BNP Paribas Cardif attended the seventh Vivatechnology event, the international trade fair for innovation and startups, from 14th to 17th June 2023, at the Parc des Expositions Porte de Versailles.

Since it was created in 2016, the event has established itself as the essential annual international meet-up for technological innovation and start-ups.

Viva Tech and BNP Paribas

Viva Tech is also an important event for BNP Paribas, a founding partner of VIVATECH and the leading European bank for supporting and financing Tech and innovation. The Group and numerous representatives from various business lines took part over the four days, promoting the expertise of their employees in the field of innovation, and showcasing three important themes:

Data for change

Mobility for all

Payments for simple life

The presence of the BNP Paribas Cardif’s team

Aiming to foresee the future of insurance and create the offers and services of tomorrow for our partners and their clients, the Cardif Lab’ presented their latest gaming innovation, “Play your Life”, a life simulation game that makes insurance more accessible.

They also organised several floor tours, introducing our partners and the Executive committee to innovative and inspiring startups.

Women in tech take centre stage through the Women & Girls in Tech programme

Sophie Robert, CIO of BNP Paribas Cardif, was also on hand to give a “reverse pitch” on Women and Girls in Tech at the ManpowerGroup stand, presenting her role in an innovative way.

“Diversity leads to many ideas, and women have a rightful place in the world of technology.”

At the initiative of BNP Paribas, and with the help of the Digital Ladies & Allies and BECOMTECH associations, “Women & Girls in Tech” was born in 2019 from the desire to deconstruct stereotypes in the Tech professions, inspire women and girls to pursue a career in this field, and encourage women and girls from various generations to feel justified in their choice of a career path in digital technology.

Conferences, round tables, and more: all ways of finding out about the different opportunities in technology, inspiring career paths, deconstructing clichés, and allowing women to take their rightful place in Tech.

Read more

Founded in 2019, Beem Energy is a French startup that empowers people to own their energy.

The company started with the Beem kit, a DIY solar kit that allows customers to produce their own solar energy, optimize their consumption at home and save on average 250€ in electricity each year. Beem has already equipped several tens of thousands of homes in France and Europe. By promoting the adoption of solar self-consumption through simple solutions, Beem encourages everyone to better understand, control and save their energy.

The Nantes-based company is developing an ecosystem of products and services to meet the growing demand from individuals who want to produce their own renewable energy. The company has the ambition to equip over 500,000 homes by 2030 and expand in Europe, particularly in Germany, Italy and the Netherlands.

Beem has raised a Series A of 20 million euros to accelerate its operations and strengthen its position as European leader in the home energy management market. The round has been supported by its historical investors Alter Equity, 360 Capital and BNP Paribas Development, as well as our C.Entrepreneurs fund (along with Cathay Innovation).

“Today, with the growth of inflation and in a context of ecological emergency, we have been convinced that we must transform the relationship individuals have with their energy. This fundraising confirms the confidence that our investors, historical and new, have in our project and allows us to accelerate our impact”

Ralph Feghali, co-founder and CEO of Beem Energy.

Read more

Wylly is one of the 10 Innovation Ambassadors 2022, selected from 86 initiatives in 21 countries and 24 entities. Discover how Guillaume Hervé and Pierre Syssau created a new online auction platform for used cars linking private owners and dealers. The startup aims to make the selling and buying experience simpler, faster and fairer.

Introduce yourself briefly:

GUILLAUME HERVÉ: My name is Guillaume Hervé, and I lead the Alternative Growth department within BNP Paribas Cardif Head Office. Our aim is to find and create options for BNP Paribas Cardif’s future growth, using a dedicated toolbox, including our investment funds C.Entrepreneurs and C.Development, but also our partnership with a Venture Studio called Rainmaking, that led to building Wylly.

PIERRE SYSSAU: Hi, I am Pierre Syssau, Deputy CEO of Icare, a subsidiary of BNP Paribas Cardif, the warranty and maintenance contract specialist for cars. Among different tasks, I lead the transformation of Icare, which pushes us to investigate new business models.

Tell us about your project: what is it about and how it came about?

PIERRE SYSSAU: The idea was powerful: how to combine Icare assets with the equity firm Rainmaking’s expertise in order to create a new business model. Access to private individuals, dealers, and knowledge about car reliability were the key selected assets to create Wylly.

Wylly is an auction marketplace allowing customers to sell their used car to professionals through a full digital and seamless experience. This will allow car professionals to get a liquidity pool of used cars from an alternative way of sourcing vehicles, in a context where new car sales are constrained by shortfalls of electronic components, and used cars are mostly sold through C2C platforms.

GUILLAUME HERVÉ: We wanted to solve one problem: building new innovative business lines while derisking the process of venture creation. This is where the idea comes from to partner with an expert in building new companies, Rainmaking Venture Studio, whose purpose is to detect opportunities, build new business models, recruit founders, finance the launch and support the scale-up

After we set up this partnership, Icare was very keen to test the process, leading to the creation of a first startup launched with Icare in 2022: Wylly.

We have structured the deal in the way that BNP Paribas Cardif and Rainmaking co-invest in the startup.

PIERRE SYSSAU: This type of setup is unique, creating a real start up working in an agile way.

What did you find most striking/surprising during this project?

GUILLAUME HERVÉ: The new company is just one year old, and the team’s velocity is truly impressive. They built a live product in only a few months. Just after the launch of the platform, more than 10,000 visitors are going on Wylly each month, which surpassed our goal.

What advice would you give to employees who also want to innovate?

GUILLAUME HERVÉ: Be sure not to come to the table with inflexible convictions. Remain willing to change your beliefs based on your observations and experience.

PIERRE SYSSAU: Think out of the box: innovation is not limited to new ideas, but ways to develop and implement in new frameworks.

Read more

Flexible & Modular is one of the 10 Innovation Ambassadors 2022, selected from 86 initiatives in 21 countries and 24 entities. Discover how BNP Paribas Cardif Colombia created an customizable product with around 50,000 possibles combinations.

Introduce yourself briefly:

My name is Henry Saenz and I’m Analytics Manager at BNP Paribas Cardif Colombia and part of the value proposition team.

Tell us about your project: What is it about and how it came about?

Thinking out of the box is usually very hard in a traditional industry such as insurance. BNP Paribas Cardif Colombia has created a unique environment for innovation in all fields and of course products are not the exception. Based on our philosophy of having a unique and personalized customer journey for each final customer, a special interdisciplinary squad was created with actuarial, analytics, ecosystem and customer experience members to face a unique challenge: creating a product with coverage, insured value, digital services and a customer experience based on the holistic understanding of 100% of the final customers of the bank.

The first step was to analyze and understand the data of all the final customers of the bank. Data has been always a unique strategic lever for BNP Paribas Cardif Colombia Understanding all dimensions of data and the distribution of clients among variables such as age, income, number of persons in the household, bank segments, etc. show us that insured values and premiums have to move in a very large range to fit all customer’s needs in terms of protection. The actuarial teams did an exceptional job in creating a solid and consistent offer for all possible combinations of the product.

After creating all options of coverage and insured values, digital services were created based on all the combinations of the product to complement and make all of them tangible; the principle was “more protection = more services” so every time the customer adds a coverage or increase the insured value, the customer can add a digital service, based on their interests and preferences.

Finally, the flexible and modular product was created with around 50,000 possible combinations of coverages, insured values and digital services.

Of course a product with more than 50,000 combinations is not easy to offer or sell, so a special sales module was created by the Customer Experience team to offer the 3 best combinations, out of the 50.000 based on propensity models created with the same data we use to create the product. The offer is supported from pre-sale with a special campaign, to all the post-sales steps (online digital welcome, , ecosystem activation, proactive retention and finally a claim) thanks to a special journey designed by the Customer Experience team.

To summarize this initiative, Cardif Colombia identifies the opportunity to create flexible and modular products to give the final customer exactly the combination of coverage, insured value and services he or she needs, moving from a traditional sale to a fully consultative sale with an experience leveraging data and analytics.

What advice would you give to employees who also want to innovate?

Break all of the traditional paradigms you can based on the final customer needs, and hear ideas from every member of your team to avoid bias. Don’t be afraid to test and don’t wait for a perfect solution, the best way to find success is to have resilience in little failures.

Read more

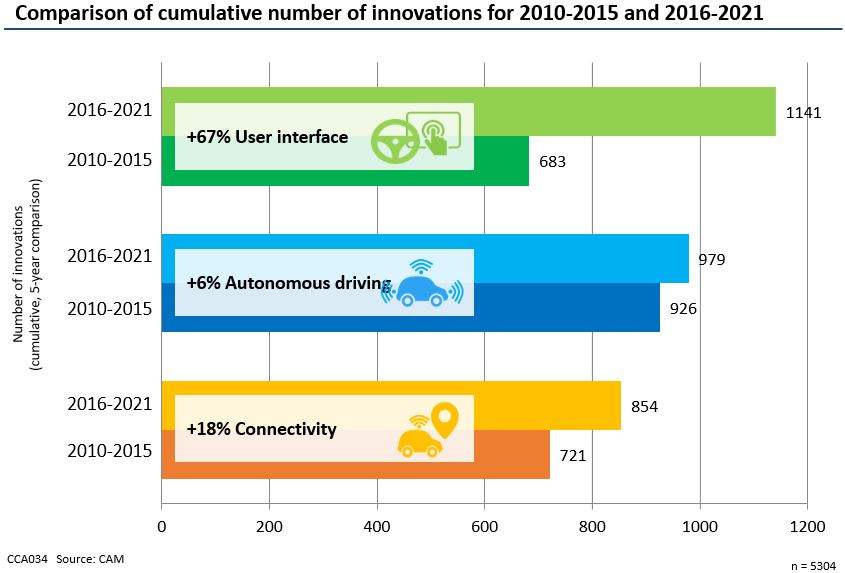

The Center of Automotive Management (CAM) realised a study for BNP Paribas Cardif, analysing the current transformation in automotive mobility and the development of innovations in the areas of electric-vehicles, autonomous driving, interconnectivity and mobility services.

The industry trends concerning connected cars can be seen from the last 10 years innovations of the 28 global automotive manufacturers. Global original equipment manufacturers generated almost 3,000 innovations in the period from 2016 to 2021 in the three sub-areas of user interface, autonomous driving and connectivity. User interface innovations make up the largest share quantitatively since 2015. The number of innovations in the area of operating and display concepts rose by 67% to reach 1,141 innovations between the two periods. A qualitative shift is also apparent, from hardware orientation – in which customers buy built-in features – towards increasing software and services orientation: vehicle hardware is increasingly being configured to enable the customer to be offered new on-demand functions and features by means of target group-specific and context-sensitive over-the-air software updates. New user interfaces that can be control increasingly via artificial intelligence algorithms are being developed in order to offer a broad digital ecosystem of services in vehicles.

The market growth trajectory of e-mobility is the most important trend in the field of passenger vehicle propulsion is continuing to accelerate in the most important market regions, despite the coronavirus and microchip crises. Electric vehicles include pure battery electric vehicles and plug-in hybrid vehicles. The widening of the range of battery electric vehicles and the grant schemes in place in core regions are increasing the acceptance rate of battery electric vehicles among the population and giving rise to a huge increase in registrations.

China remains the leading market for pure electric transport solutions in the first half of 2022. At around 2 million, the figure for new registrations of battery electric vehicles has quadrupled in comparison with 2021 (0.6 million).

On the European market, sales of battery electric vehicles increased to around 0.6 million in the first half of 2022, in contrast to the overall decline in the private passenger vehicle market. The share of battery electric vehicles as a proportion of the total has increased to 12% up 4 percentage points on the first half of 2021. This continuous upward trend is attributable both to the buyer’s subsidy and tax advantages in place in many European countries and to the widening range of battery electric vehicles available, although the growth has currently weakened somewhat owing to supply shortages.

In the United States, new registrations of battery electric vehicles grew faster than in the markets in China and Europe, to a level of around 474,000 units.

In addition to innovations related to connected car technology, an increasingly important role will be played by digital ecosystems of networked services in the future. These trends are already apparent among the top automotive manufacturers. Connected services will offer automotive manufacturers potential for revenue generation in the future.

The global connected services market volume is estimated at more than € 200 billion in total in 2030. For the original equipment manufacturer, this can mean additional revenue, as it creates a service ecosystem, thus tying customers to the brand. However, other market participants are also establishing a digital service ecosystem, especially big data players such as Alphabet/Google, Apple and Tencent and Alibaba in China.

Connected services will offer automotive manufacturers considerable potential for revenue generation in the future. In addition to the five use cases considered (highway pilot,city pilot, In car e-commerce, In-car entertainement, Vehicle-to-grid) , it is possible that there are others that could increase the market volume. Ultimately the services will not be tied to a car, but to the relevant customers, who identify themselves by their cloud ID. The advantage for customers is that they can use the booked services on any hardware (in any car), just as they are accustomed to using other services (Netflix etc.) on any device.

Read more

Pix Protection is one of the 10 Innovation Ambassadors 2022, selected from 86 initiatives in 21 countries and 24 entities. Discover how BNP Paribas Cardif Brazil moved quickly to provide coverage for a booming P2P digital payment service.

Introduce yourself briefly:

My name is Daniel Hortence Fernandes (on the left). I work in Cardif Brazil Retail and New Industries Structure, reporting to Thiago Machado (on the right). Currently, I focus on creating and developing initiatives that may bring us greater attachment rates through Retailers and more recently assumed the role to kick off our first Telco partnership in Brazil.

Tell us about your project: What is it about and how it came about?

Since February 2022, according to official data, PIX is the most used payment method in Brazil. Launched by September 2020, through a Government initiative, the innovative way for Brazilians to transfer money peer to peer outperformed all others methods faster than most people could imagine. Such drastic and fast-paced change brought along a huge of challenges to financial industry, including insurance.

Amidst of all these market movements, BNP Paribas Cardif saw itself in the right place with the right partnership to be launched: Mercado Pago – Top 3 on Digital Banks Brazilian Ranking, Mercado Libre’s owned bank with more than 40 million clients.

“In 2021, I remember we were moving on with the implementation flow of our regular Personal Insurance Protection Product, when we understood that the market was calling for more. PIX was only a promise and, the fact that it was going to be our first Digital Bank Partnership in Brazil was already a huge challenge; it could keep us caught up with the technologic efforts that initiatives like these demand and deliver the best fit for this new reality.”

Say Thiago Machado, Head of Retail and New Industries in BNP Paribas Cardif Brazil

As part of its duty of being on top of latest trends, BNP Paribas Cardif Brazil’s team always stays close to innovation industry key-players (forums, incubators, venture capitalists, entrepreneurs) and it was getting clearer every day that the traditional insurance market for personal finance protection was about to change. “PIX wasn’t the mania as it is right now, but the entire buzz we detected through conversations with Mercado Pago and the massive growth of the PIX adoption numbers provoked us to move faster.” Say Thiago Machado

By October 2021, Mercado Pago and BNP Paribas Cardif pioneered the Brazilian Market by launching what is now called “Pix Insurance”, an insurance that covers transactions or ATM cash taken out under coercion. This meant aligning with our company’s mission of making insurance more accessible in a changing world and also represented a first step on this new digital bank industry in Brazil.

For me personally, Pix Protection was something that I was glad to be involved in during my first days at Cardif. It was all about creating an insurance that could fit to the new reality of the Brazilian Market that was undergoing a massive change, with digital transactions becoming more accessible and cheaper. I would highlight that pioneering Pix Protection reinforced the leadership positioning that BNP Paribas Cardif holds in Brazil. To do that with one of the most powerful tech brands (MeLi/Mercado Pago) made that even a bigger accomplishment.

What did you find most striking/surprising during this project?

To be honest, I was amazed about how powerful it can be to be in touch with key innovators. To nourish these conversations in a healthy pace was key for us to build, faster than any other competitor, the sense that something huge was about to happen in our industry and that was high time for Insurers to move forward and get to deliver an insurance that finally fits the needs of a whole new environment.

What advice would you give to employees who also want to innovate?

Aligned with what I mentioned above, my advice would be a quote I heard from Steve Jobs during a Stanford’s Graduation: Stay Hungry, Stay Foolish. Without that, we would never be a step ahead to the market. And to conclude, my boss Thiago and I both believe, always keep the “Can-do” attitude, because sometimes one may surrender to the traditionalism and lose the opportunity to pioneer and to create a new (and better) standard.

Read more

This podcast was published on: 10/25/2021.

Many prefer to buy new phones, fearing that second-hand models will fail sooner, that the battery will be damaged or that the insurance policy will be inadequate or cost more. In this context, BNP Paribas Cardif and the SOFI Group have joined forces to develop Smarty+, an app that makes insurance more accessible to buyers of refurbished phones. Hayat Ouraghi, Senior Relationship Manager at BNP Paribas Cardif and Jean-Christophe Estroude, Chairman of SOFI Group, tell us about this partnership.

Why did BNP Paribas Cardif and SOFI Group choose to work together on a refurbished product guarantee?

Jean-Christophe Estroude: 80% of a smartphone’s environmental impact is due to its fabrication. Over 70 different materials are needed to manufacture it which accelerates resource scarcity and generates pollution. Unfortunately, consumers still prefer to buy a new phone rather than repair the slightly damaged one they have. It is worth highlighting that refurbishing used or damaged phones saves 52 kilos of CO2 and 60 kilos of raw materials extraction. The price of a reconditioned smartphone is also 30 to 50% lower than a new one. Then, why pay more when you can enjoy the same characteristics for a lower price? We concluded that buying a replacement device second-hand benefit both your wallets and the environment. With this in mind, our company decided to develop our smartphone and tablet repair tool. After reconditioning the devices, we resell them under the Smart brand to private individuals and professionals through different channels and retail networks, including our online shop. BNP Paribas Cardif spotted this expertise in us.

Hayat Ouraghi: Until recently, our insurance policy used to only cover new phones at BNP Paribas Cardif, but we’ve decided to extend our insurance offer to second-hand devices. We soon realised that there was a growing demand in the second-hand smartphone market but that the customers were potentially afraid of buying a phone that was not in good condition or that would not be covered in case of loss, theft, or accidental damage. As an insurer, our prerequisite was to protect ourselves against the risk of fraud. That’s why we needed to be able to diagnose devices remotely and make sure there was no pre-existing damage. If a smartphone is already damaged, it cannot be covered by any insurance policy. But once it’s been repaired, we can insure it. As BNP Paribas Cardif cares about the environment and our customer well-being, we are convinced that an insurance warranty that covers refurbished phones can help extend the life cycle of smartphones and enable customers to reduce their carbon footprint. With this in mind, we were looking for a phone diagnostics solution. SOFI’s seemed very interesting to us.

Then, you worked together to develop the Smarty+ app. What is it?

Hayat Ouraghi: We worked together on this diagnostic application. If someone wants to insure his smartphone, this app allows him to diagnose his device and make sure it’s working properly. When I visited SOFI Group’s factory, I discovered its industrial tool which uses a technology to diagnose incoming and outgoing phones. We decided to take inspiration from this tool and embed the technology in a very easy-to-use application that can be downloaded by a customer onto his smartphone. Then, step by step, this customer can carry out a complete diagnosis by following the instructions. For example, he will be asked to test the touchscreen by simply running his finger around it. All the sensors will be checked, as well as the wifi and so on. If the smartphone is not damaged, the customer can subscribe to our insurance and can also generate a diagnostic certificate very useful when he wants to resale his device. This is a real plus in terms of transparency.

Finally, how would you sum up this second-hand phone insurance and technological collaboration?

Hayat Ouraghi: SOFI Group has a strong CSR identity, in line with BNP Paribas Cardif’s values. They created jobs and have been able to rehire all their colleagues. This human adventure is also in line with my personal values and those of BNP Paribas Cardif. So, I am really delighted with this collaboration.

Jean-Christophe Estroude: The recognition from a large group like BNP Paribas Cardif is really important and rewarding. This collaboration on the application’s development also enabled us to be more innovative. We are very proud to have been able to work with a major group and to have launched a very innovative and interesting offer on the market.

Read more

Buyer’s Protection is one of the 10 Innovation Ambassadors 2022, selected from 86 initiatives in 21 countries and 24 entities. Discover how Guido Wassink and his team responded to a key need in their market to be able to bid safely and successfully on a home.

Introduce yourself briefly:

I am Guido Wassink, Head of Sales of BNP Paribas Cardif in the Netherlands. I have been working here since the creation of the entity in the Netherlands, now more than 25 years ago. In my current role, I am responsible for the sales team and I am always looking for commercial opportunities in the market.

Tell us about your project: what is it about and how it came about?

In the Dutch housing market there are more people looking to purchase a house than available houses on the market. This means that there are many interested people making an offer on a single house. Potential buyers try to get hold of their dream home by significantly overbidding and omitting the financing conditions of their project. Often without knowing for sure whether they will be able to get the mortgage. With the new cover Buyers Protection, the customer can now bid safely and responsibly on their future home.

The ability to anticipate the feasibility and affordability in the mortgage process, offer the customer the possibility to predict in advance how much he can responsibly bid on the home. Irresponsibly bidding is prevented.

If the offer is accepted? Then the Suretyship is provided in a few days. If the customer can’t get a mortgage? Then we will refund the guaranteed amount (which is usually a 10% penalty of the purchase price of the property). Thanks to a clever use of a combination of data, we can give the customer more potential to be successful when trying to buy a house. With Buyer’s Protection, the bidding is done responsibly and with the protection of an insurance.

With this unique proposition, we are strengthening the collaboration with various important partners, and it opens doors to new partners that have been out of our reach for many years. We reach a large group of customers, and we have cross-sell opportunities with our Suretyship product.

What did you find most striking/surprising during this project?

We are the first and still single supplier offering this cover in the market, so we did not know in advance, what benefit this would have for the customer in the buying process.

On average 6 to 10 people are bidding on a house and with Buyers Protection 45% succeeds with winning the bid and buying their dream home. This really exceeded our expectations.

What advice would you give to employees who also want to innovate?

Innovation and some perseverance suit me best. Just go ahead and do it has always been my motto. Therefore, my advice would be: believe in your project and inspire others to do so as well.

Read more

Korea’s Digital CPI (Credit Protection Insurance) Platform is one of 10 Innovation Ambassadors 2022, selected from 86 initiatives in 21 countries and 24 entities. Discover how Hong Min Yun, Won Hee Ye and their team created a new business model leveraging a rising Fintech.

Could you introduce yourself briefly?

Won Hee YE: Hi, my name is Won Hee Ye and I am a leader of Business Development team at BNP Paribas Cardif Korea. My role is to seek for new business opportunities and develop those opportunities into actual digital infrastructure, partnerships and promote additional new sales. As a relationship manager(RM) to FINDA project, I am working on overall FINDA project management which includes digital CPI platform business and upcoming fintech de-regulation projects (FINDA’s life insurance agency market penetration through exclusivity contract with BNP Paribas Cardif CPI products).

Hong Min YUN: Hello, I’m the online marketing manager at BNP Paribas Cardif Korea. I’m responsible for planning and optimizing online platforms, analyzing customer data, and leading to performance.

Our project team is made by the cooperation of our GA department and marketing department. When our GA establishes a partner alliance and the overall business model, marketing supports and actualizes it.

Our team’s strength is that when we face an issue, we proceed with sufficient prior consultation and make decisions which many members can agree with.

Tell us about your project: what is it about and how it came about?

Its main focus is to create a new B2B2C business model based on digital environment expansion and Fintech companies’ growth.

It is about efforts to create new business models such as searching partners, developing products, making customer journeys, and establishing platforms.

As digital influence and the consumption of online financial products increased, the importance of occupying the online market emerged. In addition, due to the influence of COVID-19, the need for non-face-to-face channels further increased, and as a result, « Korea’s 1st Socially Responsible Digital CPI Platform w/ Digital Loan Aggregators Providers » projects were carried out by preparing platforms, products and digital partners.

In particular, through partnership with loan aggregator, it attempts to secure excellent sales by making more natural contact on the customer journey with CPI, which is highly related to loans.

Through partnership with Korea’s best loan aggregator ‘FINDA’, we provide an environment where customers can approach CPI anytime, anywhere and increase their involvement in CPI.

Reducing the burden of repaying loans in unexpected situations

Through CPI, customers can reduce the burden of repaying loans due to sudden death and illness, and create a healthier financial environment by preventing the increase in bad loans caused by increased household debt across the country.

Identify opportunities for digital-based B2B2C business expansion

Through this project, we secured new business expansion possibilities by securing experience values for business in new environments such as digital and recognizing factors necessary for online product development and preparations for securing performance.

What did you find most striking/surprising during this project?

We experienced how useful the B2B2C business model is in promoting unfamiliar products to customers. In Korea, BNP Paribas Cardif Insurance and CPI are unfamiliar brands. Hundreds of millions of won in budget investment is needed to promote and secure enough performances in this field.

However, through a partnership with loan aggregator fin-tech company, the two actors were naturally recognized by the customers involved in loans, and the performance through our platform (homepage, app, etc.) is also on the rise as the customer’s awareness spreads.

In order to spread these positive factors, infrastructure for product development and platform advancement suitable for online customers is seeded. Users prefer easy-to-understand information, and in particular, the Korean online market has a strong need for automation and fast speed based on excellent IT infrastructure, so developing and providing corresponding platforms and products will be an important factor in the project expansion.

What advice would you give to employees who also want to innovate?

There has been a lot of effort to achieve the present results in this project. Customer journeys based on the initial business model were subject to regulation under the Korean financial policy. So, BNP Paribas Cardif Korea and partners had to respond agilely for more than half a year, such as modifying business models and improving customer journeys. As a result, we were able to develop our business without any problems, and in addition, gradually increase performance by optimizing contact points, communication messages, and platforms based on customer behavioral data.

In the end, what is important in innovation is patience and perseverance. If your organization is heavily regulated or has limited investment, it is important to carry out the project with long-term will and consistency. If you continue to try and improve even if you fail, it will accumulate as powerful experiences to later solve problems and eventually inspire innovation.