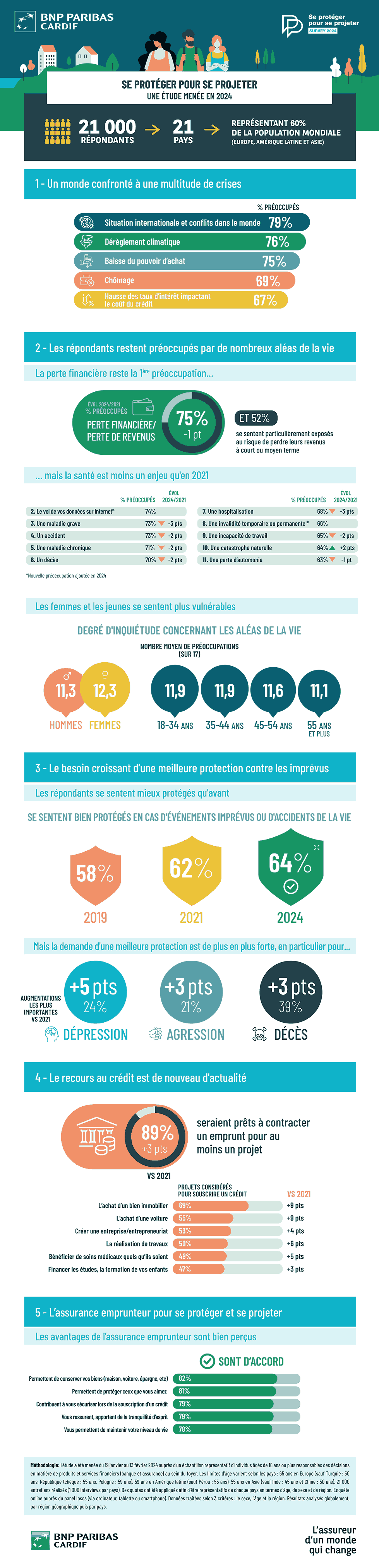

Etude protection 2025

Cette étude démontre que les besoins en protection demeurent en 2024. En tant qu’assureur nous avons la capacité et le devoir de répondre aux préoccupations actuelles pour accompagner la reprise des projets individuels avec des solutions toujours plus simples, compréhensibles, accessibles et inclusives.

Pauline Leclerc-Glorieux

Directrice générale de BNP paribas cardif