For more than 10 years, BNP Paribas Cardif has been using Artificial Intelligence to improve the quality of its services, meet the clients’ needs for immediacy and make insurance more accessible.

Michael de Toldi, Chief Analytics Officer, and Sandrine Aymes, Analytics Manager at BNP Paribas Cardif, share their expertise on AI in insurance.

Click on the image below to view our new video Cover Stories:

Pour aller plus loin

Each year, BNP Paribas Cardif’s Innovation team carries out a massive sourcing campaign across all BNP Paribas Cardif regions to identify projects that are ready for public communication that could be candidates for Innovation Ambassadors.The ultimate goal of this program is to reward exceptional teams, promote a culture of innovation, and boost our company’s efficiency through the sharing of the best practices.

This year’s submissions included 97 proposals from 24 entities across BNP Paribas Cardif. Many of the initiatives focused on two main themes:

- Artificial Intelligence

Showing the value that AI creates for partners, customers, and collaborators by optimizing processes & distribution, personalizing and improving customer satisfaction, ensuring better brand protection, and more…

- Impact

Providing offers dedicated to underserved populations (due to age or medical condition), increasing value and ease-of-use of products and services in order to make insurance more accessible.

The grand jury, composed of Stanislas Chevalet (Deputy CEO, Transformation & Development), Carine Lauru (Chief Communication officer), Nathalie Dore (Chief Impact and Innovation officer) and Vivien Berbigier (Chief Value Proposition Officer), chose 11 outstanding initiatives as the Innovation Ambassadors 2024.

The initiatives selected are from all our countries, clearly showing that innovation can be found everywhere at BNP Paribas Cardif. Stay tuned for profiles of each of our 11 Innovation Ambassador initiatives on our website and on BNP Paribas Cardif social networks in the coming months.

Read more

Financial advisors accelerate diversification of offering and grow client franchise with increasingly personalized support

- 67% of financial advisors report an increase in the number of clients, and 82% expect to develop their business in the coming years thanks to a larger client portfolio and product range.

- 67% of financial advisors note preference for lower risk investments among clients during the past 12 months.

- 68% of financial advisors believe their clients will place greater priority on yield, diversification of assets (51%) and risk exposure (46%) in the next 12 months.

- 82% of financial advisors think artificial intelligence (AI) will become indispensable to wealth management in the future.

BNP Paribas Cardif is pleased to present the results of its 2024 survey of financial advisors. Conducted with Kantar, one of the world’s leading market research agencies, this 18th edition of the BNP Paribas Cardif survey confirms a stronger market that is welcoming new investment opportunities to meet the needs of a diversified client base.

Financial advisors buoyed by confidence and the diversity of their clientele

Nearly half the financial advisors have a younger clientele (47%) and report a trend towards client profiles with more modest asset levels (34%). This confirms the success of their commercial approach and their ability to continually renew their product offering in order to attract new categories of clients. The 2024 survey shows a continuous increase in their client portfolios over the past five years, a trend that 67% of them confirm for the past 12 months.

On the strength of the expansion of the client base and their product offering, 82% of the respondents expect to pursue their development, primarily through organic growth of their firm. This momentum also reflects the confidence the financial advisors express in their business: 83% of the respondents foresee significant growth over the next five years.

From a more macroeconomic perspective, the survey also reveals a growing trend towards market consolidation. Some 41% of the financial advisors are considering acquisitions, while 46% envisage the sale of their business, reflecting a dynamic market undergoing major transformations.

At the same time, the financial advisors underline several key challenges to be addressed, in particular – for 70% of them – integrating regulatory changes, requiring constant monitoring to guarantee compliance and protect the interests of their clients. Another challenge noted by 47% of respondents is identifying investment solutions adapted to the economic environment, while 34% say recruiting new clients is a top-of-mind challenge. Charging fees for their services has, for the first time this year, emerged as a significant new challenge, cited by 29% of respondents.

Financial advisors are establishing themselves as 360-degree players to meet the challenges facing the sector.

In a turbulent market, financial advisors say the past year has seen clients placing greater priority on savings solutions that above all carry lower risk (67%), emphasizing security for their investments. However, respondents believe that potential yield will remain the argument with the greatest impact for clients (68%) in the coming year. They also cite a desire among clients to diversify assets, both in life insurance portfolios (51%) and non-life investment vehicles (28%).

To meet these expectations, financial advisors are proposing a broad and dynamic range of financial investment solutions, coupled with increasingly personalized advice to adapt to fluctuating markets and the specific needs of savers. With regards to life insurance and capitalisation products, the euro fund confirms its number four ranking among the solutions financial advisors propose to clients. In the months ahead 31% plan to propose more of these solutions alongside ETF funds (48%), structured products (39%) and private equity investments (32%).

Beyond life insurance and capitalisation contracts, financial advisors who are positioning themselves as comprehensive wealth management providers say in the coming 24 months, they want to offer individual and collective pension planning products (39% and 26%, respectively), along with individual protection (27%) and creditor insurance products (23%).

Artificial intelligence, a new ally for financial advisors

Artificial intelligence (AI) has emerged as an absolutely essential tool for wealth management in the future according to 82% of financial advisors. Nearly a quarter of them (24%) already employ AI tools to automate or facilitate certain tasks, and 50% expect to use it for these reasons in the future. Among the reasons cited, 83% of respondents say AI could help find regulatory information, and 81% believe it could help identify investment solutions. The growing importance of AI is reflected in the fact that 21% of respondents cite it as a key challenge for the profession.

Consistent with their proactive adaptability to change, some 66% of financial advisors are interested in training on how to leverage AI in their profession, in addition to financial engineering training (51%) and training for regulatory developments (45%).

Alongside these transformations in the business and new opportunities, financial advisors continue to express optimism and resilience, and 94% believe their profession is doing well. With their deep expertise, financial advisors have a positive outlook for the future, and a record 91% of respondents state they are confident about their business.

Read more

BNP Paribas enters into exclusive negotiations with AXA for the acquisition of AXA Investment Managers and a long term partnership in Asset Management

The BNP Paribas Group announces today that it has entered into exclusive negotiations with AXA to acquire 100% of AXA Investment Managers (AXA IM), representing close to €850bn1 assets under management, together with an agreement for a long-term partnership to manage a large part of AXA’s assets.

BNP Paribas Cardif, the insurance business of BNP Paribas, after having directly proceeded to the proposed transaction as principal, would have the opportunity to rely on this platform for the management of up to €160bn of its savings and insurance assets.1

With the combined contribution of BNP Paribas’ asset management platforms, the newly formed business, which total assets under management would amount to €1,500bn1, would become a leading European player in the sector.

Specifically, it would become the European leading player in the management of long-term savings assets for insurers as well as pension funds, with €850bn of assets1, leveraging powerful platforms of public and private assets. The acquisition would also allow the combined businesses to benefit from AXA IM Alternatives’ leading market position and track record in private assets which will drive further growth with both institutional and retail investors.

The agreed price for the acquisition and the set-up of the partnership is of €5.1bn at closing, expected mid-2025.

With a CET1 impact of circa 25 bp for BNP Paribas, the expected return on invested capital of the transaction would be above 18% as soon as the 3rd year, following the end of the integration process.

The signing of the proposed transaction, expected by the end of the year, is subject to the information process and consultation of the employees’ representative bodies. The closing of the transaction is expected by mid-2025 once regulatory approvals have been obtained.

“This project would position BNP Paribas as a leading European player in long-term asset management. Benefiting from a critical size in public and alternative assets, BNP Paribas would serve its customer base of insurers, pension funds, banking networks and distributors more efficiently. The strategic partnership entered into with AXA, the cornerstone of this project, confirms the ability of both our groups to join forces. This major project, which would drive our growth over the long-term, would represent a powerful engine of growth for our Group.” said Jean-Laurent Bonnafé, Director and CEO, BNP Paribas.

“AXA Investment Managers has been a homegrown success story for the AXA Group. Over the past 25 years, we have built an exceptional franchise anchored in investment expertise, a relentless client focus and a proven track record on sustainability. Thanks to the quality of its teams, AXA IM is today a leading player, notably in Alternatives in Europe.” said Thomas Buberl, CEO of AXA. “By joining forces with BNP Paribas, AXA IM would become a global asset manager with a wider product offering and a mutual objective to further their leading position in responsible investing. I would like to thank all AXA IM employees for their unwavering commitment, and their continued focus on delivering value for our clients.”

“The creation, within the Investment & Protection Services (IPS) division of the BNP Paribas Group, of a European leader in the management of long-term insurance and savings assets, would enable the IPS division to exceed EUR 2 trillion of assets entrusted by its clients. This operation would allow BNP Paribas Cardif to benefit from premium access to the services of an asset management expert on the asset classes required for insurance management. The combined expertise of the BNP Paribas Asset Management and AXA IM teams in public and private assets, as well as their leadership in sustainability, would be valuable assets to better meet future needs of clients.” said Renaud Dumora, Deputy Chief Operating Officer, Investment & Protection Services, BNP Paribas.

1 Based on assets as at 31.12.2023

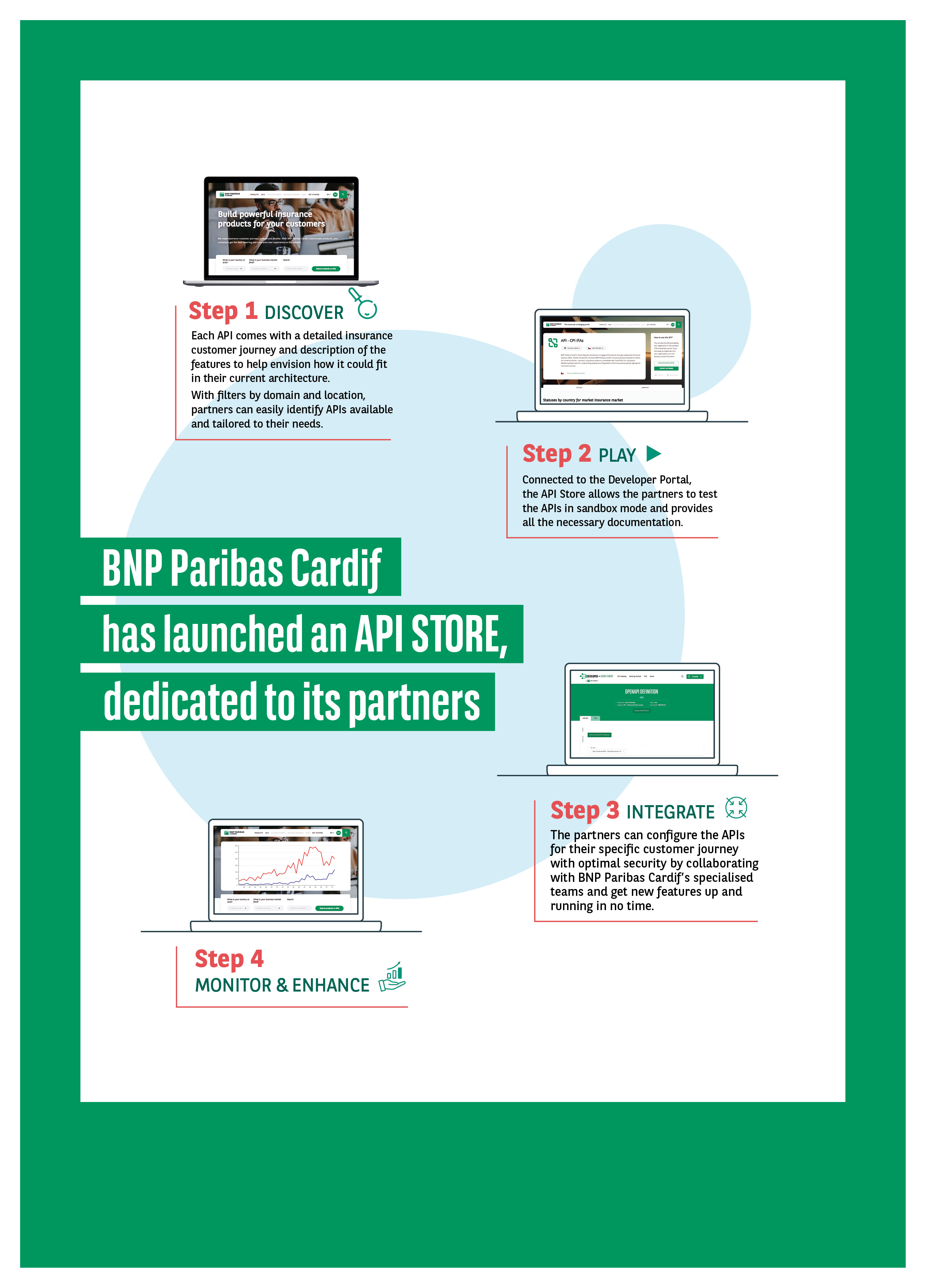

With the introduction of its API Store, BNP Paribas Cardif takes a step further toward its vision of Insurance-as-a-Service. This new digital platform showcases in-house digital assets and is easy to browse, understand and integrate for current and potential partners. It is already available in 30+ countries, with 200+ APIs covering the entire customer and distributor journeys.

Our partner experience is broken down into 4 steps:

Read more

BNP Paribas Cardif pursues commitments to align investment portfolios with carbon neutral trajectory by 2050 and reports on 2023 progress

BNP Paribas Cardif pursues commitments to align investment portfolios with carbon neutral trajectory by 2050 and reports on 2023 progress

With regards to the reduction of the carbon footprint of its investment portfolios and its contribution to alignment with the objectives of the Paris Agreement, BNP Paribas Cardif has committed to:

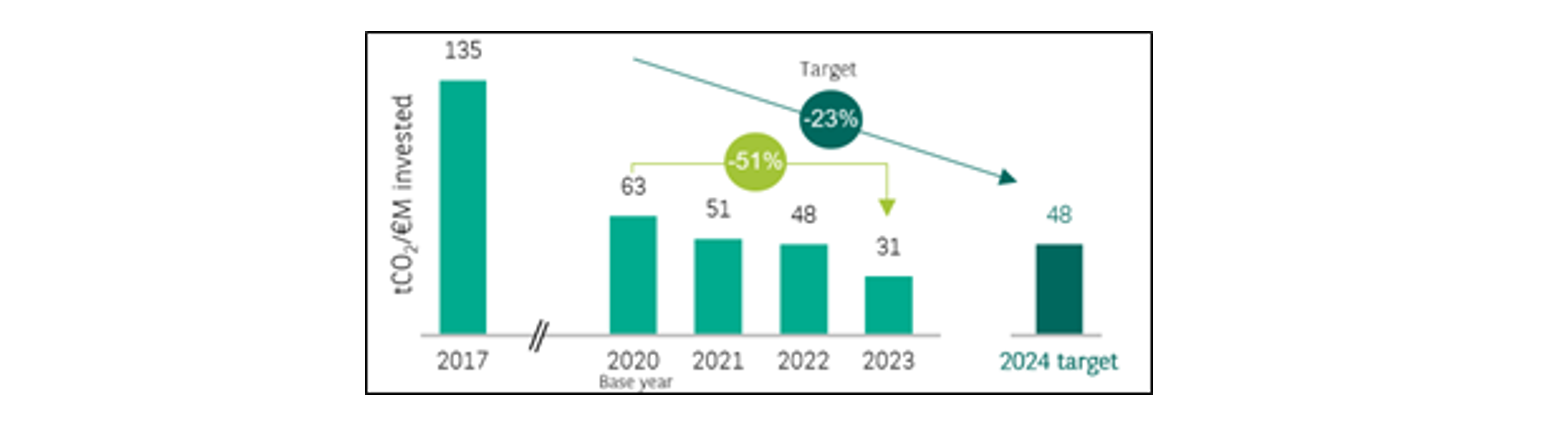

Reduce the carbon emissions footprint (Scopes 1 and 21) of its directly held equity and bond portfolios by at least 23% between end 2020 and the end of 2024.

At the end of 2023 the carbon footprint of this portfolio continued to significantly decline, reaching 31 tCO2 per million euros invested, representing a reduction of 51% compared with end 2020.

The reduction recorded between 2022 and 2023 was due in particular to more precise modelling of carbon emissions data by companies within different sectors by the data provider , in particular transformation and electricity distribution2.

Source : S&P Trucost Market Intelligence

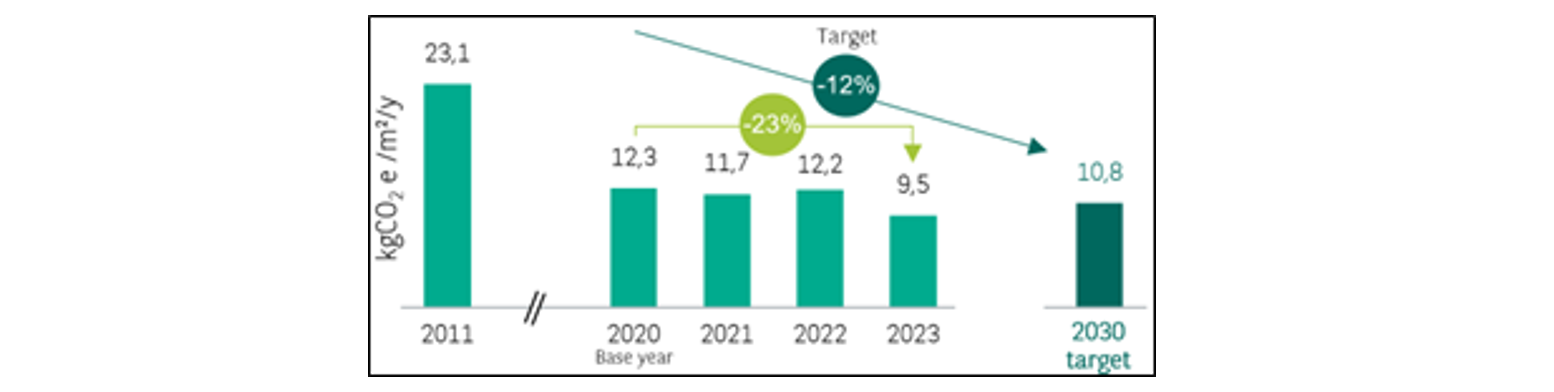

Reduce the carbon intensity (scopes 1 and 23) of directly owned office properties by at least 12% between 2020 and 2030.

At the end of 2023, carbon intensity continued to decrease, reaching 9.5 kgCO2e/m²/year, representing a decrease of 23% compared with end 2020.

The reduction of carbon intensity was significant in 2023. This was due in part to energy efficiency campaigns for buildings, leading to a reduction in energy consumption, and to a downward revision of carbon emission factors associated with electricity.

Source : Internal Data and BNP Paribas Real Estate Property Management

BNP Paribas Cardif has made a commitment to reduce the exposure of its investment portfolios (directly held equity and bond portfolios) to industries with the highest levels of greenhouse gas emissions, in application of BNP Paribas Group sector exclusions. This will lead to a definitive exit from the thermal coal value chain by 2030 for EU and OECD countries, and by 2040 in the rest of the world.

The trajectory of BNP Paribas Cardif’s investment portfolios is in line with the expected agenda.

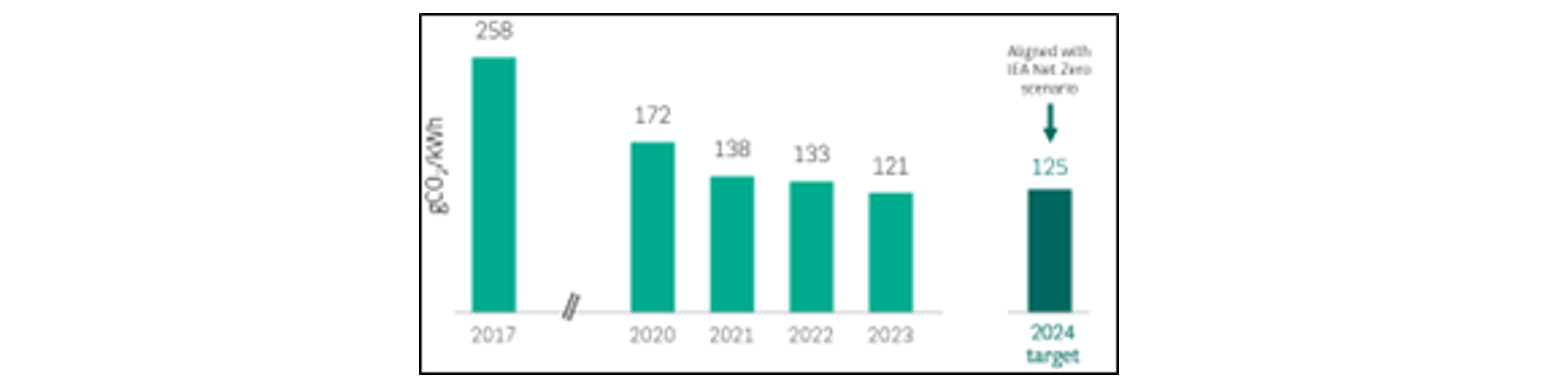

BNP Paribas Cardif has also made a commitment to reduce the carbon intensity of its investment portfolios linked to power generation. The target is to achieve an emission intensity of under 125 gCO2/kWh by the end of 2024 for power generation activities held directly in equity and bond portfolios. This target is aligned with the Net Zero Emissions scenario developed by the International Energy Agency (IEA) for power generation.

At the end of 2023, carbon intensity continued to decline, reaching 121 gCO2/kWh.

This reduction for the emission intensity of power generation activities in the portfolio was due primarily to an increase in the share of green bonds in this sector4.

Source : Asset Impact5 and International Energy Agency

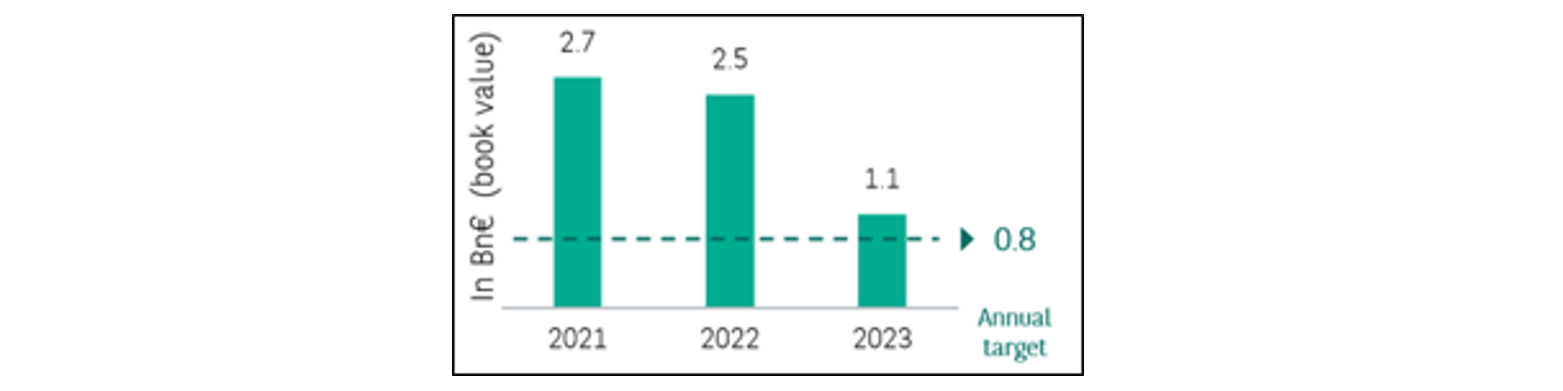

BNP Paribas Cardif also continued to make investments with a positive impact on the environment and will allocate at least 800 million euros by 2025 to investments that contribute to the energy transition and initiatives with an environmental theme. This commitment encompasses investments in sectors that involve environmental protection, including the energy transition, energy efficiency, waste recycling and the preservation of biodiversity.

In 2023, BNP Paribas Cardif allocated 1.1 billion euros to investments that contribute to the energy transition and initiatives with an environmental theme, notably through financing via green bonds.

Finally, BNP Paribas Cardif continued its shareholder engagement with some of the companies identified by the Climate Action 100+ initiative as the most emitting. This initiative, joined by the insurer in October 2021, is part of the BNP Paribas Group’s climate strategy and BNP Paribas Cardif’s responsible approach.

1 As there is currently no standard methodology for measurement of Scope 3 emissions, BNP Paribas Cardif places priority on implementing Scope 1 and 2 objectives to align with the Alliance, while continuing to measure and assess the impact of its investment portfolios across all three scopes.

2 S&P Trucost Market Intelligence

3 Reduction of carbon intensity of office properties also includes the electricity, heating and air-conditioning consumption of tenants.

4 Green bonds issued by electricity producers are used in particular to fund the creation of renewable energy capacity. During power generation (Scope 1), renewable energies do not emit greenhouse gases. In the calculation methodology, these green bonds benefit from a 90% ‘discount’ on the issuer’s carbon intensity.

5 Asset Impact | Asset-based data solutions for climate action (gresb.com)

Read more

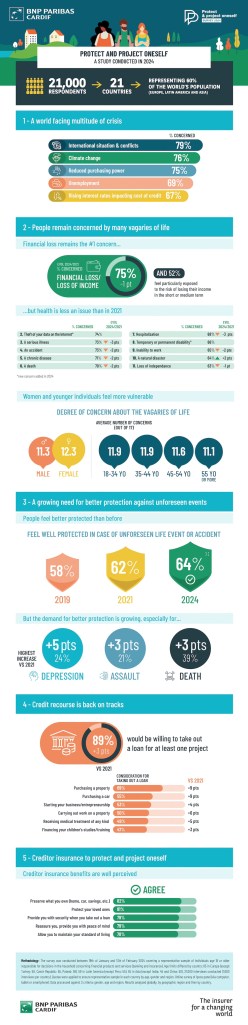

New BNP Paribas Cardif survey: “Protect & Project Oneself”1

A general sentiment of being well protected, coupled with greater expectations regarding insurance coverage

- A world facing multiple crises: international conflicts, climate events, purchasing power;

- People are slightly less concerned about unforeseen life events than in 2021, but have not returned to levels of confidence seen in 2019;

- Financial loss remains the primary source of concerns around the world, followed by cybersecurity;

- Creditor insurance is viewed as a useful solution to support a renewed focus on personal projects requiring financing.

A growing need for protection in the face of multiples crises

Results of the 2024 survey show that people are slightly less concerned about unforeseen life events than in 2021. However, the degree of concerns remains above levels measured in 2019. Although the world is gradually recovering from the pandemic, other crises remain, and inflation worries have replaced fears related to Covid since 20222. At the same time, at the global level, 79% of respondents in the survey say they are particularly concerned about international conflicts, 76% about climate change, and 75% by the drop in purchasing power. The French are more concerned with the latter two issues, notably the decline in purchasing power for 86% of the respondents. While people in all regions share concerns regarding climate change, unemployment is the top concern in Latin America and Asia (86% and 71% of respondents, respectively).

With regards to unforeseen life events, loss of income remains a major source of concern for three-quarters of the global population. Cybersecurity, a new topic included in this year’s survey, was directly ranked second, cited as a chief concern by 74% of respondents. The percentage of people citing concerns also rose for other topics such as physical assaults and violence (+3pts vs. 2021 and +4pts vs. 2019) and cars theft or damage (+2pts vs. 2021 and +4pts vs. 2019). As more time passes since the health crisis, worries about health have diminished, but still remain higher than in 2019. Concerns regarding depression rose 2 points worldwide, cited by 62% of those interviewed.

Lastly, while the percentage of people who feel they are sufficiently protected against unforeseen events continues to rise – reaching nearly two-thirds of the population in the 2024 survey (+2pts vs. 2021 ; +6pts vs. 2019) – only 14 % of respondents say they feel “very well protected”. This sentiment of vulnerability is highest in Latin America. The percentage of people who feel “very well protected” is higher in France than in any other country (72% in France vs. 64% worldwide). At the same time, expectations in terms of protection continue to climb in all three regions, particularly for issues related to mental health (+5pts vs. 2021), death (+3pts vs. 2021) and physical assault (+3pts vs. 2021).

Creditor insurance supports return to plans for personal projects

In 2024, personal projects and the need to finance them have once again become a priority, and the number of people who plan to resort to credit has increased across all geographies. In this context, creditor insurance is viewed as a useful solution in all three regions to help people move forward with their life plans. Respondents believe that these insurance products encourage them to pursue their projects while looking to the future with serenity. Creditor insurance in particular is seen as a solution that lets people retain ownership of property (82% agree), protect their family (81%), ensure security when they take out a loan (79%) and maintain their standard of living (78%).

The percentage of the population ready to resort to credit for a real estate acquisition has returned to pre-Covid levels (69%, +9pts vs. 2021), as has the number of people with plans to buy a car (55%, +9pts vs. 2021). Appetite for consumer credit is also on the rise, in particular to finance home improvement projects (cited by 50% of respondents), or to pursue plans to move to another region or another country (33%).

The 2024 survey showed an upturn in projects requiring financing both in France and the rest of the world. While a real estate acquisition remains the primary motivation for taking out a loan, the percentage remains below the 2019 level: 60% of the French cited real estate acquisitions in 2024 (stable vs. 2021 but -16pts vs. 2019). A car purchase is also cited as a reason to resort to credit (55%). Lastly, there is also an increase in the number of people who say they would resort to credit for home improvement projects (48%), to finance studies (37%) and for medical treatment (34%).

An infographic showing results from the survey is available on bnpparibascardif.com.

1 Methodology: The survey was conducted online between 19 January and 13 February 2024 on a group of 21,000 people in 21 countries on 3 continents (Europe, South America and Asia), covering a representative sample of individuals age 18 or older who are responsible for decisions in the household concerning financial products and services (banking and insurance). Age limits differed by country: 65 in Europe (except Turkey: 50, Czech Republic: 55, Poland: 59), 59 in Latin America (except Peru: 55), 55 in Asia (except India, 45, and China, 50). 21,000 interviews were conducted (1,000 interviews per country). Quotas were applied to ensure representative sample in each country by age, gender and region. Online survey of Ipsos panel using device agnostic questionnaire (computer, tablet or smartphone). Data processed against 3 criteria: gender, age and region. Results analyzed globally, by geographic region and then by country.

2Ipsos survey: “What worries the world?” – January 2024

BCC Iccrea Group and BNP Paribas Cardif signed a strategic partnership for life insurance in Italy. Alessandro Deodato, CEO of BNP Paribas Cardif in Italy and Mauro Pastore, General Manager of BCC Iccrea Group explain why this partnership is key to both companies.

Tell us a bit about the context of this partnership…

Alessandro Deodato: As CEO of BNP Paribas Cardif in Italy, my goal is to develop our business with the entrepreneurial spirit that is rooted in the company’s DNA and we are continually seeking partners with whom we can keep making insurance more accessible. Beyond the business, our relationship with BCC Iccrea Group started in an unusual way: I met Mauro Pastore in Wiesbaden a few months ago and we discovered that we both happened to be supporters of the same football team. So I knew this was the beginning of a very good relationship! As for the origins of the partnership in itself: we presented an offer to BCC Iccrea Group with another company (Assimoco, the Italian insurance branch of R+V Versicherung), in order to address their needs both in savings and protection. We accompany our partner in the savings spectrum and the life part of all Creditor Protection Insurance (CPI) products, whereas Assimoco’s perimeter is the non-life part of the protection business.

Mauro Pastore: In the area of savings, we were looking for a solid and technically qualified partner that could help us develop our strategy in the life branch of bancassurance, which is a product line we truly believe in. We were looking for a partner that could help us make BCC Vita (our company dedicated to life insurance) grow to its full capacities by enhancing and optimising its global product range, as well as improving its promotion to the customers of our 115 local banks. To us, it was clear that BNP Paribas Cardif offered the quality financial product management that we needed, as well as technical and sales promotion capabilities that are among the best in the market.

Why were you both looking for an alliance?

Alessandro Deodato: We strategically wanted to continue diversifying our distribution setup and client base while continuing to build long-term partnerships in Italy. Scalability and long-term agreements are key drivers, as they allow us and our partners to grow in a healthy manner. BCC Iccrea Group’s cooperative DNA and distinctive client base were interesting entry-points, which makes them probably the best banking group to partner with for the next 15 years, at least! Beyond giving a fresh momentum to BCC Iccrea Group’s savings activity, this partnership also allows us to reinforce our own position in savings, as we acquired 51% of BCC Vita.

Mauro Pastore: We are a banking group, present throughout Italy and with a strong and historical relationship with our partners and communities. It was essential to complete our range of financial services thanks to an efficient partner, experienced in savings management and fund structuring, a partner that could assist us technically and in the field. We believe that savings and more globally insurance solutions are more than a simple option within our own value proposition. We care about the future of our customers, and the necessary protection and risk control guaranteed by insurance is part of our holistic service vision. The value proposition of BNP Paribas Cardif is comprehensive and offers great value compared with what is available in the market. Overall, they offer some of the most effective solutions in savings and protection, for example solutions that meet customers’ future needs, or other specific demands such as the protection of salary-backed loans, which are specific to Italy. We expect to exploit some of these new resources over the next 15 years, at first in the area of savings, to increase our growth and development.

What are the mains benefits of this alliance?

Alessandro Deodato: BCC Iccrea Group and BNP Paribas Cardif share the same vision: we want to prioritise customer needs above our own individual interests. Indeed, there is no success in a partnership if we do not put the clients at the heart of the equation. The cooperative world, which is part of BCC Iccrea Group’s historical DNA, takes that consideration even further, as individuals may not only be clients but potential shareholders as well. We believe we can contribute towards enhancing the investment products currently being offered to BCC Iccrea Group’s customers, while strengthening our partner’s competitiveness in the Italian market. The idea is to help them broaden and complete their range of financial products thanks to a product mix in savings, by leveraging not only general funds, but also unit-linked investment capabilities. We also aim to improve performance and investment horizons thanks to our unique know-how and customer-retention expertise. More generally, our goal is to be a growth engine for BCC Iccrea Group: increasing the promotion of BBC Vita’s product range to the cooperative banks could be a driver to boost savings inflows and thus contribute to our partner’s growth. With our combined strengths, we believe we can help BCC Iccrea Group become one of the best banking groups in Italy, and be part of this great success story ourselves as well.

Mauro Pastore: It has only been a few months since we entered into this new partnership and we are already seeing strong collaboration. While we expect excellence from BNP Paribas Cardif in supporting us in the technical management of the product range, we provide them with our extensive network – around 2,500 branches – and our solid relationship with our customers. Joining forces and assets will soon make it possible to promote the product portfolio that we will have built together.

To what extent does this partnership contribute to improving value for clients?

Alessandro Deodato: Together we are working with the common aim to make insurance more accessible to BCC Iccrea Group’s customers. Our value proposition is a combination of compelling and unique promises, providing both financial and non-financial value to our partner and their customers. Throughout BBC Vita, we commit to improving investment product quality and financial security to meet their customers’ needs. Our goal is to is keep on delivering a combination of high-quality products and services to clients and retain their trust over the long term.

Mauro Pastore: Client value is at the heart of our strategy. We believe it is crucial to adapt and optimise our savings product range in order to design the solutions that our clients expect. We are a grouping of local banks founded on strong relationships and customer trust. We are used to listening to our customers with a level of attention that sets us apart, and for this very reason we need a partner that can help us give our clients all the attention and customer care they deserve. This is one of the reasons we chose to team up with BNP Paribas Cardif, as they are able to identify solutions specifically designed to meet the needs of the people who come to our branches. Their recognised expertise is particularly strategic for us; it will help us take our relationships with customers to another level, as well as finalising a new product offering with new benefits for both the distributing banks and end customers.

What are the next steps?

Alessandro Deodato: We are working hard, together with BCC Vita and BCC Iccrea Group, initially on product analysis, preparing to provide customers with the most appropriate and high-quality offer, as well as a comprehensive sales promotion, as soon as possible.

Mauro Pastore: As soon as we receive approvals from regulatory authorities, BNP Paribas Cardif’s acquisition of 51% of BCC Vita will become effective. Immediately afterwards we will dedicate ourselves to the design and fine-tuning of new savings products. If the partnership thrives, we expect BNP Paribas Cardif to acquire a further 19% of BCC Vita’s capital in the future.*

* Subject to approval by IVASS, the Italian insurance regulator.

Read more

BNP Paribas Cardif has once again demonstrated its commitment to innovation by participating in the 8th edition of VivaTech, one of the largest European event dedicated to technology and innovation. The 2024 edition of VivaTech, which took place from May 22 to 25 at Paris Expo Porte de Versailles, had as its main theme artificial intelligence (AI), a technology at the heart of the current transformations in various sectors, including insurance.

Watch the video highlights of this 2024 edition of VivaTech!

Big presence with key interventions

Among the highlights of the event was the intervention of Michael de Toldi, Chief Analytics Officer at BNP Paribas Cardif, who participated at BNP Paribas’ live stream dedicated to “Artificial Intelligence”. His pitch highlighted BNP Paribas Cardif‘s latest advances in AI and how these innovations are helping to improve the services offered to partners and customers.

The Cardif Lab’: at the heart of innovation

The “Floor Tour” organised by the Cardif Lab’ allowed our partners, members of the Executive Committee and even the general public to discover innovative start-ups at the cutting edge of technology in their various sectors. Promising startups discovered during this round include Aqemia, which specializes in AI drug discovery, Citadel AI, which develops AI-based security solutions, Petnow, an app dedicated to pet recognition, and Mob-Energy, which offers innovative solutions for electric vehicle charging.

By participating in VivaTech 2024, BNP Paribas Cardif is reaffirming its role as an innovative insurer and its desire to remain at the forefront of advances, particularly in the field of artificial intelligence. This active presence is a testament to the company’s commitment to transforming the insurance industry to better meet the expectations of its partners and their customers in an ever-changing world.

Read more

Neuflize OBC, the private banking unit of ABN AMRO in France, and Cardif, the insurance subsidiary of the BNP Paribas Group, have announced plans for a long-term partnership in life insurance. This partnership will lead to a distribution agreement and the acquisition by Cardif of the life insurance company Neuflize Vie from its founding parent companies, ABN Amro and AXA.

Cardif, a major player in life insurance in France and Neuflize OBC, a leading wealth management bank in France, plan to combine their forces to drive their growth in life insurance for high net worth individuals. ABN Amro’s choice of partner follows a rigorous selection process involving several leaders in the European insurance segment. Cardif’s offer proved particularly attractive due to the insurer’s robust financial foundations, its product range, and its ability to offer personalized solutions for the Neuflize OBC bank.

The integration of teams from Neuflize Vie, specialists in custom-tailored wealth management solutions, with Cardif teams reflects a shared commitment to developing a long-term partnership to serve clients of Neuflize OBC. Cardif and Neuflize OBC have partnered for more than ten years within the framework of AEP, a B2B commercial brand of Cardif specialized in designing and marketing high-end life insurance and capitalisation products. The partners share a culture of excellence to meet the demanding expectations of a high net worth clientele. This new alliance will enable Cardif and Neuflize OBC to consolidate their respective leadership positions in asset management and wealth management in France.

Combining Neuflize Vie’s innovative high-end solutions and the expertise of Cardif in insurance partnerships will allow the partners to bring a unique offer in the market. Neuflize OBC clients are assured of a seamless continuation of high-quality support matched to their private banking profiles. This partnership will also benefit Neuflize Vie’s other partners such as asset managers, independent private banks, family offices and asset management advisors, which are priority channels for both players. They will continue to benefit from the most cutting-edge products and services with the same quality of service and innovation through this new alliance.

The alliance of Cardif and Neuflize Vie will create an uncontested leader in high-end life insurance in France, supported by expert teams with recognized know-how.

“We are delighted at the prospect of this strategic alliance with BNP Paribas Cardif and the opportunity to collaborate in order to rapidly expand the offering of life insurance solutions that are central to the wealth management strategies of our clients.”

Laurent Garret, Country Executive Officer, Neuflize OBC

“I am excited about this unique opportunity for Neuflize Vie, recognized for its expertise, to partner with one of the life insurance leaders in France. We look forward to expanding our business together to benefit our clients and our partners.”

Arnaud de Dumast, Chief Executive, Neuflize Vie

“We are proud that our long-term partnership with Neuflize OBC will enable us to work together to consolidate our position in the wealth management life insurance segment in France. This new alliance illustrates our capacity to jointly deploy our value proposition to benefit our partners.”

Pauline Leclerc Glorieux, Chief Executive Officer of BNP Paribas Cardif

“We are pleased with Neuflize OBC’s confidence in bringing our Life companies together, which will allow us to continue to offer our partners and customers products and services of the highest market standards.”

Fabrice Bagne, Deputy Chief Executive of BNP Paribas Cardif, France, Italy, and Luxembourg

This agreement remains subject to applicable procedures relative to employees involved, and to approval from relevant regulatory and competition authorities.