleration of our positive impact investments. Indeed, we have invested in green bonds that make it possible to finance projects with high environmental value. What’s more, we have invested in social bonds such as the “Covid-19 Social Response Bond” issued by Cassa Depositi e Prestiti. With this social bond, we contribute to financing for small and mid-sized Italian companies who face liquidity challenges, as well as companies that promote access to medical equipment and medicines.

What is the response among clients, employees and stakeholders?

We have increased reporting of our SRI investment strategy, particularly with the publication of our first CSR (Corporate Social Responsibility) report in 2021, and we organised awareness and training sessions on sustainability for our employees. The response has far exceeded our expectations. The depth of information is greatly appreciated by our distribution partners and by our teams that are really interested in understanding how we contribute to a more sustainable world. This generates pride at the internal level and gives meaning to our actions. As an insurance company, we have a responsibility to lead the way and look beyond financial performance to have a positive impact on society.

What motivates you?

Things are changing very fast and the world is more complex than ever before. If we want to have a positive impact, we simply cannot work alone. Teamwork is something I enjoy because it is important to analyse scenarios from other perspectives. I am naturally optimistic, so I take comfort in the rising levels of awareness regarding these environmental and social impact topics. We need to act now to build a more sustainable world. I also put my trust in technology which is part of the solution. Of course, technology on its own is not enough – people make the change – and I am hopeful we can find the right combination.

What’s the next innovation?

I think impact-investing measurements will be key: we will benefit from the enhancing use of data and analytics to better measure and analyse the impact of our investments to achieve social and environmental challenges.

Is momentum growing behind ESG investments?

Absolutely. Awareness has changed dramatically in the last decade. Government policies are becoming more and more demanding: France is leading the change in Europe. Regulation is continuously evolving and will contribute to accelerate this transition: thanks to the introduction of Sustainable Finance Disclosure Regulation (SFDR) at the European level which increases transparency by mandating disclosure of sustainability information. I’m really proud to work for BNP Paribas Cardif, because we are taking the lead in sustainable investments. Our customers are increasingly asking for greater details about the impact of their investments. And, at BNP Paribas Cardif, we will continue to strengthen our commitment.

Major wins for BNP Paribas Cardif at the 2021 finprada.cz ranking including:

- Best Credit insurance

- Second financial company of 2021

These awards make the position of BNP Paribas Cardif even more solid among their current partners and prospects on the Czech market.

Best credit insurance in the Czech market 3 years in a row

BNP Paribas Cardif was able to retain its leading position in the CPI market, Consumer Price Index, on the Czech market. In the finparada.cz competition, organized by the Scott & Rose agency since 2011, BNP Paribas Cardif defended its leading position in the CPI market and topped the ranking. This independent competition evaluates the main product components, with strongest emphasis on the risk coverage and the product quality for the end consumers.

The Best Credit Insurance 2021 award

Confirming its victory over the past 2 years, BNP Paribas Cardif has won all the medals in the consumer loan CPI table and achieved first and second places in the mortgage CPI.

Furthermore, Hello Bank, the online banking service launched in 2013 by BNP Paribas, was ranked #2 in the consumer credit category.

All of these successes show that BNP Paribas Cardif’s efforts, currently with the latest generation of CPI 3.0, are appreciated by customers, business partners and independent financial experts.

In addition, thanks to its nomination in the CPI categories, BNP Paribas Cardif is ranked second financial company of 2021, standing above many large insurance and banking institutions in the CZ market.

Also known as trackers, ETFs (Exchange Traded Funds) are market listed funds that track the performance of an index (market, interest rates, commodities, real estate, etc.). Low cost and practical, they are hugely popular with fund managers and are often included in life insurance policies.

“ETFs are really taking off worldwide because they offer many advantages,”says Nicolas Blaizot, savings expertat BNP Paribas Cardif. “Quoted continuously and transparently, these financial products offer greater visibility than the portfolios run by fund managers, who are not obliged to reveal their composition on a day-to-day basis.” Because all they do is track an index, they are a form of passive management (as opposed to traditional portfolios for which the manager chooses the portfolio assets bought and sold), and therefore attract lower management fees. The simplicity of ETFs also opens up the opportunity for developingrobo-advisors(automated investment advice platforms): clients can login to a robotic system that advises on the alternative investment choices available. And in recent years, ETFs have performed at least as well as actively managed funds.

Asian potential

The BNP Paribas Cardif subsidiary in South Korea has been distributing ETFs since 2006: the majority are managed by the market leader Samsung Asset Management, and are integrated into the funds distributed by the company’s lead partners in this country Shinhan Bank and KB Bank. “ETFs are seen as particularly appealing by clients aged 45 to 60, who are building savings pre-retirement,”explains Raf Wouters, Transformation Manager at BNP Paribas Cardif in South Korea. It has to be said that the local context is very buoyant: the national pension fund is investing massively in these products, and the Korean regulator is facilitating their distribution. For the company, it is essential to support the growing appetite for ETFs worldwide.

Key numbers:

- At global level, the volume of ETFs under management is forecast to double by 2020 to a total of $6,000 billion (source: Ernst & Young).

- ETF growth year on year in Europe is running at 24%(source: PwC).

- ETF management charges are modest, averaging just 0.3% per year (source: Le Monde).

As part of its savings business, BNP Paribas Cardif offers ETFs:

- in France: most life insurance related funds include ETFs in Luxembourg, Italy and Taiwan, individual investors can already invest

- in ETFs either directly or via funds in South Korea, the local subsidiary of BNP Paribas Cardif is offering the opportunity to invest directly

- in ETFs via a very user-friendly app

Glossary:

ETF (Exchange Traded Fund): A market listed fund that tracks the performance of an index. Index: The term used to express the variation of market prices over a reference period.