BNP Paribas Cardif pursues commitments to align investment portfolios with carbon neutral trajectory by 2050 and reports on 2023 progress

BNP Paribas Cardif pursues commitments to align investment portfolios with carbon neutral trajectory by 2050 and reports on 2023 progress

With regards to the reduction of the carbon footprint of its investment portfolios and its contribution to alignment with the objectives of the Paris Agreement, BNP Paribas Cardif has committed to:

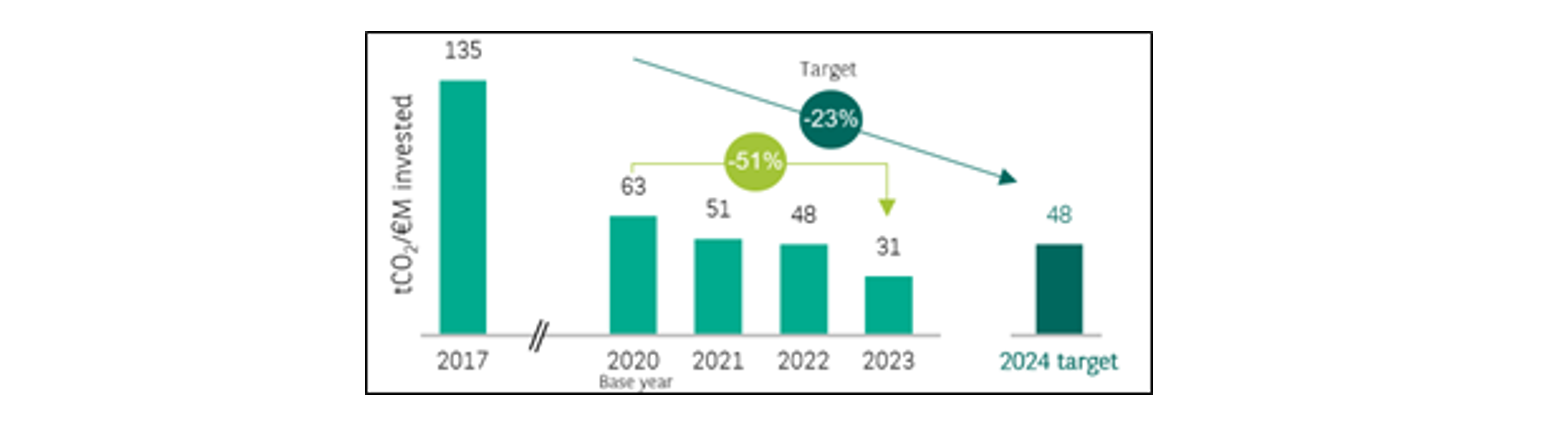

Reduce the carbon emissions footprint (Scopes 1 and 21) of its directly held equity and bond portfolios by at least 23% between end 2020 and the end of 2024.

At the end of 2023 the carbon footprint of this portfolio continued to significantly decline, reaching 31 tCO2 per million euros invested, representing a reduction of 51% compared with end 2020.

The reduction recorded between 2022 and 2023 was due in particular to more precise modelling of carbon emissions data by companies within different sectors by the data provider , in particular transformation and electricity distribution2.

Source : S&P Trucost Market Intelligence

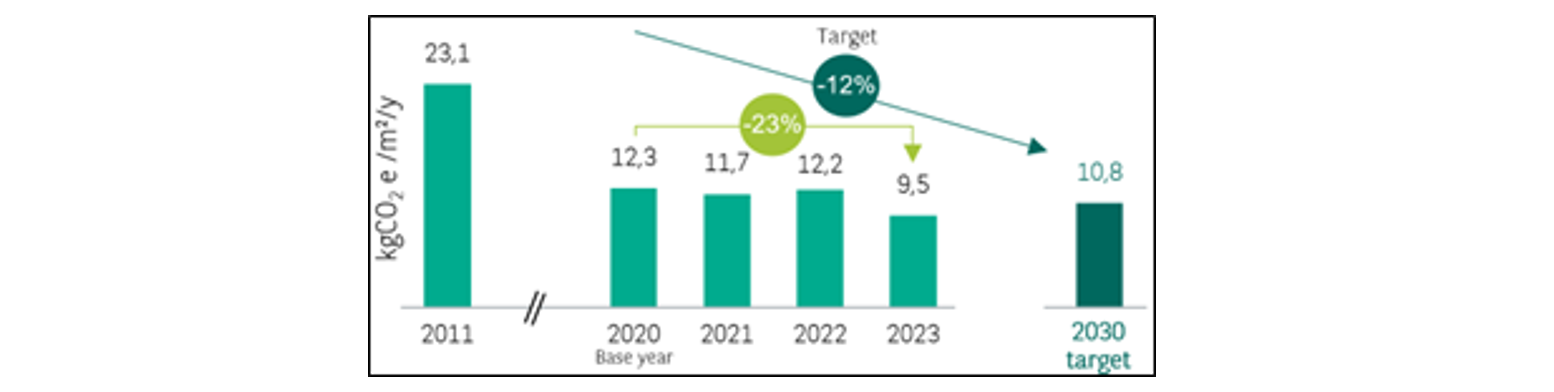

Reduce the carbon intensity (scopes 1 and 23) of directly owned office properties by at least 12% between 2020 and 2030.

At the end of 2023, carbon intensity continued to decrease, reaching 9.5 kgCO2e/m²/year, representing a decrease of 23% compared with end 2020.

The reduction of carbon intensity was significant in 2023. This was due in part to energy efficiency campaigns for buildings, leading to a reduction in energy consumption, and to a downward revision of carbon emission factors associated with electricity.

Source : Internal Data and BNP Paribas Real Estate Property Management

BNP Paribas Cardif has made a commitment to reduce the exposure of its investment portfolios (directly held equity and bond portfolios) to industries with the highest levels of greenhouse gas emissions, in application of BNP Paribas Group sector exclusions. This will lead to a definitive exit from the thermal coal value chain by 2030 for EU and OECD countries, and by 2040 in the rest of the world.

The trajectory of BNP Paribas Cardif’s investment portfolios is in line with the expected agenda.

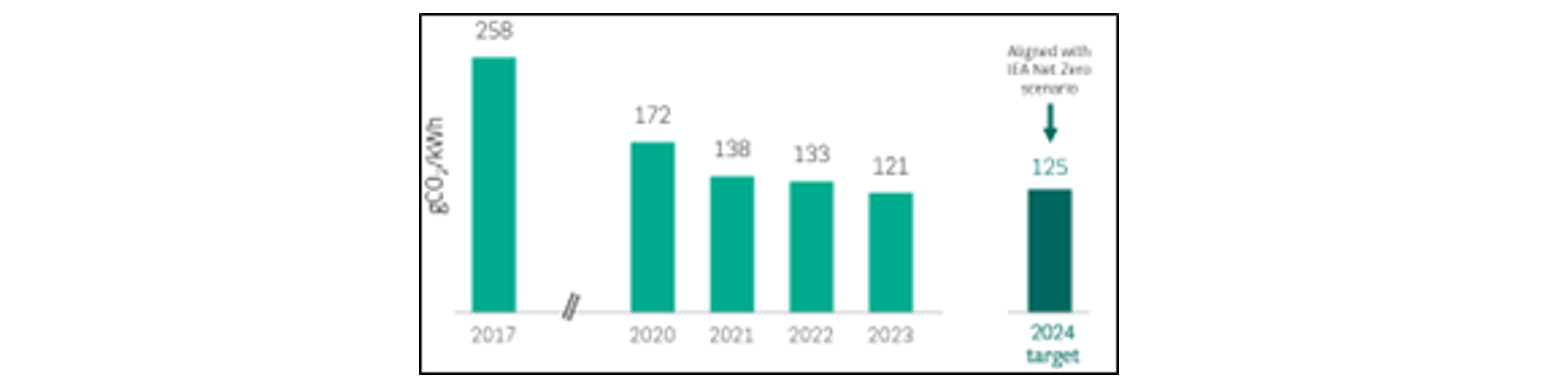

BNP Paribas Cardif has also made a commitment to reduce the carbon intensity of its investment portfolios linked to power generation. The target is to achieve an emission intensity of under 125 gCO2/kWh by the end of 2024 for power generation activities held directly in equity and bond portfolios. This target is aligned with the Net Zero Emissions scenario developed by the International Energy Agency (IEA) for power generation.

At the end of 2023, carbon intensity continued to decline, reaching 121 gCO2/kWh.

This reduction for the emission intensity of power generation activities in the portfolio was due primarily to an increase in the share of green bonds in this sector4.

Source : Asset Impact5 and International Energy Agency

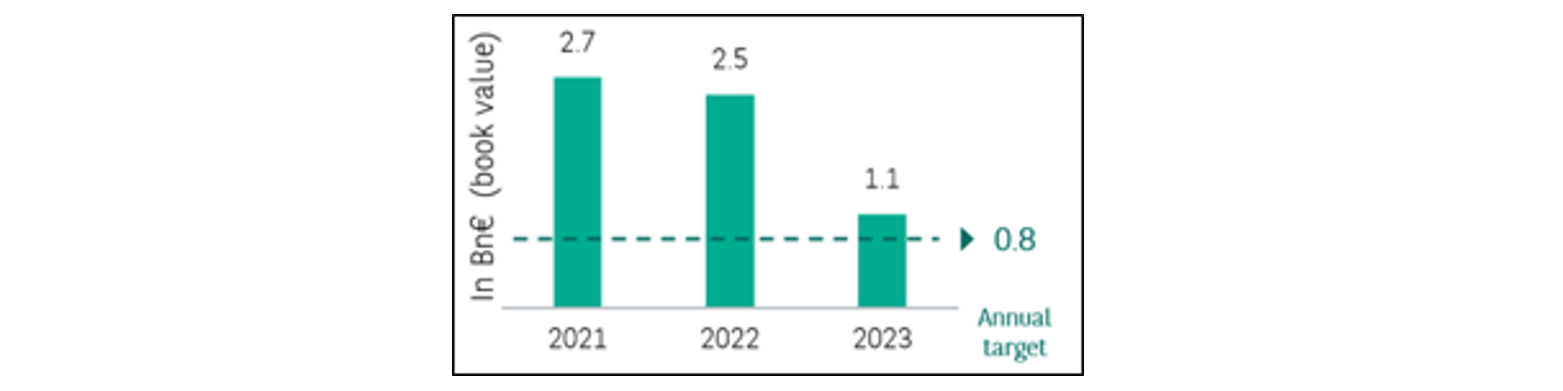

BNP Paribas Cardif also continued to make investments with a positive impact on the environment and will allocate at least 800 million euros by 2025 to investments that contribute to the energy transition and initiatives with an environmental theme. This commitment encompasses investments in sectors that involve environmental protection, including the energy transition, energy efficiency, waste recycling and the preservation of biodiversity.

In 2023, BNP Paribas Cardif allocated 1.1 billion euros to investments that contribute to the energy transition and initiatives with an environmental theme, notably through financing via green bonds.

Finally, BNP Paribas Cardif continued its shareholder engagement with some of the companies identified by the Climate Action 100+ initiative as the most emitting. This initiative, joined by the insurer in October 2021, is part of the BNP Paribas Group’s climate strategy and BNP Paribas Cardif’s responsible approach.

1 As there is currently no standard methodology for measurement of Scope 3 emissions, BNP Paribas Cardif places priority on implementing Scope 1 and 2 objectives to align with the Alliance, while continuing to measure and assess the impact of its investment portfolios across all three scopes.

2 S&P Trucost Market Intelligence

3 Reduction of carbon intensity of office properties also includes the electricity, heating and air-conditioning consumption of tenants.

4 Green bonds issued by electricity producers are used in particular to fund the creation of renewable energy capacity. During power generation (Scope 1), renewable energies do not emit greenhouse gases. In the calculation methodology, these green bonds benefit from a 90% ‘discount’ on the issuer’s carbon intensity.

5 Asset Impact | Asset-based data solutions for climate action (gresb.com)